Benefits

Why monitor your global tax with Commenda

Real Time Nexus Tracking

Track your global business activity against thousands of global nexus thresholds.

Timely Notifications

Receive nexus and deadline notifications with plenty of time to take action.

Painless Filings

Experience headache-free nexus with hands-free tax filings in every jurisdiction.

Audit-Proof Reporting

Get detailed, compliance-ready reports in seconds, with exemption certificate management built-in.

How it works

Track, manage, and stay ahead of your tax liability with ease

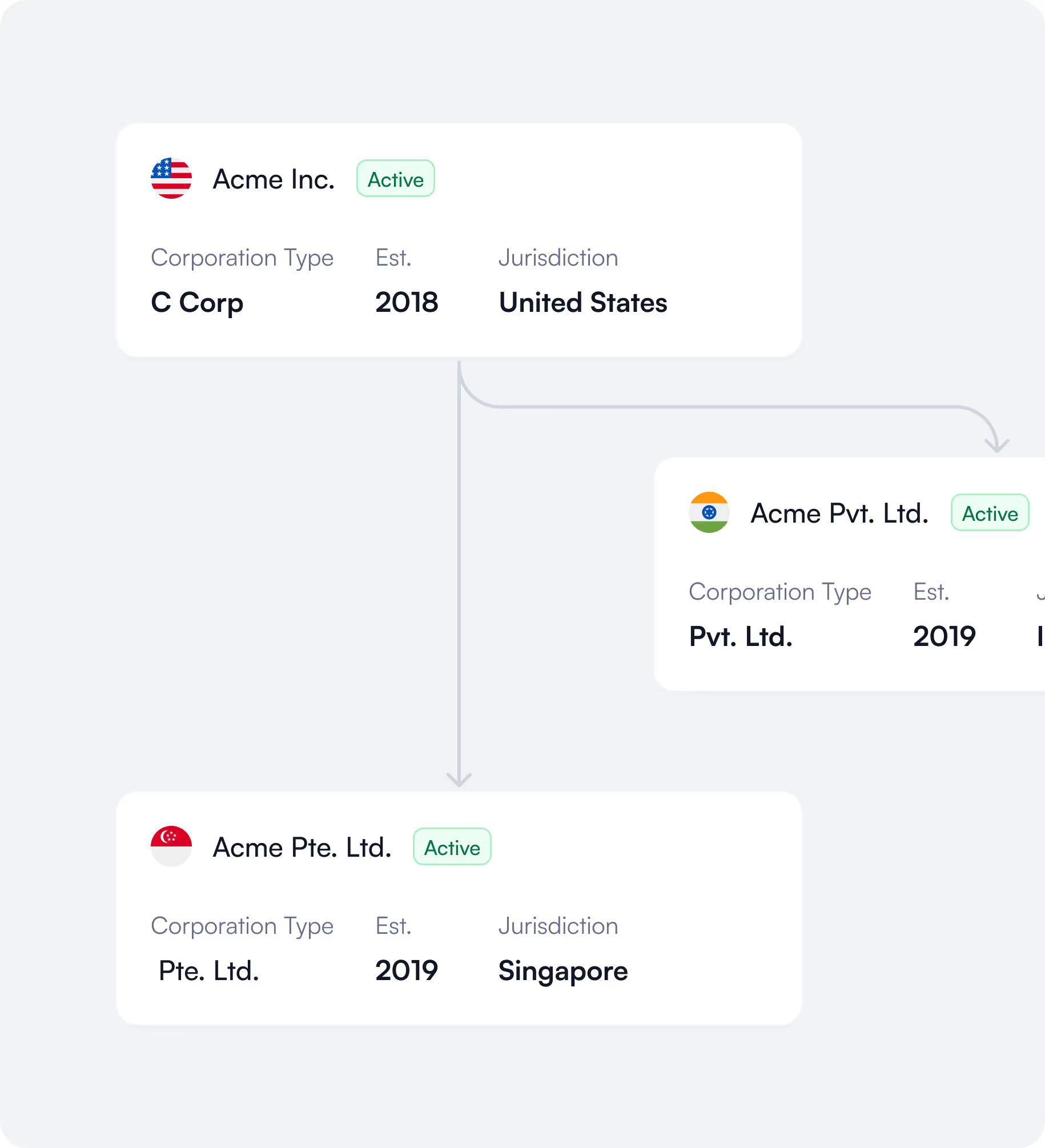

Onboard your entities

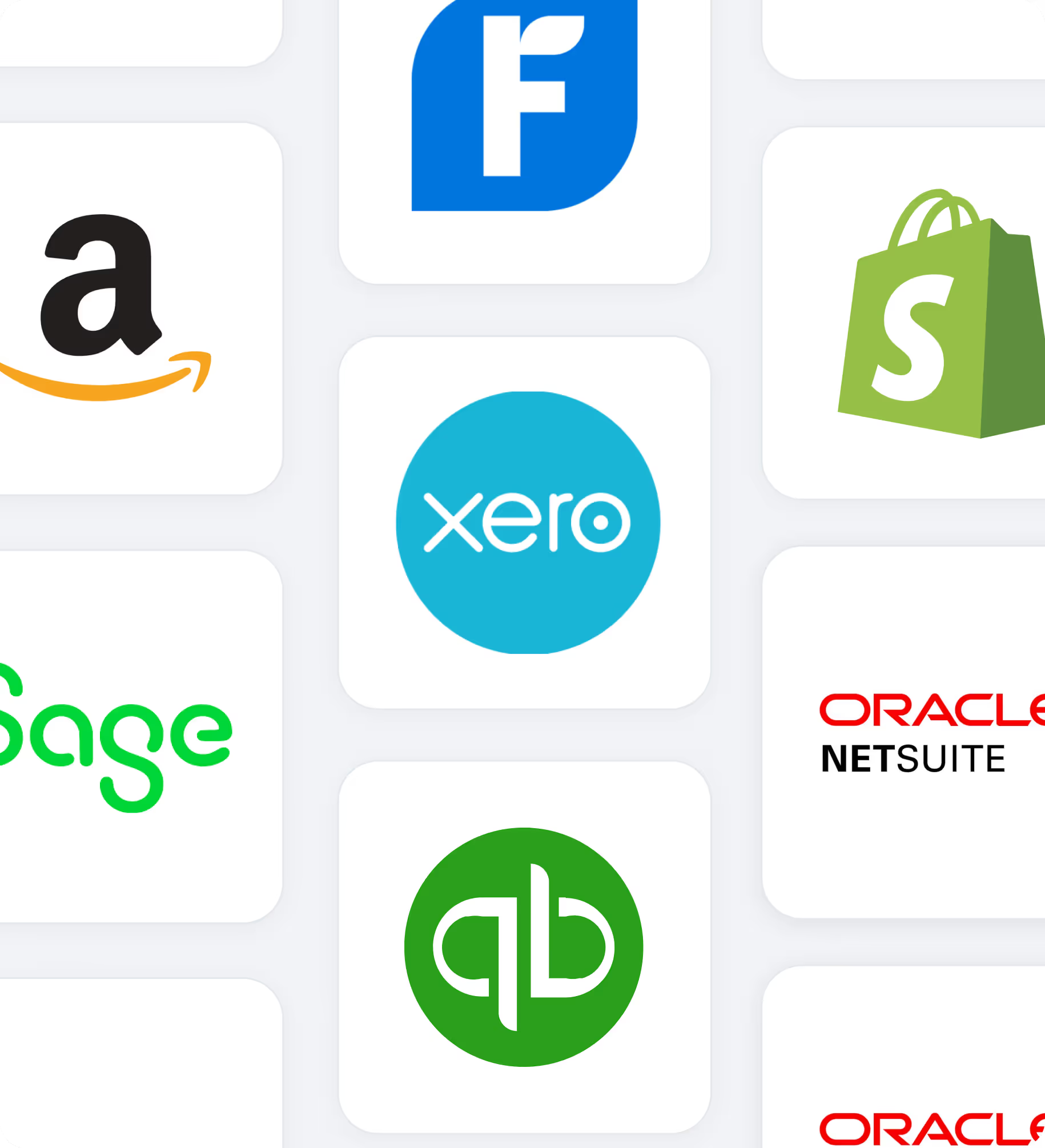

Connect your business tools

Monitor & remediate your liability

services

Got questions?

Schedule a call with one

of our experts

CUSTOMER STORIES

From Startups to

Multi-National Enterprises

Frequently Asked Questions

How does Commenda help with sales tax compliance for international businesses?

We provide an end-to-end solution that tracks your tax liability worldwide, registers entities where required, and ensures timely filings to avoid penalties.

What happens if I fail to comply with sales tax requirements?

Non-compliance can lead to fines, penalties, or even legal action. Our automated system ensures you meet all deadlines and filing requirements, reducing compliance risks.

Can I automate tax compliance without a full-time finance team?

Yes, Commenda’s platform streamlines the entire process, from tracking to filing, so you can stay compliant without hiring a dedicated tax expert.

How does Commenda integrate with my existing e-commerce or accounting platforms?

Our solution seamlessly integrates with major platforms like Shopify, Stripe, QuickBooks, and Xero, making tax tracking and reporting effortless.