What Is Fiscal Representation?

When expanding your business internationally, navigating the complex web of tax regulations can be overwhelming. Fiscal representation, also known as “representation fiscale” in French-speaking countries, serves as a crucial intermediary solution for businesses operating across borders.

This specialized service connects foreign companies with local tax authorities, ensuring proper compliance with Value Added Tax (VAT) and other tax-related obligations in countries where the business has no physical presence.

A fiscal representative acts as your local point of contact, handling administrative formalities and tax matters on your behalf while bearing joint liability for your tax obligations.

Why Non-Residents Need a Fiscal Representative

In many countries, particularly within the European Union, appointing a fiscal representative is not just beneficial – it’s mandatory for non-resident businesses. These requirements are designed to ensure that foreign entities comply with local tax laws and that tax authorities have a local point of contact for all tax-related matters. Without proper fiscal representation in countries where it’s required, businesses may face significant obstacles, including blocked VAT registrations, denied refund rights, and substantial penalties.

Beyond legal compliance, fiscal representatives offer practical benefits that address common challenges faced by businesses operating internationally. They bridge language barriers by communicating with tax authorities in the local language, interpreting complex tax regulations specific to each jurisdiction, and providing expertise on local business practices.

Types of Fiscal Representation: General vs Limited

General fiscal representation (GFR) provides comprehensive coverage for all your VAT-related activities within a country. Under this arrangement, the fiscal representative handles all aspects of your tax obligations, including VAT registration, filing returns, and managing communications with tax authorities.

This type of representation is ideal for businesses with diverse commercial activities in the foreign market, as it covers all VAT-related transactions regardless of their nature. With general fiscal representation, your business must typically obtain a local VAT number, which increases administrative responsibilities but provides greater flexibility for conducting various types of transactions. The representative assumes full liability for all your VAT obligations, making this a more comprehensive but potentially more expensive option.

Limited fiscal representation (LFR) offers a more focused approach, primarily addressing specific VAT obligations related to importing goods and subsequent business-to-business (B2B) transactions within the EU. This streamlined service is particularly valuable for businesses that primarily need assistance with import VAT and related transactions.

General vs Limited Fiscal Representation: Key Differences

| Aspect | General Fiscal Representation (GFR) | Limited Fiscal Representation (LFR) |

| VAT Registration Requirements | Businesses must obtain a local VAT number in the operating country. The registration process is complex and time-consuming, but it allows broader business activities. | Typically doesn’t require a business to register for a local VAT number. A fiscal representative handles VAT obligations under their registration number. |

| Administrative Complexity | Higher administrative burden due to its VAT registration requirements. Setup takes 6-8 weeks for full implementation. | Simplified administrative process for the business. Reduces administrative complexity significantly. |

| Scope of Services | Covers all VAT-related activities and transactions within a country. Suitable for businesses with diverse operations. Handles all tax matters, local taxes, duties, and VAT. | Focuses specifically on import VAT and related B2B transactions. Limited to import shipments and the first delivery. |

| Business Activities Allowed | Allows a broader range of business activities. Permits buying goods within the EU, using bonded warehouses, and B2C sales. | Restricted scope – no intra-EU purchases, customs warehousing, or B2C sales allowed. Limited to specific transaction types. |

| Liability Scope | The representative assumes joint liability for all VAT obligations. Comprehensive protection but broader risk exposure. | Narrower scope of liability focused on specific transactions. More targeted liability approach. |

| Cost Implications | Potentially higher costs due to broader risk exposure and comprehensive coverage. | Often results in lower fees due to a targeted approach. Generally less expensive than general representation. |

Where Fiscal Representation Is Mandatory

Fiscal representation requirements vary significantly across EU member states, with most countries mandating it for non-EU businesses.

Countries such as Austria, Belgium, Bulgaria, Croatia, Cyprus, Denmark, Estonia, Finland, Greece, Hungary, Italy, Lithuania, Poland, Portugal, Romania, Slovenia, Spain, and Sweden all require non-EU businesses to appoint a fiscal representative.

Some EU countries, including Germany, Ireland, the Czech Republic, and Slovakia, do not require fiscal representation for non-EU businesses, allowing them to register directly with tax authorities. Others, like France, have specific exemptions for certain countries, including the UK, following Brexit.

Since the UK’s departure from the EU on December 31, 2020, UK businesses are now considered non-EU entities for VAT purposes. This change has significant implications for their VAT obligations across the EU, with many countries now requiring UK businesses to appoint fiscal representatives. The requirements vary by country, with some nations like France exempting UK businesses from fiscal representation requirements despite Brexit, while others strictly enforce it.

How Fiscal Representation Works in Practice

The process of appointing a fiscal representative typically begins with selecting a qualified provider in the target country. This provider must meet specific regulatory requirements and often needs authorization from local tax authorities.

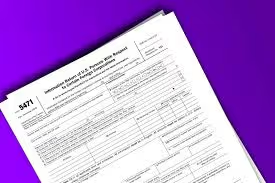

Once selected, you’ll need to complete formal appointment procedures, which usually involve signing a power of attorney and providing documentation about your business. The appointment process may require verification of your business’s legitimacy, including company registration documents, VAT registration certificates from your home country, and identification of key personnel. Some countries may also require these documents to be apostilled or notarized to confirm their authenticity.

After the appointment, your fiscal representative will handle the VAT registration process in the local country, either under your business name (for general representation) or using their VAT number (for limited representation). This registration establishes your tax identity in the country and enables you to legally conduct business there. Once registered, your representative will manage ongoing compliance requirements, including preparing and filing periodic VAT returns, maintaining required records, and ensuring all transactions are properly documented and reported.

Benefits of Using a Fiscal Representative

Working with a fiscal representative significantly reduces compliance risks by ensuring your business adheres to all local VAT regulations. Representatives stay updated on changing tax laws and implement necessary adjustments to your procedures, helping you avoid penalties, interest charges, and potential business disruptions. This compliance assurance is particularly valuable in complex regulatory environments where requirements frequently change. Your representative’s expertise helps navigate these changes smoothly, maintaining continuous compliance without disrupting your business operations.

Fiscal representatives provide invaluable local expertise that would be difficult and costly to develop internally. They understand the nuances of local tax systems, including specific exemptions, special schemes, and procedural requirements that may benefit your business. This local knowledge extends beyond tax regulations to include business practices, cultural considerations, and effective communication strategies with tax authorities. Such expertise helps optimize your tax position while maintaining strong relationships with local officials.

Strategic fiscal representation can significantly improve your cash flow through various VAT deferral mechanisms. In countries like the Netherlands, representatives can help you access schemes like Article 23 import VAT deferral, which postpones VAT payment until filing periodic returns rather than paying it upon importation.

Who Needs Fiscal Representation?

Businesses established outside the European Union that sell goods or services within EU member states typically need fiscal representation in countries where they have VAT obligations. This requirement applies regardless of transaction volume or business size, though specific thresholds may determine when VAT registration becomes necessary. The need for fiscal representation is particularly acute for non-EU companies importing goods into the EU, as this creates immediate VAT obligations in the country of importation. Without proper representation, these businesses may face significant obstacles to conducting legitimate trade.

Following Brexit, UK businesses are now considered non-EU entities for VAT purposes, creating new fiscal representation requirements across many EU countries. These requirements vary by country, with some nations mandating representation while others allow direct registration. UK businesses must carefully assess their operations in each EU country where they have VAT obligations and appoint fiscal representatives where required. Failure to do so could result in compliance issues, penalties, and business disruptions.

E-commerce businesses, particularly those selling through platforms like Amazon, often face complex VAT obligations across multiple jurisdictions. These businesses frequently need fiscal representation to navigate the intricate web of regulations governing cross-border e-commerce.

Liabilities, Costs, and Legal Requirements

One of the most significant aspects of fiscal representation is the joint liability assumed by the representative. This means the representative shares legal responsibility for your VAT obligations, potentially making them liable for unpaid taxes if your business fails to meet its obligations. Due to this liability, fiscal representatives typically require security measures such as bank guarantees or deposits to protect themselves. These requirements vary by country and representative, but can represent a significant financial consideration when establishing fiscal representation.

Many fiscal representatives require bank guarantees or security deposits as a condition of their service. These financial instruments provide security against potential VAT liabilities and vary in amount based on your business volume, transaction types, and perceived risk. In countries like Italy, the guarantee amount can range from €30,000 to €2,000,000, depending on the number of represented entities. These guarantees typically must remain in place for the duration of the representation agreement, often with minimum terms of several years.

The cost of fiscal representation varies widely based on several factors, including the country, type of representation, transaction volume, and complexity of your business activities. Fees may be structured as flat rates, percentages of transaction value, or combinations of both.

When You Don’t Need Fiscal Representation

Businesses established within the EU generally don’t need fiscal representation for transactions with other EU countries. Since the implementation of the EU VAT Directive 2006/65/EC, EU companies can register directly with tax authorities in other member states without appointing local representatives. This exemption applies to standard B2B transactions between EU entities, where the reverse charge mechanism often eliminates the need for VAT registration in the customer’s country. However, specific activities or transaction types may still create representation requirements even for EU businesses.

Providers of digital services, distance sales of goods, or imports of low-value consignments may avoid fiscal representation requirements by using the One-Stop Shop (OSS) or Import One-Stop Shop (IOSS) systems. These simplified compliance mechanisms allow businesses to register in a single EU country and file consolidated returns covering multiple member states.

How to Choose the Right Fiscal Representative

When selecting a fiscal representative, focus on providers with proven expertise in your industry and target countries, and who can clearly explain fiscal representation rules and the difference between general and limited fiscal representation. Ensure they offer comprehensive services – like VAT registration, return filing, and ongoing tax authority communication – and can adapt as your business and regulations evolve. The best representatives leverage technology, providing secure dashboards, automated reminders, and transparent compliance reporting, as seen in Commenda’s VAT returns in Portugal and reverse charge mechanism guides.

Choose a partner with strong local regulatory knowledge, clear risk management processes, and responsive support, so you can confidently manage cross-border VAT while focusing on growth.

Frequently Asked Questions (FAQs)

- What does representation fiscale mean?

Representation fiscale is the French term for fiscal representation, referring to the appointment of a local entity to handle tax obligations for foreign businesses. This concept exists across many countries but is particularly well-established in French-speaking jurisdictions, where the term is commonly used in tax regulations and business documentation.

- What is the difference between general and limited fiscal representation?

General fiscal representation covers all VAT-related activities within a country and requires your business to obtain a local VAT number. Limited fiscal representation focuses specifically on import VAT and related B2B transactions, typically without requiring your VAT registration. General representation offers broader coverage but involves more administrative requirements, while limited representation provides a streamlined approach focused on specific transaction types.

- Is fiscal representation mandatory in all EU countries?

No, fiscal representation is not mandatory in all EU countries. While most EU member states require non-EU businesses to appoint fiscal representatives, some countries like Germany, Ireland, the Czech Republic, and Slovakia allow direct registration without representation. Requirements also vary for EU businesses operating in other member states, with representation generally not required for intra-EU transactions.

- Do UK companies need a fiscal representative post-Brexit?

Following Brexit, UK companies are now considered non-EU entities for VAT purposes, meaning they need fiscal representatives in many EU countries. However, requirements vary by country, with some nations exempting UK businesses from representation requirements despite Brexit.