Ensuring your business complies with Oregon’s legal and regulatory requirements is essential for smooth operations and growth. The Oregon Business Entity Search is a vital tool for entrepreneurs, investors, and legal professionals seeking accurate information on registered entities in the state.

This tool offers detailed insights into a business’s status, ownership structure, filing history, and more, helping identify potential risks, opportunities, and compliance gaps. Whether you’re verifying name availability for a new venture or conducting due diligence on an existing company, the Oregon Business Entity Search provides the clarity needed to make informed, data-driven decisions.

In this blog, we’ll explore how the Oregon Business Entity Search works, the benefits it provides, and the key information it reveals about Oregon-registered businesses.

What Is an Oregon Business Entity Search?

An Oregon business entity search is an online tool provided by the Oregon Secretary of State‘s Corporation Division. It allows users to access public records of businesses registered in the state, facilitating transparency and informed decision-making.

Key purposes of the Oregon business entity search include:

- Verifying Business Name Availability: Ensure your desired business name is unique and distinguishable from existing entities.

- Checking Entity Status: Determine if a business is active, inactive, or dissolved, aiding in assessing its legitimacy.

- Obtaining Business Details: Access information such as entity type, registration date, and registered agent.

- Confirming Good Standing: Verify if a business is in compliance with state regulations, which is crucial for partnerships or expansions.

- Identifying Associated Entities: Discover related businesses or subsidiaries through associated name searches.

Using the Oregon business entity search ensures that your business operations are based on accurate and up-to-date information, minimizing legal risks and fostering trust with partners and customers.

Importance of Conducting an Oregon Entity Search

Performing a business entity search in Oregon is a critical step for any company considering expansion into the state. This process ensures that your business complies with local regulations, mitigates potential risks, and establishes a solid foundation for operations.

Here are some critical advantages of running an Oregon entity search:

Checking Name Availability

Before registering your business in Oregon, it’s essential to verify that your desired business name is available. The Oregon Secretary of State’s Corporation Division allows you to search for active business registrations to ensure your chosen name isn’t already in use.

If the name is available, you can proceed with registration; however, availability doesn’t guarantee exclusive usage rights. It’s advisable to consult with a legal professional to assess potential trademark conflicts and secure domain names early to protect your brand identity.

Due Diligence & Risk Mitigation

Conducting due diligence through a business entity search in Oregon helps identify potential risks and ensures you make informed business decisions. With it you can:

- Assess Business Status: Determine if a company is active, inactive, or dissolved to evaluate its reliability.

- Review Ownership Structure: Understand the entity’s structure to gauge potential liabilities and responsibilities.

- Examine Filing History: Check for consistent compliance with state regulations, indicating operational stability.

- Identify Associated Names: Discover any related or similar entities that could pose competitive or legal risks.

Legal Compliance

Ensuring your business complies with Oregon’s legal requirements is paramount. The Oregon business entity search provides access to public records, allowing you to verify a company’s registration status, registered agent, and filing history. This transparency helps in confirming that your business partners or competitors adhere to state laws, reducing the risk of legal disputes and fostering a trustworthy business environment.

Types of Business Entities in Oregon

In the State of Oregon, business entity search results include various legal structures, each with distinct formation requirements and operational characteristics. Understanding these entities is crucial for compliance and strategic planning.

Below are some common entity types you might come across:

- Limited Liability Company (LLC): Combines liability protection with flexible management. Requires filing Articles of Organization and annual reports. Popular among small to mid-sized businesses.

- Corporation: Includes business corporations, nonprofit corporations, and professional corporations. Requires filing Articles of Incorporation and annual reports. Subject to specific governance and regulatory requirements.

- Limited Liability Partnership (LLP): Provides liability protection for partners. Requires filing a registration document with the Secretary of State. Commonly used by professional service providers.

- Limited Partnership (LP): Comprises at least one general partner with unlimited liability and one or more limited partners with liability protection. Requires filing a certificate of limited partnership. Often used for investment ventures.

- Sole Proprietorship: An unincorporated business owned by a single individual. Does not require formal registration unless a fictitious business name is used. It is the simplest form of business entity.

- Assumed Business Name (DBA): A registered name under which a business operates, different from its legal entity name. Requires filing with the Secretary of State. Commonly used by sole proprietors and partnerships.

How to Perform an Oregon Business Entity Search

Businesses can use the Oregon business entity search on the Secretary of State’s website to locate registration records, filing history, and registered-agent details for Oregon entities. Below is a comprehensive list of steps that outlines how to run an Oregon SOS business entity search.

Step 1: Visit the SOS Site

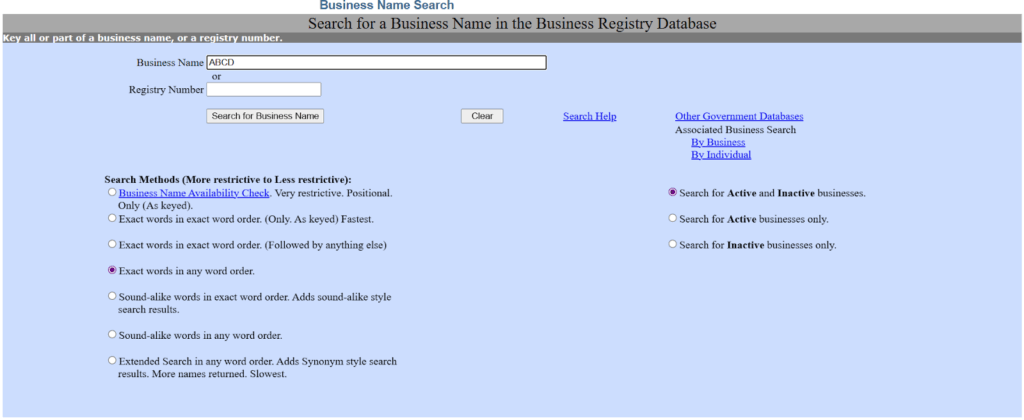

Go to the Oregon Secretary of State website and click on the Business Name Search option to open the main business entity search portal to begin your search.

Step 2: Enter Search Criteria

Type the entity name, registry number (omit the dash), or officer/agent name. You can use the exact/any-order or sound-alike search options for broader results.

Step 3: Review Search Results

Results list all active and inactive businesses by default. Here you can check entities by name, registry numbers, and status.

Step 4: Click Into Entity Details

Open the record to view more detailed information, such as summary history, filings, registered agent, and status.

Step 5: Request Official Documents (Optional)

Order a Certificate of Existence or submit a Request for Copy form for certified filings or older images.

Understanding Oregon Entity Search Results

When you use the Oregon Secretary of State business entity search, the results will include a status. This is an indicator of an entity’s legal and operational standing, and knowing what these mean is crucial to interpreting the search results accurately.

Here’s a list of common statuses you will see:

- Active: The entity is properly registered, current with required filings, and in good standing with the state.

- Inactive: The business is not currently active, which could be due to voluntary inactivity or administrative action.

- Dissolved: The entity has legally ceased operations and is no longer recognized as active under Oregon law.

- Administratively Dissolved: The business failed to comply with filing requirements (such as not submitting an annual report), leading to involuntary dissolution by the state.

- Inactive – Withdrawn: The business has voluntarily withdrawn its registration and is no longer operating in Oregon.

The status provides insight into operational legitimacy, historical activity, and adherence to state filing obligations. These are key elements for due diligence, partnership decisions, or market entry planning.

Common Issues with Oregon Business Entity Searches

Users of the Oregon business entity search may encounter several typical challenges. Below are common issues and concise troubleshooting tips to help you tackle them effectively:

Search Results Issues

- Too many results: Searching generic or partial names often yields broad matches. Refine your query using exact phrases, registry numbers, or apply advanced filters.

- No matching records: This could be due to misspellings or differences in punctuation and spacing. Try simplified terms or use “exact words in any word order” and other advanced options.

Name Similarity Confusion

Oregon law requires names to be distinguishable from existing ones. Even small differences in punctuation may not suffice, so be cautious when names are deceptively similar.

Browser or Technical Compatibility

The online registry may not work well on Safari. Use Chrome, Firefox, or Edge for the best experience. Ensure cookies are enabled for full functionality.

Scope Limitations

The registry confirms registration but doesn’t verify business licenses or regulatory compliance. Use the Business Xpress License Directory for licensing checks and consult relevant state agencies for verification.

Steps After Completing Your Oregon Business Entity Search

Once you’ve conducted your Oregon business entity search, your next steps depend on why you required the information. The following sections outline what to do next for both new business registrations and existing entity research.

For New Businesses

- Reserve Your Business Name (Optional): If your desired name is available, you can file an Assumed Business Name (ABN) registration for a one-time fee of $50. This gives you exclusive use of the name statewide for two years, ensuring no one else can claim it during your preparation period.

- Proceed with Entity Formation: When ready, register your business entity with the Oregon Business Registry. You must file Articles of Organization or Incorporation and pay the applicable formation fees of $100.

- Plan for Licensing and Tax Registration: Check whether industry-specific licenses or permits are required, and register with the Oregon Department of Revenue for applicable tax accounts. The SOS “Start a Business Guide” and local SBDC resources offer tailored guidance.

For Existing Entity Research or Due Diligence

- Document Your Findings: Save or print your search results, including entity status and filing details, for reference and verification.

- Request Official Records: If required, order a Certificate of Existence or other certified filings via the Oregon Business Registry to serve as official documentation. Typically, this will cost about $10.

- Monitor and Maintain Compliance: Set reminders for annual filing deadlines (most entities renew annually; assumed names renew every two years) to preserve active status.

Simplify Your Oregon Business Setup with Commenda

Completing an Oregon business entity search is just the beginning, as navigating ongoing compliance requires accuracy and consistency. Commenda makes it easier with automated filings, deadline tracking, and proactive alerts so you never miss an annual report or renewal.

Our entity management solutions centralize filings, documents, and compliance tasks in one platform. From AI-powered name conflict checks against Oregon and federal records to real-time monitoring of status changes, Commenda reduces risks and ensures smooth operations. With integrated tax compliance support and streamlined workflows, you can focus on growing your business while we handle the details.

Stay compliant with Oregon requirements from day one. Book a free demo with Commenda today!

FAQs on Oregon Business Entity Search

Q. How do I verify if my chosen business name is available in Oregon?

You can use the Oregon business entity search tool on the Secretary of State’s website. Enter your desired name, and the system will display any exact or similar matches. If no conflicts appear, the name is likely available, though final approval occurs during the registration process.

Q. Can I reserve a business name in Oregon after my entity search?

Yes. Oregon allows you to reserve an Assumed Business Name (ABN) for a two-year period. This ensures exclusive statewide use while you prepare formation documents. The filing fee is currently $50.

Q. What does it mean if a business entity in Oregon is listed as “dissolved”?

“Dissolved” means the business entity has been formally closed with the Oregon Secretary of State. Once dissolved, the entity no longer has the authority to conduct business in Oregon, though it may still need to settle outstanding debts or obligations.

Q. How frequently is the Oregon business entity database updated?

The Oregon Secretary of State updates its entity database in real time. Filings completed online are usually reflected immediately, while mailed submissions may take a few business days to appear.

Q. Can sole proprietorships be found through Oregon’s entity search tool?

No. Sole proprietorships and general partnerships typically do not register with the Secretary of State unless they file an Assumed Business Name. Only registered entities such as LLCs, corporations, and limited partnerships will appear in the search.

Q. Are official business documents available directly via Oregon’s entity search platform?

Yes. From an entity’s detail page, you can view and order official records such as Articles of Organization, Certificates of Good Standing, and annual reports. Some documents are free to view, while certified copies may require a small fee.

Q. Why might my Oregon entity search return no results for an existing business?

There are several possible explanations. The business may be operating as a sole proprietorship, which does not require formal registration with the state. It could also be listed under a different or shortened legal name than the one you searched for.