Expanding into Mexico? Understanding VAT registration is a must for non-resident companies looking to trade legally and efficiently. This article breaks down who needs to register, how to do it, and what to expect post-registration.

Why Non-Resident Firms Must Register for VAT in Mexico

Expanding into Mexico gives foreign companies, especially from the U.S.,access to one of Latin America’s biggest consumer markets. But this move also comes with strict tax rules, including VAT registration for non-resident businesses in Mexico.

Selling goods or services in Mexico without registering can result in customs delays, platform delistings, and steep fines. The Mexican Tax Administration Service (SAT) monitors cross-border activity closely and expects prompt compliance.

Commenda helps simplify registration and ongoing compliance for foreign companies. With the right support, you can avoid costly issues and tap into Mexico’s growing market with confidence.

When Does a Foreign Business Need to Register? Key Triggers

VAT registration in Mexico isn’t just for businesses with a physical presence. Foreign companies may be required to register as soon as they engage in certain taxable activities, even without a local office or employees.

Understanding these triggers is key to staying compliant and avoiding unexpected tax obligations.

Here are the most common situations that require VAT registration for non-resident companies:

- Holding inventory in Mexico: If your business stores goods in a local warehouse, even if managed by a third party, you’re likely required to register.

- Importing and selling goods locally: Companies that import products into Mexico and sell them to local customers must register and collect VAT.

- Providing digital or remote services to Mexican consumers: SaaS platforms, streaming services, or other online providers targeting individuals in Mexico are typically within scope.

- Facilitating sales via online marketplaces: If you’re using platforms like Mercado Libre or Amazon Mexico, you may be legally obligated to register, especially if those platforms are required to withhold or report VAT.

- Participating in trade shows or commercial events: Even temporary business activity, like selling at a trade fair in Mexico, can trigger registration.

For example, a U.S. e-commerce brand using a fulfillment center in Guadalajara, or a Canadian software company billing Mexican clients monthly, would both be considered liable for VAT registration in Mexico.

Registration Thresholds & Nexus Tests

Mexico applies a nil threshold for VAT registration by non-resident businesses. And, because there’s no minimum threshold, VAT registration for foreign companies in Mexico becomes mandatory as soon as taxable activities begin.

There is no minimum sales volume that allows you to delay registration, making it essential for businesses to monitor their activities closely from the start. For low-value imports, VAT is typically charged at the border, but this does not exempt sellers from registration if they also conduct local sales or hold inventory within the country.

Mexico VAT Number Format Explained

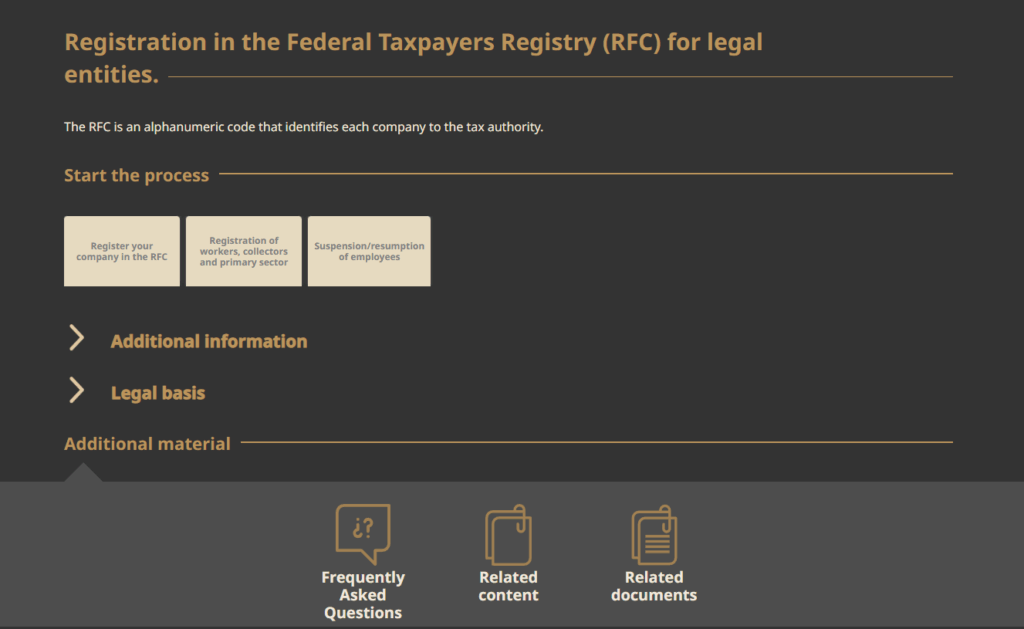

In Mexico, the VAT number is referred to as the RFC (Registro Federal de Contribuyentes). This tax ID is issued by SAT and is required for all entities conducting taxable activities in the country.

Here’s a quick breakdown of the RFC structure for legal entities:

| Element | Description | Example |

| 3 Letters | Derived from the business name | ABC |

| 6 Digits (Date) | Date of incorporation (YYMMDD format) | 210615 |

| 3 Alphanumeric Suffix | Unique SAT-generated code + checksum | 9K1 |

| Full RFC | Combination of all the above | ABC2106159K1 |

Common Mistakes to Avoid:

- Mixing up the letter “O” with the number “0”

- Using an individual’s RFC format (which includes birthdate) instead of a corporate one

- Omitting or altering the checksum suffix

Getting the RFC format wrong can lead to registration rejections or issues with invoice validation.

Is a Local Tax Agent or Fiscal Representative Required?

Yes. For non-resident tax registration in Mexico, appointing a local fiscal representative is a legal requirement for completing your VAT registration. This representative acts as the official liaison between your business and the SAT, helping ensure full compliance with local VAT rules.

The fiscal representative must be a licensed entity or individual established in Mexico and is responsible for handling filings, correspondence, and any VAT payments on behalf of the foreign company. In some cases, the representative may be held jointly liable for unpaid taxes, interest, or penalties, so choosing a trusted and experienced agent is essential.

While Mexico does not typically require a bank guarantee or financial bond for VAT registration, the fiscal representative’s liability makes it critical to maintain accurate records and remain current on filings.

Special Schemes & Simplifications

Mexico offers VAT schemes to ease compliance for certain sectors, especially helpful for non-resident businesses.

- Import VAT Deferment: Registered businesses can defer VAT at customs and report it in monthly returns, improving cash flow.

- Simplified E-Services Regime: Non-resident digital providers must register, collect VAT, and file simplified returns.

- Small Business Exemption: Applies to low-turnover resident entities, not foreign firms.

- Consignment & Warehouse Programs: Requires correct VAT handling on inventory transfers and sales.

These schemes help reduce costs and simplify VAT obligations in Mexico.

Step-by-Step: How to Register for VAT/GST in Mexico

Looking for a clear path through the process? This Mexico VAT registration guide outlines the key steps foreign companies need to follow to stay compliant.

Here’s a step-by-step overview:

- Gather Required Documents: Prepare key documents, including your certificate of incorporation, proof of business activity, valid ID or passport copies for directors, a Mexican tax agent’s power of attorney (if applicable), and bank reference letters.

- Create a SAT Tax Portal Account: To register for VAT online in Mexico, you’ll need to set up an account on the SAT platform and complete the registration form.

- Upload Documents and Submit Application: Submit all required documents through the online portal. Ensure formats and file sizes comply with portal requirements (typically under 150 KB per file).

- Pay Any Required Government Fees: While VAT registration is generally free, certain cases, such as digital service providers or importers, may involve processing fees or security deposits.

- Receive Your Mexican Tax ID (RFC): Once approved, you will be issued an RFC. Processing times vary but typically take 2–4 weeks.

This registration process is crucial for ensuring compliance and unlocking access to local markets and customers. Always verify current requirements with SAT or a trusted local advisor.

Required Documents Checklist

To complete VAT registration in Mexico, foreign companies must prepare and submit the following documents:

- Certificate of Incorporation: Verifies your company’s legal existence in its home country.

- Directors’ IDs or Passports: Government-issued identification for company directors or legal representatives.

- Proof of Business Activity: Invoices, contracts, or operational details showing taxable activity in Mexico.

- Bank Reference Letter: Confirms your company’s banking relationship and financial standing.

- Signed Power of Attorney: Required if appointing a local tax agent or fiscal representative to act on your behalf.

Ensure all documents are clear, up to date, and translated into Spanish if required.

Processing Time & Government Fees

VAT registration in Mexico for non-resident companies typically takes 3 to 8 weeks, depending on the completeness of your application and the responsiveness of the tax authority.

There is generally no government fee for standard VAT registration. However, certain categories, such as digital service providers or businesses involved in import activities, may be required to pay a processing fee or provide a security deposit as part of the approval process.

While bank guarantees are not usually mandatory, SAT may request additional financial assurances in cases where tax exposure is deemed high. Ensuring accurate documentation and representation can help avoid delays or added compliance hurdles.

Post-Registration Obligations

Once the VAT registration in Mexico is completed, businesses must file monthly VAT returns, typically due by the 17th day of the following month. Payments must be made in Mexican pesos, with currency conversion based on official exchange rates.

E-invoicing (CFDI) is mandatory, and all invoices must follow SAT’s digital format and approval system.

Companies are required to maintain tax records for at least five years. Currently, Mexico does not enforce SAF-T or e-Waybill systems, but compliance with evolving digital tax mandates is recommended.

Claiming Input‑Tax Credits & Refunds as a Non‑Resident

Foreign businesses registered for VAT in Mexico can claim input tax credits on expenses tied to taxable activities.

You’ll need CFDI-compliant invoices and proof of business relevance. Refunds are possible if credits exceed output VAT; SAT typically processes them within 40 business days, though requests for extra documents can extend this.

Common rejections include incomplete paperwork or unclear business purpose. For imported services, reverse-charge rules may apply, limiting refund eligibility.

Penalties for Late Registration or Non‑Compliance

Non-compliance with VAT rules in Mexico can trigger serious consequences: Your business might be required to pay a fee, based on the nature of non-compliance.

- Failure to register on time: MXN 3,870–11,600

- Late filing: MXN 1,560–38,700

- Late DIOT submission (transaction report): MXN 11,580–23,160

- Late payment/return: surcharge of ~5% + ~0.033% daily interest; interest of ~1.47% monthly on unpaid VAT

- Issuing invalid invoices (CFDI): fines up to MXN 10,080 each

Additional risks include customs seizure, marketplace delisting, and personal liability for directors where willful non-compliance is found.

Staying proactive with registration and compliance is key to avoiding unnecessary costs and disruptions.

Deregistration & VAT Number Changes

If your business stops taxable activities in Mexico, you can request VAT deregistration via the SAT portal. File a final return, submit a formal request, and provide proof of ceased activity.

For changes like mergers or name updates, notify SAT and submit updated documents. Until SAT confirms deregistration or changes, you must continue filing returns. Keeping your information current helps avoid penalties and maintain compliance.

Conclusion

Expanding into Mexico brings exciting opportunities, but also complex tax obligations. From understanding when to register to navigating compliance rules and input tax refunds, getting VAT right is essential for smooth cross-border operations.

With Commenda, foreign businesses can simplify the entire VAT lifecycle. Our platform handles registrations, document submissions, and ongoing compliance with precision and speed. Backed by automated tools, clear guidance, and expert support, you can avoid delays, reduce manual errors, and stay compliant in a constantly evolving tax landscape.

Want to streamline your VAT registration in Mexico? Book a demo today and see how Commenda makes tax compliance smarter, faster, and easier for global businesses.

FAQs: Foreign Business VAT/GST in Mexico

Q. Do non-resident remote sellers need to register for VAT in Mexico if they only supply digital services?

Yes. Mexico requires non-resident providers of digital services (e.g., streaming, SaaS, e-learning) to register for VAT, collect it from Mexican consumers, and file simplified monthly returns, even without a physical presence in the country.

Q. What is the sales threshold that triggers mandatory foreign business VAT registration in Mexico?

There is no minimum threshold. Foreign businesses must register for VAT as soon as they engage in taxable activities in Mexico, regardless of turnover.

Q. How long does the VAT number application process take for a company with no local branch?

The typical processing time is 2 to 4 weeks, assuming all documents are complete and compliant with SAT’s requirements.

Q. Can I reclaim input tax in Mexico without a resident tax representative?

No. Non-resident businesses must appoint a licensed local tax agent or fiscal representative to claim input VAT and remain compliant with filing rules.

Q. Which documents are required to open a non-resident VAT account online?

You’ll need a certificate of incorporation, directors’ IDs/passports, proof of business activity in Mexico, a bank reference letter, and a signed power of attorney if using a fiscal rep.

Q. What penalties apply for late or missed VAT filings by overseas entities?

Penalties include fines (ranging from MXN 1,560 to over MXN 38,000), interest on late payments, possible customs blocks, and delisting from digital marketplaces.

Q. Is there a simplified or low-value import scheme for cross-border e-commerce sellers?

Mexico does not currently operate a formal low-value import VAT exemption. All imports are subject to standard VAT rules, and sellers must register once inventory is held or sales occur locally.

Q. How do currency conversions affect VAT payments from foreign bank accounts?

All VAT payments must be made in Mexican pesos, using official exchange rates published by the Bank of Mexico on the transaction date or return filing date.

Q. Can multiple marketplaces share one Mexican VAT registration, or must each seller register separately?

Each legal entity selling into Mexico must register for VAT individually. Marketplaces may handle withholding, but sellers remain responsible for proper registration and compliance.

Q. What are the annual costs of appointing a fiscal representative in Mexico, and can Commenda handle this role?

Costs vary by provider and complexity but often range from USD 1,000 to 3,000 annually. Yes, Commenda can act as your fiscal representative and manage end-to-end VAT compliance in Mexico.

Q. How do I cancel or deregister my Mexico VAT number if my turnover drops below the threshold?

Submit a deregistration request via the SAT portal, along with a final return and proof of ceased activity. Formal closure is still required.

Q. Does the reverse-charge mechanism remove the need for VAT registration on B2B services?

Not always. Reverse charge may apply, but registration can still be required depending on the service and customer type.