Ensuring compliance with North Carolina’s legal and regulatory framework is essential for any business entering or operating in the state. The North Carolina Business Entity Search is a vital tool for verifying information about companies registered with the Secretary of State.

It allows entrepreneurs, investors, and legal professionals to confirm entity status, review ownership structures, examine filing histories, and assess overall compliance. By providing transparency on whether a business is active, dissolved, or in good standing, this search helps identify risks and opportunities with confidence.

In this blog, we’ll explore how the North Carolina Business Entity Search supports business formation, due diligence, and strategic decision-making.

What is a North Carolina Business Entity Search?

The North Carolina business entity search is an online database maintained by the NC Secretary of State. It lets businesses, investors, legal advisors, and others access critical public registration data for entities formed or registered in North Carolina.

Here are some purposes and uses for the business entity search:

- Verify Name Availability: Ensure your desired name isn’t already registered or deceptively similar to existing entities.

- Confirm Entity Legitimacy & Status: Check whether a business is active, dissolved, suspended, or in good standing.

- Access Essential Business Data: Retrieve details such as the registered agent, formation date, jurisdiction, business type, and principal address.

- Review Filing & Document History: View filings like annual reports, amendments, or request certificates of existence.

This tool is indispensable for startups, mid-market enterprises, cross-border businesses, and legal professionals performing due diligence.

Importance of Conducting a North Carolina Entity Search

Conducting a business entity search in North Carolina is a crucial first step for businesses expanding into the state. This process ensures clarity on name availability, legal standing, and helps safeguard against risks, helping businesses run confident, compliant operations.

Here are a few key benefits of running a business entity search:

Checking Name Availability

North Carolina mandates that entity names must be distinguishable, not deceptively similar to existing names, and must use required designators like “LLC” or “Inc.” The state’s “distinguishable upon the record” rule reinforces this standard.

By performing a thorough North Carolina business entity search, you can verify that your desired name isn’t already in use. This prevents rejection of your formation documents and helps avoid consumer confusion.

Due Diligence & Risk Mitigation

Beyond checking name availability, the search also supports stronger decision-making by offering access to critical records. Using this search, you can:

- Verify entity status: Confirm whether a business is active, dissolved, suspended, or revoked

- Assess records: Access registered agent information, formation dates, and filing histories to evaluate credibility and operational transparency.

Legal Compliance

To remain in good standing with state regulations, businesses must also use the search to confirm compliance requirements:

- Meet naming requirements: Ensure the name adheres to NC naming rules, avoiding restricted terms (like “bank,” “architect,” etc.)

- Reduce liability: Check for reserved or similar names that could block approval and potentially expose you to disputes.

Types of Business Entities in North Carolina

In the state of North Carolina, business entity search results cover a wide range of legally recognized structures. Whether you’re forming a local startup or assessing an established enterprise, understanding these categories is essential for informed decision-making.

Here are the primary entity types included in the search:

- Corporations (C-Corp & S-Corp): These are formal business entities created by filing Articles of Incorporation. C-Corps are taxed at both the entity and shareholder levels (“double taxation”), while S-Corps are IRS-designated pass-through entities and avoid corporate-level tax.

- Limited Liability Companies (LLCs): Offering flexibility and liability protection, LLCs are popular among small and mid-size businesses. North Carolina recognizes single-member, multi-member, professional (PLLC), and Series LLCs.

- Professional Entities (PC, PLLC): These are tailored for licensed professionals, such as doctors, lawyers, or accountants, who operate under specific regulatory standards. Forms include Professional Corporations and Professional LLCs registered under Chapter 55B.

- General Partnerships and Sole Proprietorships: Often unregistered, though a “certificate of assumed name” may be required in some counties

- Limited Partnerships (LP), Limited Liability Partnerships (LLP), and Limited Liability Limited Partnerships (LLLP): These require formal registration with the Secretary of State and offer varied liability structures depending on the partnership type.

How to Perform a North Carolina Business Entity Search

In North Carolina, businesses can use the official Secretary of State portal to ensure accurate, up-to-date results. The North Carolina business entity search helps you verify names, statuses, and filings. Here’s a step-by-step guide to the process:

Step 1: Visit the portal

Go to the North Carolina Secretary of State website, open the online services tab, and click on Business Search. This is the official North Carolina secretary of state business entity search tool.

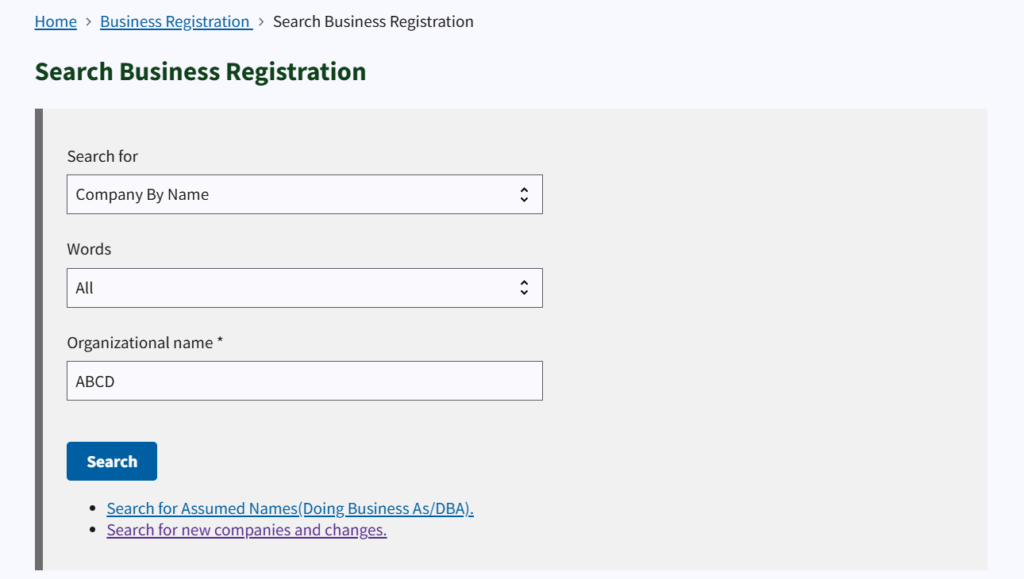

Step 2: Enter search criteria

Search by Entity Name, SOSID (state ID), Registered Agent, or Company Officials. Use partial names to see more matches.

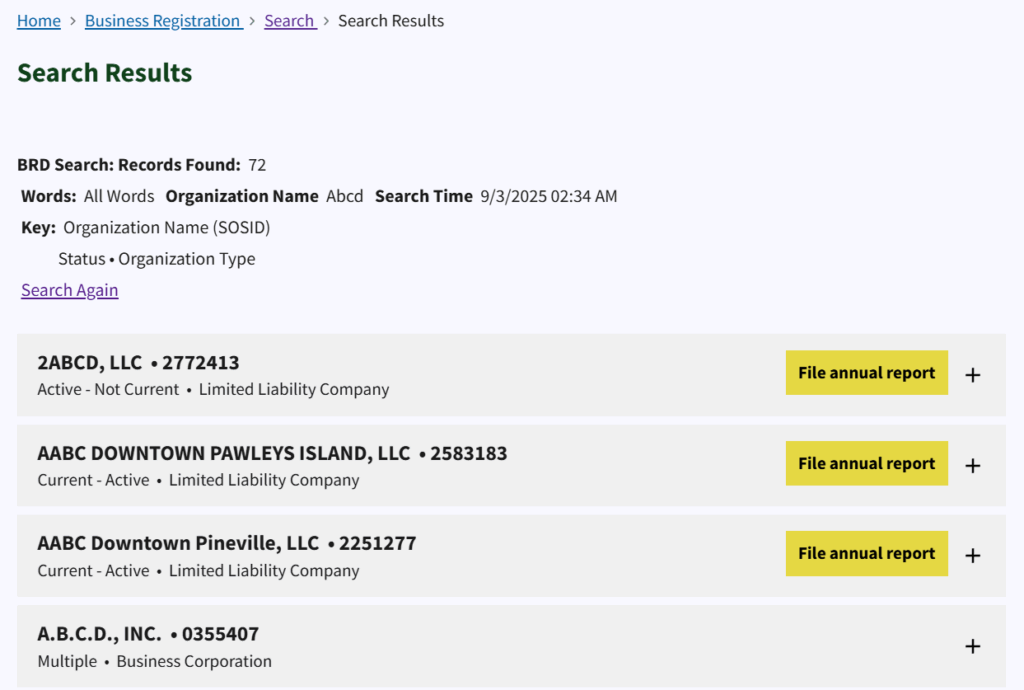

Step 3: Review results

Scan the results list for matching entities, then note status (e.g., Active, Dissolved) and type before proceeding. Results can be expanded when clicked upon to view additional information.

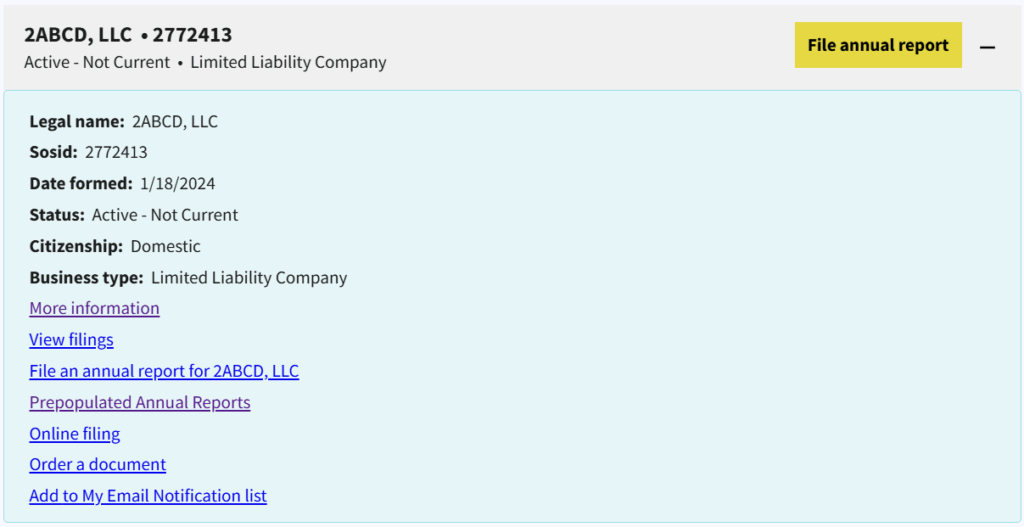

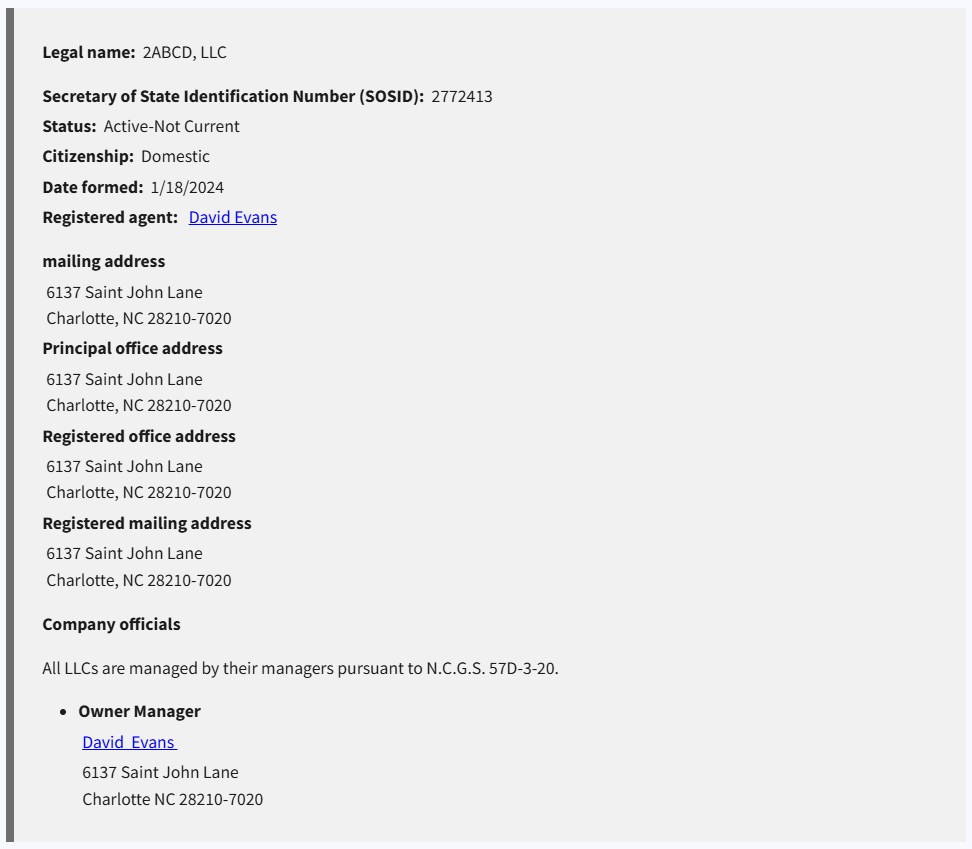

Step 4: Open the entity record

Expand the result you want to look up and click on “More Information” to view the business’ profile, which contains official address information and the name of company officials.

Step 5: Request official documents (optional)

To order additional documents, you can click on the “Order a document” options on the search results page. You will need to be a registered user in the SOS portal to be able to down documents.

Understanding North Carolina Entity Search Results

When you conduct a North Carolina SOS business entity search, you’ll encounter several possible statuses, each reflecting the legal standing of an entity. Interpreting these accurately is crucial for informed decisions.

Here’s a breakdown of key statuses you may see:

- Current (Active): Indicates the entity is compliant with all filings and fees, and is officially active in the NC Business Registry, signifying operational stability.

- Multiple: Reflects overlapping issues such as administrative dissolution and tax suspension, showing significant compliance problems.

- Suspended: Triggered by the NC Department of Revenue due to tax-related noncompliance; the entity cannot file most documents until resolved.

- Dissolved: The business has voluntarily ceased operations by filing Articles of Dissolution and is no longer active.

- In Process: The entity’s formation documents have been received and are under review; entity creation is pending.

- Cancelled: Often applies when partnerships formally terminate registration (e.g., LP, LLP, LLLP). The entity is no longer active.

- Admin. Dissolved: The state has dissolved the entity due to failure to file required reports; only agent changes can be filed.

- Revoked: The entity’s registration has been revoked due to noncompliance, typically with filings or agent requirements.

- Doc Tracking Canceled: Indicates an administrative interruption where document processing was halted; may signal internal administrative issues.

- Withdrawn: A foreign entity has voluntarily withdrawn its Certificate of Authority and is no longer registered in NC.

- PA Suspended: Targeted at professional entities suspended by regulatory boards under N.C.G.S. Chapter 55B, such as healthcare or legal professionals.

- Withdrawn by Merger: A foreign entity is no longer registered because it merged with or converted into another entity.

- Auto Dissolve: The entity was automatically dissolved by legislative mandate, due to statutory grounds.

- Failure to Pay Fee: Entity formation documents were rejected due to issues with the filing fee (e.g., insufficient funds); the entity is not active.

Common Issues with North Carolina Business Entity Searches

While the North Carolina business entity search is a reliable tool, users may occasionally encounter hurdles. Below are common challenges and practical ways to overcome them to ensure accurate and efficient results:

Overwhelming or Missing Results

- Too many matches: Generic or partial names yield broad lists. Try narrowing down with SOSIDs or specific entity types.

- Too few or none: Double-check spelling or try variations like plurals, abbreviations (“Corp.” vs. “Corporation”), or the “Contains Words” search option to uncover similar entries.

Similar Names Causing Confusion

North Carolina demands that business names be “distinguishable”; even subtle variations in wording or suffix (LLC vs. Inc.) can result in duplicate-like listings. Pay close attention to naming conventions and entity type when assessing availability.

System Interruptions or Delays

The SOS website may occasionally experience maintenance or updates that affect performance. If search results fail, try refreshing your browser, switching to a different browser, or checking back later.

Misunderstanding Status Labels

Statuses like “Administratively Dissolved” or “Withdrawn” don’t always mean you’re clear to use the name as these entities are still registered in the system and may still block name reuse. Always verify before assuming availability.

Scam Notices Mimicking SOS Communications

Be cautious of unsolicited mail or emails claiming to be from the SOS demanding urgent filings or fees as these are often scams. Always use the official SOSNC.gov portal for filings or annual reports.

Steps After Completing Your North Carolina Entity Search

After finishing your North Carolina business entity search, your next steps will depend on why you needed to conduct the search in the first place. New businesses should focus on formation tasks, while existing entities may need to update or verify records.

For New Enterprises

- Reserve Your Business Name (Optional): If your name is available but you’re not ready to form your entity immediately, you may file an Application to Reserve a Business Entity Name for a $30 fee. This reserves your name for up to 120 days.

- Proceed with Formation: If you’re ready to launch, file the appropriate formation document, such as Articles of Organization or Articles of Incorporation, with the NC SOS, typically for a filing fee of around $125 for LLCs.

- Set Up Business Essentials: Secure a registered agent, apply for an EIN, register for state taxes, and obtain any necessary licenses or permits to ensure your operation is fully compliant.

For Existing Entity Research

- Document Your Findings: Save or print the search record for reference or internal due diligence.

- Request Official Documents: Order certified copies, a Certificate of Existence (Good Standing), or other filings via the SOS portal for legal or transactional purposes.

- Assess Compliance Status: If an entity’s status appears inactive or non-compliant (e.g., suspended, dissolved), investigate reinstatement or further compliance actions to address gaps.

Simplify Your North Carolina Business Setup with Commenda

Ensuring compliance after a North Carolina business entity search can be complex. Commenda streamlines the process with tailored solutions designed to simplify incorporation, filings, and ongoing compliance.

Our platform offers smart entity management, automated deadline tracking, and real-time alerts to help you avoid missed filings or costly penalties. With tools like AI-powered name checks and centralized document handling, we make compliance straightforward and reliable.

Focus on growing your business while we handle the details. Book a free demo with Commenda today and experience smooth business setup in North Carolina.

FAQs on North Carolina Business Entity Search

Q. How do I verify if my chosen business name is available in North Carolina?

You can confirm name availability by conducting a North Carolina business entity search through the Secretary of State’s Corporations Division database. If no conflicting results appear, the name may be available for registration.

Q. Can I reserve a business name in North Carolina after my entity search?

Yes. You may reserve a name for 120 days by filing an Application to Reserve a Business Entity Name with the Secretary of State and paying the required fee.

Q. What does it mean if a business entity in North Carolina is listed as “forfeited”?

“Forfeited” indicates that a business lost its legal standing, typically due to failure to file annual reports or pay required fees. Reinstatement may be possible by correcting these issues.

Q. How frequently is the North Carolina business entity database updated?

The database is updated regularly, usually within 24 hours of filings, ensuring that most information is current and accurate.

Q. Can sole proprietorships be found through North Carolina’s entity search tool?

No. Sole proprietorships are not required to register with the Secretary of State, so they will not appear in the search results.

Q. Are official business documents available directly via North Carolina’s entity search platform?

Yes. Users can access and request certified copies of formation documents, annual reports, and Certificates of Existence directly from the search portal.

Q. Why might my North Carolina entity search return no results for an existing business?

This may happen due to spelling errors, use of a DBA (“doing business as”) name instead of the registered name, or if the business was recently formed and not yet processed into the database.