Canada vs USA incorporation decisions have become increasingly critical for entrepreneurs seeking the optimal jurisdiction for their business ventures. With significant regulatory changes, evolving tax landscapes, and shifting investor preferences in 2025, choosing between Canadian and American incorporation requires careful analysis of costs, compliance requirements, and strategic advantages.

This comprehensive guide offers data-driven insights to help you make informed decisions that align with your specific business goals.

What’s the Basic Incorporation Process in Canada vs the USA?

| Step / Requirement | Federal Incorporation (Canada) | Provincial Incorporation (Canada) | Delaware Corporation (USA) | Wyoming LLC (USA) |

| Name Search & Reservation | Not required for online filings (NUANS not mandatory) | Varies by province (often required) | Required (state-specific) | Required (state-specific) |

| Articles/Certificate Filing | Online via the Corporations Canada portal | Online in most provinces | Certificate of Incorporation filed with the Division of Corporations | Articles of Organization filed online |

| Business Number / EIN | BN from Canada Revenue Agency (CRA) | BN from CRA | EIN required from the IRS | EIN required from the IRS |

| Registered Agent Requirement | Not required | Not required | Mandatory (fees ~$78/year) | Mandatory (fees ~$50–$150/year) |

| Filing Fee (Local Currency) | CAD 200 | Ontario: $360 CADAlberta: $CAD 275 | USD 89 (plus registered agent fees) | $USD 102 |

| Average Processing Time | 1 business day | 1–2 business days | 1–2 weeks (without expedited service) | Same day (online approval) |

| Online Filing Available | Yes | Most provinces | Yes | Yes |

| Expedited Processing | Available for an extra fee | Available in some provinces | Available (extra fee) | N/A (already same-day) |

| Other Notes | Streamlined, minimal documentation | Varies by province; fees and requirements differ | State-specific requirements; more paperwork for non-residents | Immediate entity formation; very fast |

How Much Does It Cost to Incorporate in Canada vs the USA?

| Jurisdiction / Entity Type | Filing Fee (Local Currency) | Filing Fee (USD) | Annual Fees (Local) | Annual Fees (USD) | Franchise Tax (Annual) | Registered Agent (Annual) | Express Processing |

| Canada – Federal Corporation | CAD 200 | $146 | $0 | $0 | $0 | N/A | +$100 CAD (4-hour service)4 |

| Ontario Corporation | $CAD 360 | $263 | $0 | $0 | $0 | N/A | Available in some cases |

| Alberta Corporation | CAD 275 | $201 | $0 | $0 | $0 | N/A | Available in some cases |

| British Columbia Corporation | CAD 350 | $256 | $0 | $0 | $0 | N/A | Available in some cases |

| Delaware Corporation (USA) | $USD 89 | $89 | $0 | $0 | $450 minimum | $50–USD 150 | Available (extra fee) |

| Wyoming LLC (USA) | USD 102 | $102 | $USD 62 | $62 | $0 | $50–USD 150 | N/A (already same day) |

| Delaware LLC (USA) | $USD 90 | $90 | USD 300 | $300 | $300 minimum | $50–$USD 150 | Available (extra fee) |

Total First-Year Cost Comparison

- Federal Corporation (Canada): USD 146

- Wyoming LLC (USA): $USD 164

- Delaware Corporation (USA): $USD 314Delaware LLC (USA): USD 390

Notes:

- Federal and most provincial Canadian corporations have no annual government fee; some provinces may charge for annual returns12345.

- US entities must pay annual franchise taxes and maintain a registered agent.

- Express processing is available for Canadian federal filings for an additional CAD 100, with a 4-hour turnaround.

- Currency conversions are approximate and may vary.

Do You Need Resident Directors? Ownership & Residency Rules Compared

Canadian Director Residency Requirements

Significant changes have transformed Canadian director residency requirements since 2021:

Federal corporations still require 25% Canadian resident directors. However, many provinces have eliminated this requirement:

- Ontario: Removed residency requirement in July 2021

- Alberta, British Columbia, Quebec: No residency requirements

- Nova Scotia, New Brunswick: No requirements

For corporations with fewer than four directors, at least one must be a Canadian resident under federal rules.

US Director Requirements

No residency requirements exist for directors in popular US jurisdictions:

- Delaware: Directors need not be state residents or shareholders

- Wyoming: No residency or shareholding requirements for directors

- Nevada: No residency restrictions

This provides significant flexibility for international entrepreneurs compared to Canadian federal incorporation.

Canada vs USA Corporate Tax Rates in 2025: Which Is Lower?

Canadian Corporate Tax Rates

Small business rates provide substantial advantages for qualifying corporations:

- Federal small business rate: 9%

- Combined federal + provincial: 11-13% for income up to $500,000

- General corporate rate: 27% average (15% federal + 12% average provincial)

Provincial variations create planning opportunities:

- Alberta: 23% combined general rate (lowest)

- Prince Edward Island: 26% combined rate (highest)

- Manufacturing & processing: Potential rate reductions available

US Corporate Tax Rates

Federal corporate tax applies at a flat 21% rate since the Tax Cuts and Jobs Act. State taxes add a burden:

| State | Corporate Rate | Combined Effective Rate |

| Wyoming | 0% | 21% |

| Delaware | 8.7% | 29.7% |

| California | 8.84% | 29.84% |

| New Jersey | 11.5% | 32.5% |

Delaware’s advantages include no state income tax on out-of-state earnings, making the effective rate 21% for non-Delaware operations.

Annual Compliance Burden: Filing Requirements North vs South of the Border

Canadian Annual Compliance

Federal corporations face comprehensive annual obligations:

- Annual Return: Due within 60 days of anniversary date ($12 fee)

- Individuals with Significant Control (ISC) filing: Required since January 2024

- Corporate tax return: Due 6 months after fiscal year-end

- Director change notifications: Within 15 days of changes

Provincial requirements vary but generally include:

- Annual return filing: Varies by province

- Business license renewals: Where applicable

- Notice of changes: For address, director, or ownership changes

US Annual Compliance

Delaware Corporation requirements include:

- Annual franchise tax: Due March 1 ($50 filing fee + tax)

- Annual report: Required with franchise tax payment

- Registered agent maintenance: Ongoing requirement

Wyoming LLC offers simpler compliance:

- Annual report: Due on anniversary date ($62 fee)

- No franchise tax: Significant cost savings

- Registered agent: Required annually

Key advantage: US entities face no beneficial ownership register requirement, unlike Canadian ISC filings.

Banking & Payments: Is It Easier to Open a Business Account in Canada or the USA?

Canadian Business Banking

Documentation requirements for Canadian business accounts:

- Articles of incorporation

- Business registration certificate

- Government-issued photo ID for directors

- Proof of business address

Process characteristics:

- In-person visits are often required

- “Big 6” banks control 85% of the market.

- USD accounts are available through major banks

- Minimum deposits: $1,000-$5,000 typical

US Business Banking

Stricter requirements for non-residents:

- US entity registration is mandatory

- EIN (Employer Identification Number)required

- SSN or ITIN preferred, but not always mandatory for Canadians

- US mailing address needed

Access challenges:

- Patriot Act compliance creates hurdles for non-residents

- In-person visits are required for account opening.

- Fintech alternatives: Wise, Mercury offer online solutions

Cross-border solutions: RBC Bank offers seamless Canada-US business banking with integrated services.

Raising Venture Capital: Why VCs Prefer a Delaware C-Corp, but Not Always

Venture Capital Preferences

Delaware C-Corporation remains the gold standard for venture capital.

- Over 60% of new VC managers choose Delaware for fund domicile.

- Investor familiarity: Reduces due diligence time and costs

- Court of Chancery: Specialized business court system

- Precedent-rich environment: Predictable legal outcomes

Tax structure advantages:

- Avoids pass-through complications for institutional investors

- No UBTI (Unrelated Business Taxable Income) concerns

- Clean exit strategies for IPOs and acquisitions

Canadian Corporation Challenges

Venture capital barriers for Canadian entities:

- Section 116 certificates are required for non-resident exits

- 25% withholding tax potential on share sales

- Dual entity structures are often required for US funding.

SR&ED tax credits provide some advantages for R&D intensive companies, offering up to 35% refundable credits for small businesses.

Flip transactions allow conversion from Canadian to US entities but trigger tax consequences and complexity.

Intellectual Property & Data Privacy Rules: PIPEDA vs CCPA/State Acts

Patent and Trademark Costs

Canadian IP costs through CIPO:

- Patent application fee: CAD 400 ($USD 293 standard entity

- Small entity discount: 50% reduction available

- Professional fees: $5,000-CAD 15,000 depending on complexity

US IP costs through USPTO:

- Patent filing fees: Vary by entity size and complexity

- Professional fees: $5,000-$USD 10,000typical

- Timeline: Similar to Canada for prosecution

Privacy Law Compliance

PIPEDA (Canada) requirements:

- Broad application to private sector organizations

- Consent-based framework with fair information principles

- Maximum penalties: CAD 100,000 per violation

- 30-day response requirement for rights requests

CCPA (California)obligations:

- Revenue threshold: $25 million annual revenue or 50,000+ consumers

- Consumer rights: Access, deletion, opt-out of sale

- Penalties: $2,500 for unintentional violations, $7,500 for intentional violations

- 45-day response period for consumer requests

Key differences: CCPA provides data portability rights and the right to deletion not available under PIPEDA.

Work-Visa & Founder Immigration Pathways (Start-Up Visa vs E-2/TN)

Canadian Start-Up Visa Program

Canada’s Start-Up Visa offers a permanent residence pathway :

- Designated organization support required from approved investors, accelerators, or incubators

- Language requirements: CLB 5 in English or French

- Settlement funds: Required to demonstrate financial capacity

US E-2 Treaty Investor Visa

E-2 Visa advantages for Canadian entrepreneurs:

- No minimum investment amount: Must be “substantial” relative to the business

- Typical investment: $100,000+ USD for most applications

- Renewable status: Indefinite renewals possible

- Family benefits: Spouse work authorization, children’s education

Application process:

- Business plan requirement: Detailed 5-year projections

- Active management: Must direct and develop the enterprise

- Consular processing: Interview at the US consulate in Toronto

Decision Matrix: Canada or USA Incorporation for (Your Scenario)?

| Business Goal | Canada Best Choice | USA Best Choice | Key Considerations |

| Tax Optimization | Federal Corporation | Wyoming LLC | 11% vs 21% small business rates |

| VC Funding | Not Recommended | Delaware C-Corp | Investor preference critical |

| Privacy Protection | Alberta Corporation | Wyoming LLC | Strong privacy laws both |

| Low-Cost Setup | Federal Corporation | Wyoming LLC | $146 vs $164 first year |

| Fast Processing | Federal Corporation | Wyoming LLC | 1 day vs same day |

| Cross-Border Operations | Federal Corporation | Delaware C-Corp | Dual entities are often needed |

Top 5 Mistakes When Comparing Canada and USA Incorporation

- Ignoring franchise taxes: Delaware’s $450+ annual minimum is often overlooked.

- Misunderstanding director residency: Federal Canada still requires 25% Canadian residents

- Underestimating compliance costs: ISC filings and annual returns add ongoing burden

- Overlooking banking difficulties: US account opening challenging for non-residents

- Assuming VC flexibility, Most US investors require a Delaware C-Corp structure.

How Commenda Streamlines Cross-Border Incorporation & Annual Filings

Commenda simplifies the complex process of choosing between Canada and USA incorporation by providing comprehensive entity formation services in both countries.

Our platform automates compliance requirements, obtains necessary business numbers (EIN/BN), and manages ongoing tax and regulatory filings from a single dashboard, ensuring entrepreneurs can focus on growing their business rather than navigating bureaucratic complexities.

FAQs

- Is it cheaper to incorporate in Canada or the USA when you factor in corporate tax rates and filing fees?

Canada offers lower initial costs with federal incorporation at USD 146 and no annual fees. US options range from $164 (Wyoming LLC) to $390 (Delaware LLC) in the first year. However, Canada’s small business tax rates (11-13%) significantly undercut US rates (21%+ federal) for qualifying income up to $500,000.

- What are the director-residency requirements for Canadian corporations versus popular U.S. states like Delaware or Wyoming?

Federal Canadian corporations still require 25% of directors to be Canadian residents, while most provinces, including Ontario, Alberta, and BC, have eliminated this requirement. Delaware and Wyoming impose no residency requirements for directors, providing greater flexibility for international entrepreneurs.

- How do the annual compliance obligations, annual returns, franchise tax, and BO registers differ north and south of the border?

Canadian federal corporations must file annual returns within 60 days of the anniversary date, plus new ISC (beneficial ownership) filings since 2024. Delaware corporations pay an annual franchise tax by March 1 (minimum $450) while Wyoming LLCs pay only $62 annually. US entities face no beneficial ownership register requirements, unlike Canada’s mandatory ISC filings.

- Which jurisdiction offers a more founder-friendly startup visa pathway: Canada’s Start-Up Visa or the U.S. E-2/TN options?

Canada’s Start-Up Visa provides permanent residence but requires designated organization support. US E-2 visas offer more flexibility with no minimum investment amount (typically $100,000+), renewable status, and faster processing, though no direct path to permanent residence.

- Do venture-capital investors truly prefer a Delaware C-Corp over a Canadian corporation, and why?

Yes, over 60% of new VC managers choose Delaware for its predictable legal framework, Court of Chancery specialization, and established precedents. Canadian corporations face additional complexity with Section 116 certificates for non-resident exits and potential 25% withholding taxes, often requiring dual entity structures for US funding.

- Can I flip a Canadian corporation to a U.S. entity later without triggering double taxation or shareholder penalties?

Flip transactions are possible but complex, often triggering deemed disposition for tax purposes and requiring careful structuring to minimize double taxation. Many entrepreneurs establish parallel US entities early to avoid future complications, especially when anticipating US investment or expansion.

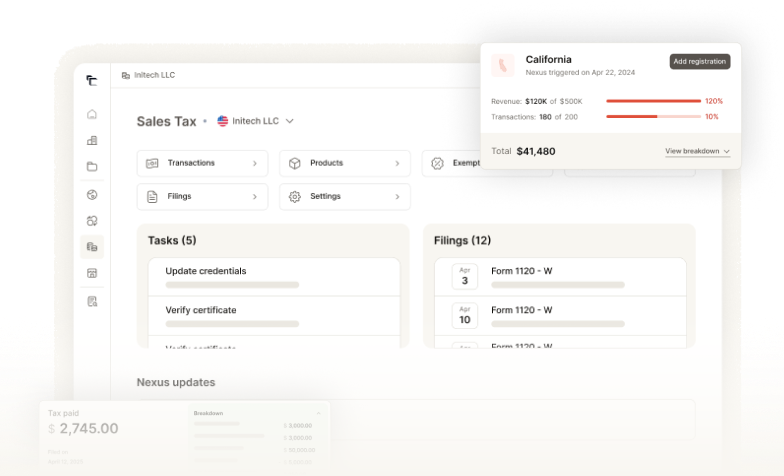

- How does sales-tax registration work for a U.S. company selling into Canada versus a Canadian company selling into U.S. states?

US companies selling into Canada must register for GST/HST if revenues exceed CAD 30,000 annually. Canadian companies selling into US states face varying state sales tax thresholds, with economic nexus rules typically triggering at $100,000+ in annual sales or 200+ transactions per state. Both scenarios require jurisdiction-specific registration and compliance.

- What cross-border withholding tax issues arise when a U.S. parent owns a Canadian subsidiary (and vice versa)?

The US-Canada Tax Treaty generally reduces withholding tax on dividends to 5% for parents owning 10%+ of voting stock. Interest payments between related entities face 0% withholding under treaty provisions. Management fees and royalties may qualify for reduced rates, but proper documentation and transfer pricing compliance are essential to avoid disputes and penalties.