Foreign-owned and U.S.-based companies must meet federal and state compliance requirements. This guide covers key annual filings, including IRS forms, state franchise taxes, and Form 5472, tailored to the needs of cross-border and domestic businesses.

What Is Annual Tax Filing in the USA?

Annual tax filing in the USA refers to the mandatory submission of financial and business information to federal and state authorities each year. These filings ensure that a company is in good standing and compliant with U.S. tax laws, regardless of whether it earned any income during the year.

For foreign-owned companies, annual tax filing typically involves reporting to the Internal Revenue Service (IRS) and to the state in which the business is incorporated. This includes income tax returns, franchise tax payments, and informational filings such as Form 5472 for foreign-owned entities.

Key aspects of U.S. annual tax filing include:

- Filing a federal tax return with the IRS based on the company’s entity type (LLC, C-Corp, etc.)

- Submitting state-level filings like franchise tax reports or annual statements

- Disclosing foreign ownership through forms like Form 5472, even if no income was earned

- Keeping the company’s Employer Identification Number (EIN) and registered agent information current

- Ensuring proper bookkeeping and record retention for audit readiness

Whether operating a holding company, remote business, or active U.S. subsidiary, annual tax filing is a legal obligation that applies to all U.S.-registered entities. Failure to comply can lead to penalties, interest charges, and even dissolution of the company.

Filing Requirements for Annual Compliance in USA

Filing requirements differ based on the type of entity (LLC, C-Corp, Partnership) and whether the business is domestic or foreign-owned. Here’s a breakdown:

1. Federal Tax Filings (IRS)

| Entity Type | Required Forms | Deadline | Notes |

|---|---|---|---|

| LLC (Single-Member) | Form 1040 + Schedule C (if owned by U.S. person) OR Form 5472 + Pro Forma 1120 (if foreign-owned) | April 15 | EIN mandatory |

| LLC (Multi-Member) | Form 1065 + K-1s | March 15 | Treated as partnership |

| C-Corp | Form 1120 | April 15 (calendar year) | Flat 21% corporate tax |

| S-Corp | Form 1120S | March 15 | Not eligible for non-residents |

| Foreign-Owned LLC | Form 5472 + Pro Forma 1120 | April 15 | Mandatory even with $0 income |

Penalty for failing to file Form 5472: Minimum $25,000 per year

Source: IRS – Form 5472 Instructions

2. State-Level Annual Reports & Franchise Tax

Each state has different rules. Most foreign founders register in Delaware, Wyoming, or Florida. Here’s a look at Delaware, the most common:

| Requirement | Form | Due Date | Fees |

|---|---|---|---|

| C-Corp Franchise Tax | Franchise Tax + Annual Report | March 1 | Starts at $225; can exceed $100,000 |

| LLC Annual Tax | Flat Franchise Tax (no report) | June 1 | $300 |

| Registered Agent Maintenance | Not a filing, but ongoing | Annual | ~$100–$300/year |

3. Employer Identification Number (EIN)

- EIN is required for opening U.S. bank accounts, paying U.S. taxes, or processing payments via Stripe, PayPal, etc.

- No annual filing for EIN, but notify IRS if ownership or address changes.

- Apply or update via: IRS EIN Portal

4. Form 5472: Essential for Foreign-Owned LLCs

If your U.S. LLC is 100% foreign-owned, even if inactive, you must file:

Required for reporting any “reportable transactions” between the entity and its foreign owner (e.g., funding, expenses, transfers).

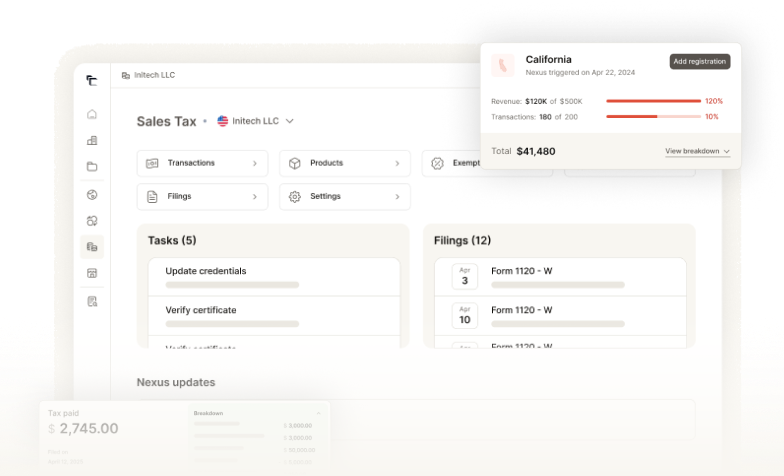

5. State Sales Tax Nexus and Registration

If your U.S. entity sells goods/services to customers within a state, you may trigger sales tax nexus:

- Threshold: Often $100,000 in sales or 200 transactions annually

- Must register in that state and file periodic sales tax returns

- Use tools like Commenda for sales tax automation

- Learn more: Sales Tax Nexus by State

6. Bookkeeping and Record Retention

The IRS requires that businesses retain:

- Receipts

- Contracts

- Invoices

- Financial statements

- Bank records

For at least 3 years (best practice: 5–7 years). Organized records help during audits and ensure accurate tax filings.

Timeline for Annual Compliance in the USA

| Month | Task | Entity Type |

|---|---|---|

| January | Start bookkeeping for prior fiscal year | All |

| March 1 | File Delaware C-Corp Annual Report & Franchise Tax | C-Corps |

| March 15 | File Form 1065 (partnership) or 1120S | LLC (multi-member), S-Corps |

| April 15 | File 1120 / 5472 / FBAR (if needed) | C-Corps, Foreign-owned LLCs |

| June 1 | Pay Delaware LLC Franchise Tax | LLCs |

| Quarterly | Sales tax filings (as needed) | Ecommerce companies |

Common Mistakes Foreign Companies Should Avoid

- Missing Form 5472 — One of the most overlooked filings; it’s mandatory for 100% foreign-owned LLCs.

- Assuming zero income = zero filing — The IRS still expects returns, even with no revenue.

- Forgetting franchise tax — Especially in Delaware; can lead to company dissolution.

- No registered agent renewal — All states require an active agent; missing this can void your company’s existence.

- Incorrectly classifying your LLC — Improper filing as S-Corp (which foreigners cannot own) leads to rejections.

Tools and Portals for U.S. Compliance

- IRS Business Portal

- Delaware Annual Report Filing

- Sales Tax Nexus Map

- Commenda’s Compliance Dashboard

How Commenda Helps with the U.S. Compliance

Commenda is built specifically for global founders and companies operating across borders. Our platform ensures you never miss a filing and remain compliant year-round.

With Commenda, you can:

- Track federal and state filing deadlines

- File Form 5472, Franchise Tax, and Annual Reports

- Automate EIN and IRS updates

- Use a registered agent in Delaware or other states

- Access CPA-reviewed templates and expert support

- Manage multiple entities from one compliance dashboard

Book a free consultation with Commenda to simplify your U.S. compliance operations.

FAQs on Annual Compliance in the USA

1. Do I need to file Form 5472 if my LLC has no income?

Yes. All 100% foreign-owned single-member LLCs must file Form 5472 annually, even with zero revenue or operations.

2. What is the penalty for missing U.S. compliance deadlines?

It varies. Form 5472 alone carries a minimum $25,000 fine. Delaware charges late fees and may dissolve your company for non-payment.

3. Do I need a registered agent in every state?

No. Only in the state where your company is incorporated (e.g., Delaware). But if you register in additional states (foreign qualification), you’ll need one in each.

4. Can a foreigner file taxes without a U.S. Social Security Number?

Yes, using an EIN or ITIN. Commenda can help you obtain the right identifier based on your structure.

5. Does my LLC need to pay corporate tax?

It depends on your election. Default single-member LLCs are pass-through and don’t pay corporate tax, but C-Corps pay a 21% federal rate.

6. How do I know if I have sales tax obligations?

Check your nexus status based on sales volume or transaction count in each state. Tools like Commenda simplify this.