Verifying a VAT ID in Vietnam is a critical step for businesses and individuals to prevent fraud, avoid penalties, and ensure full compliance with tax regulations. Using an invalid or inactive VAT ID can result in delayed transactions, denied tax deductions, suspended invoices, and reputational damage. Performing a VAT ID check or VAT ID verification online provides peace of mind, confirming that the VAT ID you are dealing with is valid, active, and associated with the correct entity.

This guide explains how to verify VAT ID online, details the structure and importance of VAT IDs, and describes troubleshooting methods, bulk validation solutions, and automated verification tools to simplify compliance.

VAT ID Verification in Vietnam: Step-by-Step Process to Check a VAT ID Number Online

Fraud and tax penalties are significant risks in business operations. Incorrect VAT IDs or unverified suppliers can lead to non-compliance, delayed payments, or even contract disputes. A proper VAT ID verification process ensures businesses are protected.

The Vietnamese government offers an official portal that enables a quick and reliable VAT ID lookup in Vietnam. A verified VAT ID guarantees that the entity is legitimate and registered with the General Department of Taxation (GDT).

Step-by-Step Process:

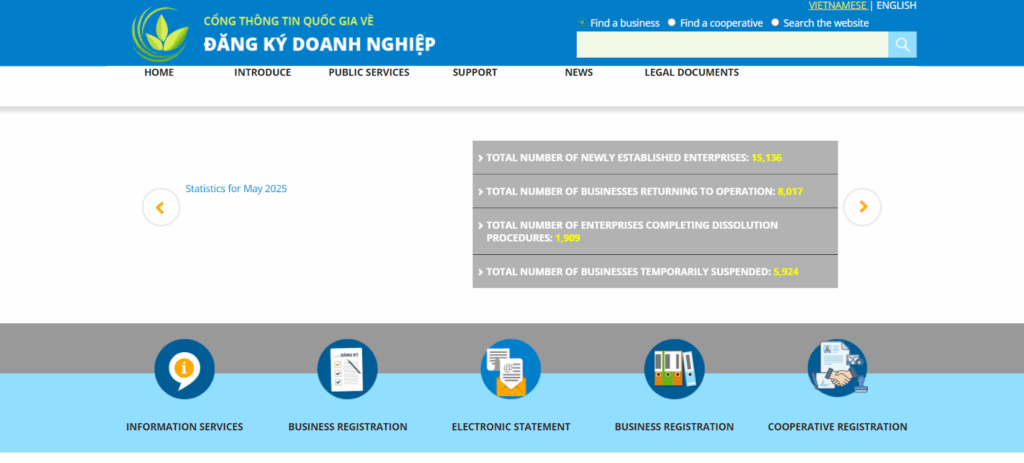

- Visit the Official Portal: Go to the National Business Registration Portal (https://dangkykinhdoanh.gov.vn).

- Search VAT Number: Select the “Search Enterprises” option and enter the complete VAT ID.

- Complete Security Check: Fill in the CAPTCHA to verify your request.

- Click “Search”: The portal displays the registration status, legal representatives, addresses, and company type.

- Interpret Results: Confirm that the VAT ID is “active” and that company details match the documentation provided by your vendor or partner.

Performing a VAT ID lookup in Vietnam ensures that businesses avoid fraudulent suppliers, maintain legal compliance, and can claim tax deductions or input VAT credits safely and securely. Using official portals or trusted digital tools reduces the risk of manual errors and ensures timely verification.

What Is a VAT ID in Vietnam? Definition, Purpose & Issuing Authority

A VAT ID, also called a Tax Identification Number (TIN) or “Mã số thuế”/MST, is a unique 10-13 digit number issued to every VAT-registered entity in Vietnam. It is mandatory for local businesses, foreign-owned companies, branches, and individuals liable for VAT.

Purpose of a VAT ID:

- Tracking Tax Obligations: Ensures accurate reporting and compliance with VAT regulations.

- VAT Deduction & Reclaim: Only entities with valid VAT IDs can reclaim input VAT.

- Legal Filings: Required for contracts, invoices, customs declarations, and e-invoicing.

Issuing Authority: The General Department of Taxation (GDT) under the Ministry of Finance issues, maintains, and monitors VAT IDs in Vietnam.

Where It Appears: VAT IDs are printed on invoices, contracts, customs documentation, e-invoices, and official tax filings. For example, when importing goods, customs authorities require a valid VAT ID to process clearance.

A correct and verified VAT ID is a key identifier for businesses, establishing legitimacy and enabling compliance with Vietnam’s tax laws. Regular VAT ID verification ensures that all your business transactions are conducted in a legally valid manner.

Importance of the VAT ID for Businesses & Individuals

A VAT ID is more than just a number—it is central to business operations, financial compliance, and credibility.

- Compliance: Businesses must maintain active VAT IDs. Using an inactive or incorrect VAT ID may lead to fines, delayed filings, or rejected invoices.

- VAT Reclaim: Input VAT can only be reclaimed with a valid VAT ID, which can impact cash flow if the number is invalid.

- Cross-Border Transactions: Exporters, importers, and e-commerce operators require verified VAT IDs for customs clearance, shipping, and international transactions.

- Trust & Credibility: Displaying a verified VAT ID on invoices and portals signals reliability to clients, suppliers, and regulators.

- 2025 Stat: In 2025, penalties for VAT/TIN violations in Vietnam range from 2,000,000 to 5,000,000 VND for incorrect reporting, late filings, or the use of invalid VAT IDs.

Verifying VAT IDs helps businesses stay compliant, avoid financial loss, and strengthen relationships with partners. Regular VAT ID verification is a proactive measure that supports operational efficiency and risk mitigation.

Why Verify a VAT ID in Vietnam? Compliance, Fraud Prevention, Tax Credit Protection

Failing to verify a VAT ID exposes businesses to financial and legal risks. A thorough VAT ID check protects both the company and its clients.

Consequences of Invalid VAT IDs:

- Financial Penalties: Fines, late fees, and possible suspension of VAT deductions.

- Denied Tax Credits: Input VAT cannot be reclaimed if the ID is invalid.

- Operational Delays: Suspended e-invoices and customs clearance issues.

- Legal Challenges: Contracts may be deemed unenforceable if one of the partners is not registered.

- Reputational Risk: Businesses may be blocked or face scrutiny from authorities.

Vendor Due-Diligence: Most companies, especially multinationals, require an upfront VAT ID check before onboarding suppliers. Performing a VAT ID lookup in Vietnam confirms legitimacy, protects transactions, and ensures compliance with local tax laws.

VAT ID Number Format Explained (Digits, Letters & Checksum)

Vietnamese VAT IDs follow a structured system designed for accuracy and easy verification.

Format:

- 10-digit code for main entities (e.g., 0193456780)

- 13-digit code for branches or subsidiaries (e.g., 0193456780-001)

Structure:

- First two digits: Province code

- Next seven digits: Unique entity identifier

- Tenth digit: Checksum

- Optional final three digits: Branch or subsidiary sequence

Common Typos: Transposed digits, missing branch numbers, extra spaces, or confusing O and 0.

Sample IDs:

- Main: 0193456780

- Branch: 0193456780-001

Understanding the correct structure is crucial for accurate VAT ID verification, thereby reducing errors in both manual entry and automated validation systems.

Step-by-Step Process to Verify a VAT ID on the Official Vietnam Portal

Here’s a detailed guide to performing an official VAT ID check online:

- Visit the Official Portal: Open https://dangkykinhdoanh.gov.vn and select “Search Enterprises.”

- Enter the Full VAT ID: Include the branch number if applicable.

- Complete Security Step: Fill in the CAPTCHA to verify that you are not a bot.

- Click ‘Search’: The portal displays the registration status, legal representatives, address, and company type.

- Interpret Results: Confirm that the entity is “active” and that the details match your documentation.

Performing this VAT ID lookup in Vietnam ensures compliance, prevents fraud, and validates the tax credentials of your business partners.

Troubleshooting Invalid or Inactive Results

| Error Message | Likely Cause | Quick Fix |

| “No results found” | Typo or incorrect number | Double-check VAT ID, remove spaces, or verify from the invoice/document |

| “Inactive” status | Suspended for tax/legal breach | Contact the partner or GDT for clarification |

| “Recently issued ID” | Not yet registered in the portal | Wait 1–3 working days and retry |

| “Dissolved” | The company ceased operation | Confirm legitimacy through GDT or partner contact |

Regular VAT ID verification reduces errors in invoicing, tax filing, and compliance reporting.

The Role of Licensed Tax Agents in VAT ID Registration & Verification

Licensed tax agents play a crucial role in complex registration and verification tasks.

When Needed:

- VAT registration for new entities

- A foreign company set up in Vietnam

- Handling e-invoice disputes

- Complex compliance tasks or tax appeals

Services Offered:

- Filing registrations

- Drafting legal and tax documents

- Appeal handling for suspended IDs

- Acting as local representatives for foreign entities

Choosing a Tax Agent: Ensure the agent has valid licensing, relevant sector experience, positive references, and offers digital solutions for efficient VAT ID verification. Using a tax agent ensures accuracy and reduces compliance risks.

VAT ID Verification in Major Cities/Regions: Why It Matters for Local Businesses

In cities like Ho Chi Minh City, Hanoi, or Da Nang, verifying VAT IDs helps businesses avoid shell companies and non-compliant suppliers.

Local Significance:

- Free Trade Zone suppliers require valid VAT IDs for customs clearance

- Necessary for leasing commercial properties or opening bank accounts

- Helps validate e-commerce and B2B transactions

Regional regulators such as the Ministry of Planning and Investment (MPI) and the General Department of Taxation (GDT) ensure proper enforcement. A verified VAT ID in these areas safeguards businesses from compliance issues and operational risks.

Bulk & Automated VAT ID Validation (CSV Upload, API, Commenda Integration)

Manual VAT ID verification is slow and prone to human error. Bulk validation and API solutions streamline this process.

Options:

- Manual Portal Checks: Input each VAT ID individually—time-consuming and error-prone

- CSV Upload: Bulk upload VAT IDs for instant validation

- API Integration: Platforms like Commenda offer real-time VAT ID verification, single-endpoint API, 99.9% uptime, and a 14-day free trial

Benefits:

- Instant verification for large datasets

- Continuous monitoring of VAT ID status

- Integration with ERP and accounting systems

- Reduced compliance errors

Automated validation ensures large-scale businesses or multinational suppliers perform accurate VAT ID checks efficiently.

Conclusion

Verifying VAT IDs in Vietnam is crucial for ensuring compliance, preventing fraud, and enhancing operational efficiency. A complete VAT ID verification process, whether manual or automated, ensures accurate records, avoids fines, and strengthens business relationships.

Key Takeaways:

- VAT IDs are required for all VAT-liable entities in Vietnam

- Verify format, status, and entity details before using a VAT ID

- Licensed tax agents can simplify registration and compliance

- Bulk or automated VAT ID validation improves speed and accuracy

Start free VAT ID registration and verification with Commenda. This platform offers instant validation, automated monitoring, and integration with accounting systems to simplify compliance and ensure accurate VAT ID management.

Get a free demo and see how Commenda simplifies VAT ID checks with speed, accuracy, and compliance.

FAQs on VAT ID verification in Vietnam

1. What is a VAT ID in Vietnam, and how is it different from a tax registration certificate?

A VAT ID in Vietnam is a unique 10-13-digit number identifying VAT-liable entities. A tax registration certificate confirms registration but does not serve as a transactional identifier for invoices or VAT filings.

2. Why should I verify a VAT ID online before issuing an invoice or purchase order?

Verifying ensures the VAT ID is active, correct, and linked to a legitimate entity. It prevents errors, rejected invoices, and denied VAT deductions, and protects your business from potential fraud or non-compliance penalties.

3. What penalties can my business face for quoting an invalid or inactive VAT ID on tax returns in Vietnam?

Penalties include fines of 2–5 million VND, suspension of VAT deductions, rejection of invoices, potential customs delays, and reputational harm to regulators or clients.

4. How do I check the real-time status of a VAT ID on the official Vietnam government portal?

Visit the National Business Registration Portal, select “Search Enterprises,” enter the full VAT ID, complete any CAPTCHA, and review results, including entity status, legal representatives, and address.

5. Can I still claim input-tax credit / VAT refund if my supplier’s VAT ID is later cancelled?

No. Only transactions with valid VAT IDs at the time of filing are eligible for input VAT credit or refunds. Cancelled or inactive IDs typically invalidate claims.

6. How long does it take for a newly issued VAT ID to appear as “active” in the online lookup tool?

Typically, it takes 1–3 working days for a newly issued VAT ID to appear as “active” in the official Vietnam portal. Delays may occur due to processing or system updates.

7. What common errors cause a “No records found” result when I try to validate a VAT ID?

Common errors include typos, omitted digits, wrong branch suffix, extra spaces, or using letters instead of numbers (e.g., O vs. 0). Always double-check the VAT ID before lookup.

8. Is there a free API or bulk CSV upload option to bulk-verify [TAX-IDs] for hundreds of vendors at once?

Yes. Platforms like Commenda offer bulk VAT ID validation through CSV upload or API integration, enabling instant status checks for multiple vendors while maintaining high uptime and reliability.

9. How often should finance teams re-check supplier VAT ID numbers to stay compliant with Vietnam regulations?

Finance teams should verify supplier VAT IDs quarterly or before each significant transaction to ensure continued validity, prevent compliance breaches, and safeguard against potential changes, such as suspension or cancellation.

10. Does the official Vietnam VAT ID verification portal provide historical data on status changes (e.g., “active” to “suspended”)?

No, the official portal typically displays only the current status. Historical changes are not provided; therefore, ongoing monitoring or utilizing third-party platforms is recommended for tracking status over time.

11. What data privacy safeguards apply when I submit a VAT ID lookup through third-party services like Commenda?

Reputable platforms encrypt submitted VAT IDs, comply with local data protection laws, limit access to authorized personnel, and ensure that your lookup data is not stored or shared without consent.

12. When is it mandatory to engage a licensed tax agent for VAT ID registration or verification in Vietnam?

Engagement is recommended for foreign entities, complex compliance cases, VAT registration for new businesses, or when filing appeals or disputes. Licensed agents ensure accuracy and compliance with Vietnamese tax law.