Understanding Minnesota’s sales tax can be challenging, especially since rates vary across the state. Knowing these rates and how they apply is essential whether you’re a business owner or making personal purchases. From understanding the state’s base tax rate to learning the local nuances, this guide will help break it down.

We’ll walk you through the sales tax variations, key exemptions and how to handle them effortlessly. Let’s simplify Minnesota sales tax so you can stay compliant and avoid confusion.

What Is the Sales Tax Rate in Minnesota?

As of 2025, Minnesota’s statewide sales tax rate is 6.875%. However, local jurisdictions can impose additional taxes, which can lead to varying total sales tax rates depending on the location within the state.

For example:

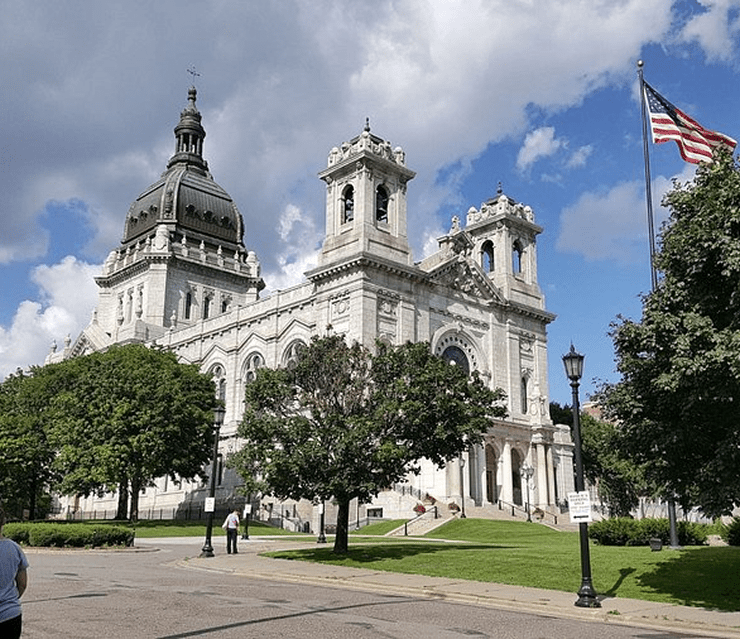

- Minneapolis has a total sales tax rate of 8.025% (6.875% state + 1.5% local + 0.25% regional transit).

- St. Paul totals 7.875% (6.875% state + 1% local).

- Duluth has a total rate of 7.875% (6.875% state + 1% local).

Learning these variations is essential for businesses operating in Minnesota to ensure compliance. Charging the correct sales tax based on location can help avoid issues and penalties related to miscalculations. Always check the current tax rates to ensure you’re collecting and remitting the correct sales tax amount in Minnesota.

For more on tax rates in your area, consider using the Minnesota Sales Tax Calculator to ensure accuracy.

Also read: US Sales Tax Guide: Introduction, Nexus, and How to Calculate Rates

Minnesota Sales and Use Tax Overview

The Minnesota Department of Revenue (DOR) administers sales and use tax within the state. Businesses selling taxable goods and services must collect and remit sales tax to the state. By knowing the key tax regulations, sales tax exemptions in Minnesota, and filing requirements, businesses can ensure they remain compliant with Minnesota sales tax laws.

Key Features of Minnesota Sales Tax

- State Sales Tax Rate: The base Minnesota state sales tax rate is 6.875%.

- Local Sales Taxes: Counties and municipalities may levy additional sales taxes, leading to varying total sales tax rates. For example, Minneapolis has a total sales tax rate of 8.025%.

- Nexus Requirements: Businesses must collect sales tax in Minnesota if they meet either:

- Physical Nexus: Owning or operating a business location or warehouse or having employees in Minnesota.

- Economic Nexus: Remote sellers exceeding $100,000 in gross revenue or 200 separate transactions annually must collect and remit Minnesota sales tax.

Taxable goods and services include:

- Electronics

- Clothing

- Furniture

- Prepared food and beverages

- Telecommunications services

Sales tax exemptions in Minnesota apply to several categories, including:

- Groceries (unprepared food items)

- Prescription medications and medical devices

- Sales to government agencies and qualified nonprofits

- Manufacturing machinery and equipment used for production

When Do Businesses Need to Collect Sales Tax in Minnesota?

Businesses must collect Minnesota sales tax when establishing a nexus in the state. Nexus is the connection that triggers the obligation to collect and remit sales tax. Minnesota recognizes two primary types of nexus: physical nexus and economic nexus.

1. Minnesota Physical Nexus

A business has a physical nexus in Minnesota if it meets any of the following criteria:

- Operates a physical location such as a store, office, or warehouse in Minnesota.

- Has employees, agents, or independent contractors working in Minnesota.

- Stores inventory within Minnesota, including in third-party fulfillment centers.

- Participates in trade shows or sales events held in Minnesota.

- Provides delivery services using company-owned vehicles to customers in Minnesota.

2. Minnesota Economic Nexus

Even if a business has no physical presence, it must collect sales tax in Minnesota if it meets the state’s economic nexus threshold:

- Gross revenue exceeding $100,000 from sales into Minnesota in the previous or current calendar year.

- 200 or more separate transactions involving taxable sales into Minnesota.

Failing to comply with Minnesota’s sales tax laws can result in penalties and interest charges. For more detailed guidance, click here.

Failure to Collect Minnesota Sales Tax

Failure to collect and remit Minnesota sales tax can result in significant penalties and interest charges. The Minnesota Department of Revenue enforces strict measures for non-compliance. Here’s a breakdown of the penalties and charges:

1. Penalties for Late Payment and Filing

- Late Payment Penalty: If sales tax is not paid by the due date, a penalty of 5% of the unpaid tax is applied per month, with a maximum of 25% of the total tax owed.

- Failure to File Penalty: If a business does not file its sales tax return by the due date, a penalty of 5% per month is applied, up to 25% of the total unpaid tax.

2. Interest Charges

Interest accrues on unpaid Minnesota sales tax at a rate set by the state, calculated based on the federal short-term rate plus 3%. Interest is compounded daily, meaning the longer the payment is delayed, the higher the amount owed.

3. Underpayment Penalties

If a business underreports its Minnesota state sales tax, it may face a penalty of 10% on the underpaid amount. Additional penalties may apply if the underpayment exceeds 10% of the total tax liability or exceeds $500.

4. Criminal Penalties for Tax Evasion

Willfully failing to collect or remit Minnesota sales tax can be classified as tax fraud. Penalties for severe violations can include fines up to $10,000 and possible imprisonment for up to five years.

Avoid costly penalties and ensure your Minnesota sales tax compliance is effortless by using Commenda. Commenda automates tax calculations and filing, ensuring your business stays on top of tax responsibilities.

Minnesota Sales Tax for Out-of-State Sellers and Amazon FBA Program Sellers

Out-of-state businesses selling to Minnesota residents must comply with Minnesota economic nexus rules. You may have sales tax obligations if you use Fulfillment by Amazon (FBA) or other third-party logistics providers with inventory stored in Minnesota.

Physical Nexus for FBA Sellers

For Amazon FBA sellers, storing inventory in a Minnesota fulfillment center establishes a physical nexus, requiring you to collect and remit Minnesota sales tax. You can track inventory locations in Amazon Seller Central by reviewing the Inventory Event Detail Report to determine if your stock is in a Minnesota warehouse.

Economic Nexus Threshold for Remote Sellers

Even without a physical presence, remote sellers must collect Minnesota sales tax if they meet the state’s economic nexus threshold:

- $100,000 in gross sales into Minnesota in the current or prior calendar year or

- 200 or more separate retail transactions in Minnesota within the same period.

If your business exceeds these thresholds, you must register for a Minnesota sales tax permit and start collecting and remitting sales tax by the first day of the calendar month following the threshold exceedance.

Also read: Which States Do Not Accept Out-of-State Resale Certificates

How to Register for a Minnesota Seller’s Permit

Registering for a Minnesota Seller’s Permit is essential if you sell taxable goods or services in the state. Follow this simple registration process to ensure you’re compliant:

- Gather Required Information

Before registering, you’ll need the following:

- Federal Employer Identification Number (EIN) or your Social Security Number (for sole proprietors)

- Business details: legal name, address, and contact information

- Sales projections: estimated annual sales and taxable sales

- Register Online

- Visit the Minnesota Department of Revenue website and the e-Services portal.

- Create an account or log in if you already have one.

- Select Register for Minnesota Tax Accounts and choose Sales and Use Tax.

- Fill in the required business and sales details.

- Submit the Application

- Once you’ve filled out your details, apply through the portal. There’s no fee for registration.

- Wait for Confirmation

- After submission, you will receive your seller’s permit. This typically takes a few business days. You’ll be able to print your permit or save it electronically.

How to Collect Sales Tax in Minnesota

In Minnesota, businesses must register with the Minnesota Department of Revenue (DOR) to legally collect and remit sales tax. Minnesota follows a destination-based sales tax system, meaning the tax rate is based on the buyer’s location rather than the seller’s.

To collect Minnesota sales tax accurately:

- Obtain a Seller’s Permit – Register through the Minnesota Department of Revenue website to receive a Minnesota sales tax ID.

- Determine the Correct Sales Tax Rate – Minnesota has a statewide sales tax rate of 6.875%, with local rates potentially adding up to 2% for specific counties and cities.

- Verify Tax Rates – Use the Minnesota Sales Tax Calculator to determine the exact tax rate for each location or transaction.

- Collect and Remit Taxes – Charge the correct sales tax, file returns on time, and remit the payments based on your assigned filing frequency.

Tax-Exempt Customers in Minnesota

Specific customers in Minnesota are exempt from paying sales tax on eligible purchases. Familiar tax-exempt entities in the state include:

- Government Entities – Federal, state, and local government agencies are exempt from Minnesota sales tax.

- Nonprofit Organizations – Nonprofits with valid Minnesota sales tax exemption certificates can make tax-free purchases.

- Religious Organizations – Churches and religious institutions may qualify for sales tax exemptions in Minnesota for certain purchases used for spiritual purposes.

- Resale Purchases – Businesses buying items for resale must present a Minnesota resale certificate to avoid sales tax on inventory purchases.

To grant tax-exempt status, businesses must collect and maintain sales tax exemption certificates with details like the reason for exemption and the organization’s tax ID. Ensure you’re current on Minnesota sales tax exemptions to comply with the state regulations.

Filing Sales Tax Returns in Minnesota

When collecting Minnesota sales tax, filing returns on time is important. The filing frequency depends on your business’s total sales tax liability and can be monthly, quarterly, or annually. Below is an overview of the filing frequency.

| Filing Frequency | Description | Due Date |

|---|---|---|

| Monthly | Businesses collecting over $500 in sales tax per month. | 20th of the following month |

| Quarterly | Businesses collecting between $100 and $500 per month. | 20th of the month following the quarter (April, July, October, January) |

| Annually | Businesses collecting less than $100 in sales tax per month. | January 31st of the following year |

Filing Steps

- Log in to the Minnesota Department of Revenue website: Access the e-Services portal with your account credentials.

- Select “Sales and Use Tax.”: Choose the correct filing type (sales tax, use tax, etc.) for your business.

- Enter Sales Data: Input your gross sales, taxable sales, and any sles tax exemptions.

- Review Your Return: Double-check all the data for accuracy to ensure your return is correct.

- Submit the Return: To avoid penalties, file your sales tax return electronically by the due date.

- Pay the Tax: Remit the sales tax payment after filing.

How to Pay Your Minnesota Sales Tax

After filing your Minnesota sales tax return, timely payment is crucial to avoid penalties. There are several ways to remit your payment:

- Electronic Funds Transfer (EFT): This method allows direct transfers from your bank account to the state’s account. It’s efficient and ensures timely payments.

- E-Check: An electronic version of a traditional check. Provide your bank routing and account numbers for the payment to be processed.

- Credit or Debit Card: Pay via credit or debit card through the Minnesota Department of Revenue’s website.

- ACH Credit: ACH Credit is an option for businesses who prefer to initiate payments through their financial institutions.

Using Sales Tax Automation Tools

With the right tools, managing Minnesota sales tax obligations can be hassle-free, and you can streamline the process and minimize errors. Commenda provides a powerful solution to automate Minnesota sales tax calculations, reporting, and filing.

With Commenda’s sales tax calculator, businesses can easily calculate the correct sales tax based on various rates, jurisdictions and achieve sales tax compliance across Minnesota. It automatically tracks changes in tax rates and sales tax exemptions, ensuring that you stay current with the latest requirements.

Minnesota Sales Tax Compliance Checklist

- Determine Nexus – Assess whether your business has a physical nexus (e.g., location, employees) or economic nexus (sales over $100,000 or 200 transactions in Minnesota).

- Register for a Minnesota Seller’s Permit – Apply for a sales tax permit through the Minnesota Department of Revenue before collecting tax.

- Collect the Correct Sales Tax Rate – Charge the applicable Minnesota state sales tax rate of 6.875%, plus any local taxes, depending on the location.

- Track Exempt Sales – Maintain proper exemption certificates for tax-exempt sales, such as sales to government or nonprofit entities.

- File and Remit Taxes on Time – Submit monthly, quarterly, or annual returns based on your sales tax liability to the Minnesota Department of Revenue.

- Maintain Accurate Records – Keep detailed transaction records for at least three years to comply with audit requirements.

How Should I Prepare for Minnesota Sales Tax Audits and Appeals?

Preparing for a Minnesota sales tax audit requires thorough record-keeping and an understanding of the state’s tax compliance requirements. Here’s how you can prepare:

Understand What Triggers an Audit

Certain factors can increase your likelihood of a sales tax audit in Minnesota, including:

- Discrepancies between reported sales and taxes remitted.

- Frequent late filings or missed payments.

- Large tax-exempt sales without appropriate documentation.

- Random audits are conducted by the Minnesota Department of Revenue (DOR) to ensure compliance.

Maintain Proper Documentation

To reduce audit risks, keep comprehensive sales tax records for at least three years, including:

- Sales invoices and receipts.

- Tax-exempt certificates for eligible buyers.

- Copies of tax returns and remittance records.

- Business bank statements and expense reports.

Be Prepared for the Audit Process

If you are selected for an audit, the Minnesota Department of Revenue (DOR) will review:

- Your filed sales tax returns.

- Documentation for any exempt transactions.

- Records related to out-of-state and online sales. Ensure all documents are organized and respond to audit requests promptly.

Understanding the Appeals Process

If you disagree with the audit findings, you have the right to appeal:

- Request an informal review and submit any supporting evidence.

- If unresolved, file a formal appeal with the Minnesota Tax Court within 60 days.

- If necessary, escalate the case for further legal review.

Also read: Sales Tax Audits: Common Triggers, Risks, and How to Prepare

Minnesota Sales Tax Rates by City

In Minnesota, the state sales tax rate is 6.875%. However, local jurisdictions can impose additional sales taxes, leading to varying total sales tax rates across different cities. Below is a table listing 10 cities in Minnesota, along with their respective total sales tax rates:

| Filing Frequency | Description | Due Date |

|---|---|---|

| Monthly | Businesses collecting over $500 in sales tax per month. | 20th of the following month |

| Quarterly | Businesses collecting between $100 and $500 per month. | 20th of the month following the quarter (April, July, October, January) |

| Annually | Businesses collecting less than $100 in sales tax per month. | January 31st of the following year |

Consider using Commenda to automate your Minnesota sales tax calculations, reporting, and filing to make your sales tax process seamless and stress-free; book a free consultation today.

FAQs

What triggers the sales tax nexus in Minnesota?

A business has a nexus in Minnesota if it has a physical presence (office, employees, inventory, or warehouse) or meets the economic nexus threshold of $100,000 in sales or 200 transactions in the state.

What should I include in my Minnesota sales tax compliance checklist?

Determine if you have a nexus in Minnesota. Register for a Minnesota seller’s permit. Collect and charge the correct Minnesota sales tax rate. Maintain exemption certificates for tax-exempt sales. File and remit sales tax returns on time. Keep accurate records for at least 3 years.

How do I register for a Minnesota seller’s permit?

You can register for a Minnesota sales tax permit online through the Minnesota e-Services Portal provided by the Minnesota Department of Revenue .

What is Minnesota’s economic nexus rule for remote sellers?

Out-of-state sellers must collect Minnesota sales tax if they exceed $100,000 in sales or complete 200 or more transactions in the state within the current or previous calendar year.

What happens if I don’t collect sales tax in Minnesota?

Failure to collect Minnesota sales tax can result in penalties, interest charges, and audits. The Minnesota Department of Revenue may assess back taxes and additional fines for non-compliance.

Are there special taxes, excise charges, or local add-ons I need to consider?

Yes. Some items, such as tobacco, alcohol, and lodging, are subject to additional excise taxes. Local jurisdictions may also impose local sales tax and the state rate.

Do I need a Minnesota seller’s permit if I’m only a wholesaler?

You may not need to collect sales tax if you sell exclusively to resellers and do not sell directly to consumers. However, you must obtain a resale certificate from your buyers.

Do I need a Minnesota seller’s permit if I only sell temporarily in the state?

Yes. If you conduct temporary sales at trade shows or fairs, you must obtain a temporary sales tax permit through the Minnesota Department of Revenue.

What is the penalty for filing and/or paying Minnesota sales tax late?

Late payments incur a 5% penalty of the unpaid monthly tax, up to 15%. Interest is also charged on overdue amounts; further non-compliance may result in additional fines.

Is software-as-a-service (SaaS) taxable in Minnesota?

Yes, SaaS and digital goods are taxable in Minnesota if used within the state. Businesses selling SaaS products should apply the appropriate Minnesota sales tax rate.