Calculating and understanding sales tax in North Dakota doesn’t have to be complicated.

Whether you’re a business owner or a consumer, this guide provides you with easy-to-use tools and clear explanations to help you:

- Understand North Dakota sales and use tax

- Understand nexus criteria

- Identify taxable items

- Navigate the filing process

With step-by-step instructions on how to obtain your sales tax permit, this guide ensures you stay compliant with state laws. Let’s simplify your tax responsibilities and get started on mastering North Dakota sales tax today.

What Is the Sales Tax Rate in North Dakota?

Understanding the sales tax rate in North Dakota is essential for both consumers and businesses operating within the state. Here’s a detailed overview of the current sales tax structure.

The base state sales tax rate in North Dakota is 5%. This rate applies to most goods and services sold within the state.

In addition to the state sales tax, local jurisdictions in North Dakota have the authority to impose their own sales taxes. This means the total sales tax rate can vary depending on where a transaction occurs.

As a result, total sales tax rates can range from 5% to 8.5% when local taxes are included.

Examples of local sales tax rates:

- Fargo: 7.5% (5% state + 2.5% local)

- Bismarck: 6.5% (5% state + 1.5% local)

- Grand Forks: 7.25% (5% state + 2.25% local)

North Dakota Sales and Use Tax Overview

North Dakota operates under a destination-based sales tax system, meaning businesses must charge sales tax based on the buyer’s location rather than their own. This approach simplifies compliance for out-of-state sellers and requires them to understand their nexus obligations if they have a physical presence or meet economic thresholds in North Dakota.

Key Features of North Dakota Sales Tax

- Sales Tax: Charged on tangible personal property and certain services.

- Use Tax: Applicable to out-of-state purchases that are used or consumed within North Dakota, where no sales tax was paid.

- Local Sales Tax: Additional local taxes may apply, varying by jurisdiction.

Taxable and Exempt Items

Not all goods and services in North Dakota are subject to sales tax. Understanding what is taxable versus exempt is crucial for compliance.

Common taxable items include:

- Tangible personal property (e.g., furniture, electronics)

- Certain services (e.g., repair services, telecommunications)

Additionally, alcohol is taxed at 7%, new farm machinery used exclusively for agriculture production at 3%, and new mobile homes are taxed at 3%.

Sales tax exemption in North Dakota applies to several key categories, including:

- Food for home consumption

- Prescription medications

- Certain medical devices

For a comprehensive list of taxable and exempt items, Commenda recommends you to refer to the North Dakota Department of Revenue’s guidelines and resources.

When Do Businesses Need to Collect Sales Tax in North Dakota?

In North Dakota, businesses must understand when they are required to collect sales tax to ensure compliance with state regulations. The obligation to collect sales tax is primarily determined by the concept of “nexus,” which refers to the connection a business has with the state.

Key Nexus Criteria

- Physical Nexus: A business has a physical nexus in North Dakota if it has a tangible presence in the state. This includes having a physical location, such as a store or office, or employing workers within the state.

- Economic Nexus: North Dakota economic nexus applies to businesses that do not have a physical presence in this state but exceed certain sales thresholds. As of February 2025, if a business makes more than $100,000 in sales during the previous or current calendar year, it must collect North Dakota sales tax.

Types of Transactions Subject to Sales Tax

Businesses must collect sales tax on most retail sales of tangible personal property and certain services. Here are some examples:

- Taxable Goods: Most physical products sold, including electronics, furniture, and clothing.

- Taxable Services: Certain services, such as repair services and telecommunications.

Use Tax Considerations

If a business purchases items from out-of-state vendors that do not charge North Dakota sales tax, it must pay use tax on those items when they are used or consumed within the state. The use tax rate is the same as the sales tax rate (5% plus any applicable local taxes).

Businesses must collect sales tax in North Dakota if they have nexus in the state and sell taxable goods or services to North Dakota residents. Nexus, which creates a sales tax collection responsibility, can be established through physical presence or economic activity.

Failure to Collect North Dakota Sales Tax

Failing to comply with North Dakota’s sales tax regulations can lead to several penalties and legal actions. Here’s what you need to know:

Penalties for Non-Payment or Late Payment

- Late Payment Penalty: A 5% penalty is applied to any tax not paid by the deadline or $5, whichever is greater.

- Interest: North Dakota charges interest at a rate of 12% per year, calculated from the filing deadline to the date the tax, interest, and penalties are fully paid. Note that interest is not collected for the first month, and a return is filed late.

Penalties for Late Filing

- Late Filing Penalty: For the first month a return is not filed, a penalty of 5% or $5 (whichever is greater) will be assessed.

- Additional Penalties: Each month the return remains unfiled, an additional 5% is added to the penalty, up to 25% of the tax due.

Criminal Penalties

In North Dakota, criminal failure to pay sales tax is classified as a Class A misdemeanor.

Long-Term Non-Compliance

- Neglecting to collect tax in states where nexus has been established can result in civil penalties.

- If a company collects tax but does not remit it to the state, it is considered civil fraud at a minimum and possibly criminal fraud.

- Companies that have been non-compliant for multiple years and have made no effort to correct the issue or are unresponsive to state efforts may face lawsuits. Penalties can be as much as three times the tax bill in damages, in addition to total back taxes.

The Office of State Tax Commissioner may take action for continued failure to file or pay sales and use taxes. If no tax is due, the return must still be filed. Failure to do so will result in the Sales Tax Compliance Section notifying the permit holder that the return is delinquent and that a penalty is due.

North Dakota Sales Tax for Out-of-State and Amazon FBA Program Sellers

Out-of-state sellers, including those utilizing Amazon’s FBA (Fulfillment by Amazon) program, must understand North Dakota’s sales tax regulations to ensure compliance.

North Dakota Economic Nexus:

Remote sellers must collect sales tax if they exceed a set sales threshold, even without a physical presence in North Dakota.

- Remote sellers with no physical presence in North Dakota must collect sales tax if their taxable sales exceed $100,000 in the previous or current calendar year.

- Once the $100,000 threshold is met, remote sellers must obtain a permit and begin collecting tax on sales delivered during the following calendar year or within 60 days after the threshold is met, whichever is earlier.

Fulfillment by Amazon (FBA):

- Storing inventory in North Dakota via FBA can create a physical nexus, requiring sales tax collection on all sales shipped to the state.

- Even without physical presence, exceeding $100,000 in gross annual sales in the state necessitates registration and tax collection.

Marketplace Facilitators:

- Marketplace facilitators, like Amazon, are required to collect sales and use taxes in North Dakota must certify to each marketplace seller that it will collect and remit all state and local sales and use taxes.

- A marketplace seller that received written certification from the marketplace facilitator is no longer liable for tax on sales made through that marketplace. Suppose a marketplace seller has a valid North Dakota sales and use tax permit. In that case, the seller should not report sales made through a marketplace if the facilitator has certified its responsibility to collect and remit tax.

Registering for a North Dakota Seller’s Permit

To legally collect sales tax in North Dakota, you must obtain a sales and use tax permit. You should apply for a permit 30 days before opening for business. If you purchase an existing business, you must apply for a new sales tax permit. Registering is best completed online via the Portal for North Dakota State Government website.

How to Register for a Seller’s Permit

Here are the steps to guide you through the process:

- Determine Nexus: Confirm that your business has established nexus in North Dakota before registering. Nexus can be created through physical presence (e.g., a store or warehouse) or economic presence (e.g., exceeding $100,000 in sales).

- Complete the Application: Visit the North Dakota Department of Revenue website and complete the application for a seller’s permit. This can typically be done online, but paper applications are also available.

- Provide Necessary Information: Be prepared to provide details about your business, including:

- Federal tax ID (EIN)

- Knowledge of your business entity structure

- Business owner information

- North American Industry Classification System (NAICS) number

- Start date with the state of North Dakota

- Your estimated yearly tax liability with North Dakota

- Business name, address, and contact information

- Projected monthly sales

- Projected monthly taxable sales

- Products to be sold

- Personal identification info (SSN, address, etc.)

- Description of business activities

- Submit the Application: After completing the application, submit it and any required fees. Once processed, you will receive your seller’s permit.

- Maintain Compliance: Keep your seller’s permit information up-to-date and renew it as state regulations require.

How to Collect Sales Tax in North Dakota

Once you have registered for a seller’s permit, you must understand how to collect sales tax effectively.

- Determine the Applicable Sales Tax Rate: The base state sales tax rate is 5%, but local jurisdictions may impose additional taxes. Use the Sales Tax Rate Lookup tool to find the total sales tax rate applicable to your location.

- Implement Sales Tax Collection Procedures: Set up your point-of-sale system or online checkout process to automatically calculate and add sales tax based on the buyer’s location.

- Provide Customers with Receipts: Ensure that receipts clearly show the amount of sales tax collected alongside the total sale amount.

- Keep Accurate Records: Maintain thorough records of all sales transactions, including the amount of sales tax collected. This will be essential for filing returns and during potential audits.

Learn how Commenda can simplify sales tax tracking, filing returns, and compliance.

Also Read: Sales Tax Permit: How to Register, Verify, and Why Your Business Needs It

Tax-Exempt Customers

Certain customers and types of transactions may be exempt from sales tax in North Dakota, and it is essential to understand these exemptions.

Who Is Considered Tax-Exempt?

- Resale Exemptions: Retailers purchasing goods for resale are exempt from paying sales tax at the time of purchase. They must provide a resale certificate to the seller.

- Nonprofit Organizations: Some nonprofit organizations may qualify for tax-exempt status if they provide documentation proving their exemption status.

- Government Entities: Sales made to federal, state, or local government entities are typically exempt from sales tax.

- Specific Exempt Items: Certain goods and services, such as food for home consumption and prescription medications, are exempt from sales tax.

Filing Sales Tax Returns in North Dakota

Filing sales tax returns is an essential responsibility for businesses operating in North Dakota. Understanding the filing frequency, steps involved, and payment methods ensures compliance with state regulations and helps avoid penalties.

Filing Frequency

The frequency of filing sales tax returns in North Dakota depends on the amount of sales tax collected by the business. Here’s a summary of the filing frequencies:

| Filing Frequency | Filing Due Date |

|---|---|

| Monthly | Last day of the following month |

| Quarterly | Last day of the month following the quarter (e.g., Q1 returns due April 30) |

| Annually | January 31st of the following year |

Filing Steps

Filing sales tax returns in North Dakota involves several key steps:

- Gather Sales Data: Collect all relevant sales data for the reporting period, including total sales and the amount of sales tax collected.

- Access Online Portal: Log in to the North Dakota Department of Revenue online portal or use the appropriate paper forms.

- Complete the Sales Tax Return Form: Fill out the required information on the sales tax return form, including:

- Total sales

- Total taxable sales

- Total sales tax collected

- Review and Verify: Double-check all entries for accuracy to ensure there are no mistakes that could lead to penalties.

- Submit the Return: Submit your completed return electronically through the online portal or mail it if using a paper form.

- Keep Records: Retain copies of your filed returns and supporting documents for at least three years in case of an audit.

How to Pay Your North Dakota Sales Tax

You can pay your North Dakota sales tax through various methods:

| Payment Method | Description |

|---|---|

| Online Payment | Use the North Dakota Department of Revenue’s online payment system. |

| Check or Money Order | If filing by mail, include a check or money order payable to the North Dakota Department of Revenue along with your return. |

| Electronic Funds Transfer (EFT) | Businesses with larger tax liabilities may be required to pay via EFT. |

Using Sales Tax Automation Tools

Managing sales tax can be complex and time-consuming for businesses, especially those operating in multiple states like North Dakota. To simplify this task, many companies turn to sales tax automation tools, such as Commenda.

Commenda is a powerful sales tax automation solution designed to streamline calculating, collecting, and remitting sales tax. With its user-friendly interface and robust features, Commenda helps businesses ensure compliance with state regulations while minimizing the risk of errors.

Join 250+ businesses who trust Commenda to handle their sales tax. Click here to see how Commenda can simplify your sales tax needs.

North Dakota Sales Tax Compliance Checklist

Here’s a comprehensive checklist to help you navigate the requirements effectively.

- Register for a Seller’s Permit: Confirm nexus and complete the application for a seller’s permit with the North Dakota Department of Revenue.

- Understand Sales Tax Rates: Know the state sales tax rate (5%) and any applicable local rates that may apply.

- Collect Sales Tax: Set up your system to automatically calculate and collect sales tax based on the buyer’s location.

- Maintain Accurate Records: Keep detailed records of all sales transactions and documentation for tax-exempt sales.

- File Sales Tax Returns: Determine your filing frequency (monthly, quarterly, or annually) and submit returns by the due dates.

- Pay Sales Tax Owed: Choose a payment method (online, check, or electronic funds transfer) and ensure timely payments.

- Stay Informed on Tax Changes: Regularly check for updates in North Dakota sales tax laws and rates that may affect your business.

- Use Sales Tax Automation Tools: Consider implementing tools like Commenda to streamline sales tax calculations, collections, and filings.

How Should I Prepare for North Dakota Sales Tax Audits and Appeals?

Preparing for a sales tax audit in North Dakota requires a clear understanding of the audit process and proactive steps to ensure compliance. Here’s a guide to help you navigate this critical task.

Understanding the Audit Process

The Department of Revenue conducts sales tax audits in North Dakota to ensure that businesses accurately collect and remit sales tax. Auditors will review your records, transactions, and tax returns to verify compliance. The audit can be triggered by discrepancies in reported sales, random selection, or specific concerns raised during previous filings.

Steps to Prepare for an Audit

- Organize Financial Records: Gather all relevant financial documents, including sales invoices, receipts, tax returns, and sales tax records collected. Ensure these records are organized and easily accessible.

- Review Sales Tax Returns: Review your filed sales tax returns to confirm that they accurately reflect your sales data. Check for any discrepancies or errors that may need correction.

- Understand Sales Tax Exemption in North Dakota: Familiarize yourself with any tax-exempt sales you have made and ensure you have the necessary documentation (e.g., exemption certificates) to support these transactions.

- Conduct a Self-Audit: Perform a self-audit to identify potential issues before the official audit begins. This can help you address any discrepancies proactively.

- Consult with a Tax Professional: If you have concerns about your records or the audit process, consider consulting with a tax professional specializing in sales tax compliance.

During the Audit

- Be Prepared to Provide Documentation: During the audit, promptly provide all requested documentation. This includes sales records, tax returns, and any other relevant information.

- Stay Professional and Cooperative: Maintain a professional demeanor and cooperate fully with the auditors. This can help facilitate a smoother audit process.

- Ask Questions: If you do not understand something during the audit, don’t hesitate to ask questions for clarification.

- Take Notes: Document key points discussed during the audit, including any findings or concerns raised by the auditor.

- Review Findings Carefully: After the audit is complete, carefully review any findings or recommendations provided by the auditor before accepting them.

Also read: Sales Tax Audits: Common Triggers, Risks, and How to Prepare

North Dakota Sales Tax Rates by City

| City | Total Sales Tax Rate |

|---|---|

| Bismarck | 6.5% |

| Fargo | 7.5% |

| Grand Forks | 7.25% |

| Minot | 6.0% |

| West Fargo | 7.5% |

| Williston | 7.0% |

| Dickinson | 6.0% |

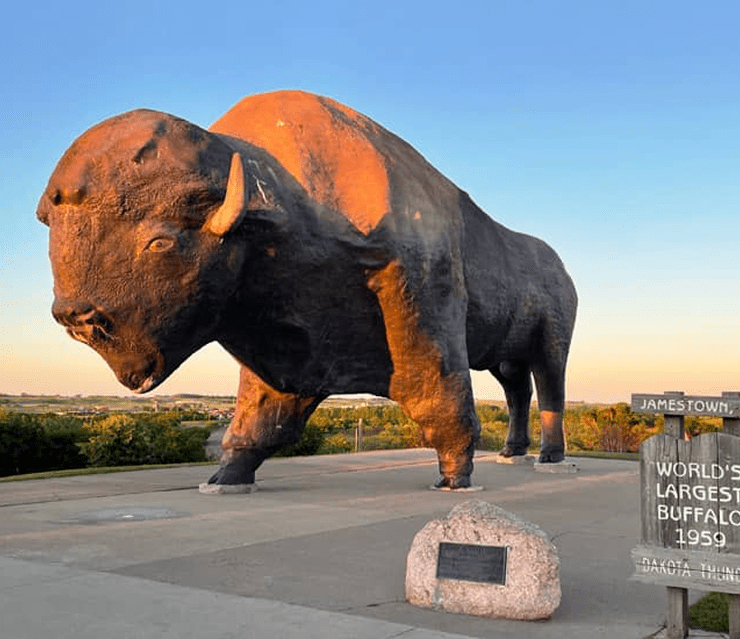

| Jamestown | 6.0% |

| Mandan | 6.5% |

| Devils Lake | 6.0% |

Navigating the complexities of sales tax can be challenging. Let Commenda simplify the process for you.

Commenda can help you:

- Automate sales tax calculations

- Manage multi-state tax compliance

- Stay up-to-date on changing tax laws

Ready to streamline your sales tax process?

Schedule a demo with Commenda today!

FAQs

What is the current sales tax rate in North Dakota?

The base state sales tax rate in North Dakota is 5%. However, local jurisdictions can impose additional taxes, resulting in total rates ranging from 5% to 8.5%, depending on the city.

Do I need to collect sales tax if my business is located outside of North Dakota?

Yes, if your business has established nexus in North Dakota—either through physical presence or economic thresholds (over $100,000 in sales in a year) — you must collect sales tax.

How do I register for a seller’s permit in North Dakota?

To register for a seller’s permit, you must complete an application through the North Dakota Department of Revenue’s website, provide necessary business information, and confirm your nexus status.

What items are exempt from sales tax in North Dakota?

Sales tax exemption in North Dakota applies to items like food for home consumption, prescription medications, and certain medical devices. Nonprofit organizations may also qualify for tax-exempt status with proper documentation.

What are the steps to prepare for a sales tax audit?

To prepare for an audit, organize your financial records, review your sales tax returns for accuracy, understand any exemptions claimed, conduct a self-audit, and consider consulting a tax professional.

How do I pay the sales tax owed to North Dakota?

You can pay your sales tax online through the North Dakota Department of Revenue’s payment system, by check or money order when filing paper returns, or via electronic funds transfer (EFT) if required.

What should I do if I disagree with an audit finding?

If you disagree with the findings of an audit, you can appeal through the appropriate channels within the North Dakota Department of Revenue. Ensure you have all relevant documentation to support your case.

Are there any tools available to help manage sales tax compliance?

Yes, tools like Commenda can automate sales tax calculations, collections, and filings, helping businesses streamline their compliance processes and reduce errors.

Where can I find more information about North Dakota sales tax regulations?

For more detailed information and resources, you can visit the North Dakota Department of Revenue website or consult with a qualified tax professional familiar with state regulations.