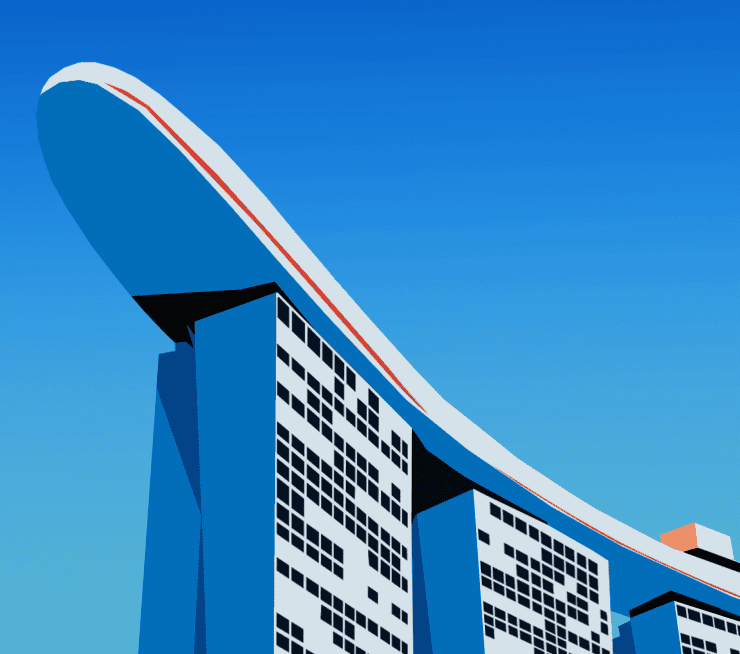

Do business in

Singapore

Trusted by hundreds of cross-border businesses

Benefits

Why choose Commenda for your company expansion in the Singapore

A one-stop shop for global companies setting up their Singapore presence.

Register from anywhere in the world

Incorporate your business from anywhere in the world through our digital-first process.

Access local tax and legal expertise

We offer flexible and recurring options with best-in-class local accountants and experienced lawyers available on demand.

Stay compliant, automatically

We help automate filings and compliance tasks, keeping your business up to date with GST, corporate tax, and everything in between.

Entity Types

Choose the right business structure for your company

Pte Ltd

- Limited liability for shareholders, minimizing personal financial risk.

- Attractive corporate tax framework, including tax exemptions for startups.

- Strong credibility with customers, investors, and financial institutions.

- Clear shareholding structure, facilitating the issuance of shares for fundraising.

- Perpetual existence, independent of changes in ownership.

- Must have at least one resident director (a Singapore citizen, PR, or holder of valid work pass).

- Required to file annual returns with the Accounting and Corporate Regulatory Authority (ACRA).

- Strict compliance with Singapore’s Company Law and corporate governance.

- Shares are not publicly traded unless you convert to a public company.

LLP

- Each partner’s liability is generally limited to their own actions and capital contributions.

- Flexible management structure compared to a corporate entity.

- Profits are taxed at the individual partner level (pass-through taxation), potentially reducing overall tax burden.

- Ideal for professional services, small practices, or partnerships seeking liability protection.

- Must have at least two partners and one manager who is ordinarily resident in Singapore.

- An LLP has separate legal personality, but partners may still be personally liable for their own negligence.

- Some investors or creditors may prefer the corporate structure of a Pte Ltd for larger investments.

- Requires annual declaration of solvency with ACRA.

Got questions? Schedule a call with one of our experts

Choose a convenient time to chat with our incorporation experts and get the answers you need to take the next step.

Download your free Pre-Incorporation checklist

We’ve put together all of the documents and details you need before you open a company.

Frequently Asked Questions

Yes, foreigners can own 100% of a Singapore company but must have a local director.

Typically, 1-3 business days.

No, everything can be completed remotely.

Corporate tax is capped at 17%, with exemptions for startups.

If your annual revenue exceeds SGD 1M, you must register for GST.