IRD Verification in New Zealand: Step-by-Step Process to Check an IRD Number Online

Operating a business or being a taxpayer in New Zealand comes with specific responsibilities, one of which is ensuring that your IRD (Inland Revenue Department) number is accurate and valid. Without proper verification, you risk facing penalties, delayed returns, or reputational damage due to potential fraud.

However, verifying an IRD number in New Zealand is not as straightforward as it may seem, as the process is subject to privacy and security regulations. While direct third-party verification isn’t publicly available, we will guide you through the necessary steps to validate IRD number.

What Is an IRD in New Zealand?

An IRD number is New Zealand’s tax identification number, similar to the tax registration numbers (TRN, VAT, GSTIN, or EIN) used in other countries. This unique identifier is issued by the Inland Revenue Department (IRD) and is essential for businesses and individuals involved in any form of taxation.

The number is used for a variety of purposes, such as filing tax returns, applying for tax credits, and making payments to the government.

You will need to provide your IRD number when dealing with official documents, including invoices, tax returns, and GST filings. It also appears on tax correspondence and is critical for completing any business-related government transactions.

Importance of the IRD Number for Businesses & Individuals

The IRD number is essential for both businesses and individuals in New Zealand, ensuring compliance with the country’s tax system.

For Businesses:

- Tax Compliance: Required for filing tax returns and registering for GST.

- Reclaiming GST: A valid IRD number is necessary for claiming GST on purchases.

- Trust & Credibility: A verified IRD number helps build trust with partners and customers, proving legal tax registration.

For Individuals:

- Income Tax Filing: Used to file personal tax returns.

- Tax Benefits: Allows individuals to claim deductions or credits to reduce their tax liabilities.

- Government Services: Needed for services such as social welfare and KiwiSaver.

Ensuring your IRD number is valid helps streamline tax obligations and establish trust in business dealings.

Why Verify an IRD Number in New Zealand?

Performing an IRD check is a vital step for both businesses and individuals to ensure they are dealing with a valid and active IRD number. Failure to verify the IRD number can result in:

- Fines: The use of an incorrect or invalid IRD number can lead to tax penalties, affecting your business operations.

- Denied Claims: If the IRD number is invalid, businesses could face issues when claiming tax deductions, GST refunds, or filing tax returns.

- Reputational Damage: Vendors and business partners often perform due diligence checks. If they discover your IRD number is invalid, it could damage your business’s reputation, leading to trust issues with partners and clients.

By regularly having an IRD status lookup, you can safeguard your business against these potential issues, ensuring your operations remain compliant and seamless.

Note: The late filing penalty in New Zealand is $50 if your net income is less than $100,000, $250 for net income between $100,000 and $1 million, and $500 for net income over $1 million.

IRD Number Format Explained

The IRD number in New Zealand follows a specific format that consists of 8 digits. Here’s a breakdown of how it is structured:

Format: XXX-XXX-XXX

- The first 7 digits represent a unique identifier for the individual or business.

- The final digit is a check digit, which helps ensure the validity of the IRD number.

Example of an IRD Number:

An example of a New Zealand IRD number might look like this: 123-456-789, where:

- 123-456-78 represents the unique identifier for the individual or business.

- The final 9 is the check digit.

Common Errors to Watch Out For

When verifying an IRD number, it’s important to be aware of common mistakes that can occur:

- Incorrect Formatting: Missing hyphens or incorrect placement of digits.

- Missing Digits: Ensure that the number includes all 8 digits (the first 7 digits and the check digit).

- Typographical Errors: A typo in any of the digits, especially the check digit, can result in an invalid IRD number.

By understanding the correct format of an IRD number, you can confidently enter and verify the number for tax and business compliance.

Step-by-Step Process to Verify IRD on the Official New Zealand Portal

Verifying an IRD number in New Zealand is not as straightforward as entering a number and receiving a public “valid/invalid” status. Due to privacy and security protocols, the Inland Revenue Department (IRD) restricts direct third-party validation of IRD numbers online.

Here’s how you can IRD lookup New Zealand, depending on your relationship to the IRD number:

If You Are the IRD Number Holder

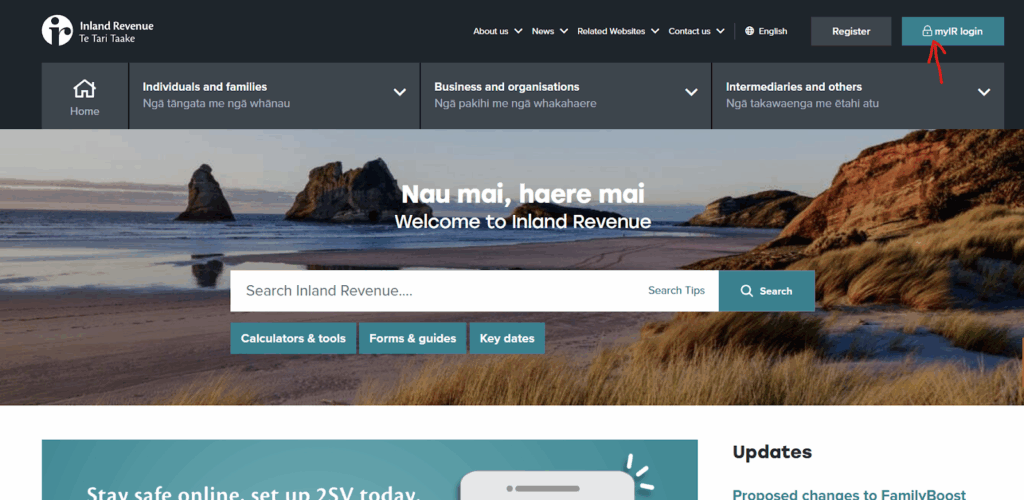

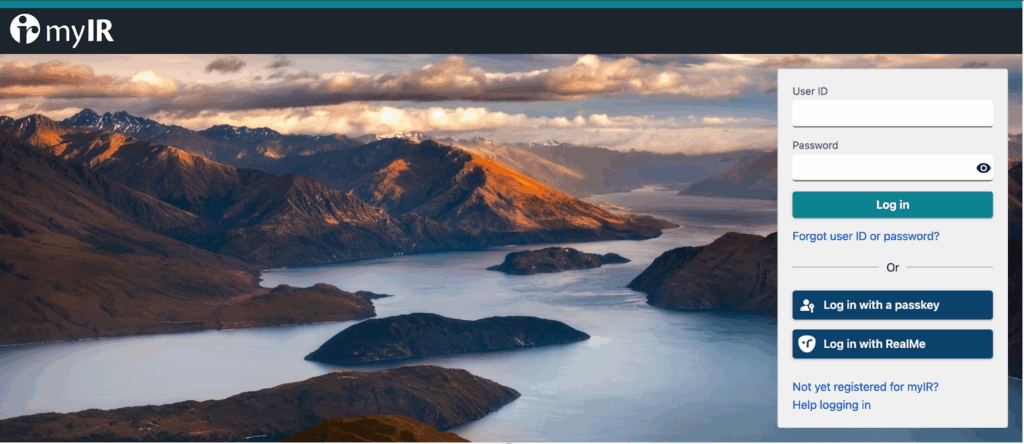

- Log in to myIR: Access your account on the official website using your credentials. Here, you can view your registered IRD numbers and confirm their status.

- Check Official Correspondence: All official IRD letters, notices, and tax documents will display your IRD number. Cross-reference these documents to ensure consistency.

If You Are Verifying a Third Party’s IRD Number

- Request Documentation: Ask the individual or business to provide official IRD correspondence, tax invoices, or registration certificates that show their IRD number.

- Use the IRD Number Validation Service (For Approved Entities): If you are an approved digital service provider or have a legitimate business need, you may access the IRD number validation service. This service requires not only the IRD number but also additional identity information (such as name, date of birth or incorporation, and address).

- Contact IRD Directly: If you have concerns about a supplier or partner’s IRD number and cannot verify it through documentation, contact IRD for guidance on acceptable verification methods.

For a more thorough approach, you can also perform a New Zealand tax registration number check through approved channels to ensure the business or individual is properly registered with the Inland Revenue Department.

Key Points for IRD Verification

- There is no public lookup tool for third-party IRD numbers due to privacy laws.

- Always rely on official documentation or direct confirmation from the IRD number holder.

Troubleshooting IRD Verification Results in New Zealand

If you attempt an IRD check or IRD verification using a random or unknown number, you may encounter the following:

| What You See | What It Means | What To Do Next |

| List of general tax resources, prompts to log in, or “It looks like you have tried to search for an IRD number” message | The system does not confirm IRD number validity publicly for privacy reasons | If you are the IRD number holder, log in to myIR to view details. If you are verifying a third party, request supporting documentation directly from them. |

| No confirmation of “valid” or “invalid” | IRD numbers are not validated for third parties online | Use the IRD number validation service if you are an approved digital service provider with required identity information. Otherwise, rely on documentation from the entity or request proof from IRD. |

| Error or no result | Number may be incorrect or not in use | Double-check the IRD number format. If you still have concerns, contact IRD directly or ask your supplier for official confirmation. |

The Role of Licensed Tax Agents in IRD Registration & Verification

Licensed tax agents are essential for businesses and individuals needing assistance with IRD registration and IRD verification. They help ensure compliance with tax laws, assist in filing tax returns, and resolve any discrepancies related to the IRD number.

For businesses, tax agents can manage complex filings, while individuals can rely on them for personal tax advice and ensure all deductions or credits are properly claimed.

Additionally, if you are dealing with multiple jurisdictions, they can help you check New Zealand VAT numbers in other countries to ensure full compliance.

IRD Verification in New Zealand: Why It Matters for Local Businesses

In New Zealand, verifying an IRD number is essential for businesses to ensure they comply with tax regulations. A valid IRD number ensures smooth tax filings and prevents delays or issues when applying for GST refunds or tax deductions.

For local businesses, such as those in Auckland or Wellington, IRD verification is key to maintaining trust with clients and vendors. IRD check helps you avoid potential legal issues and penalties, safeguarding your business’s reputation.

Regular IRD checks are an important practice for any New Zealand-based business to stay in compliance and keep operations running efficiently.

Bulk IRD Validation: API Integration for Businesses

For businesses that need to verify hundreds or thousands of IRD numbers at once, manual checks can be time-consuming and error-prone. Instead, bulk IRD validation via API integration offers a faster and more efficient solution.

Services like Commenda’s Bulk IRD validation API allow businesses to upload a CSV file with a list of IRD numbers, which are then verified in real-time through the API.

Benefits of Using Bulk Validation:

- Time Efficiency: Process hundreds of IRD verifications in seconds.

- Accuracy: Automated systems reduce the risk of human error.

- Seamless Integration: Easily integrate bulk validation into your business system.

Commenda offers a seamless API for real-time validation with 99.9% uptime and a 14-day free trial, making it easy to integrate IRD checks into your business systems.

Conclusion: Simplifying IRD Verification in New Zealand

From IRD number registration to ongoing compliance management, Commenda provides end-to-end solutions for businesses operating in New Zealand. Our comprehensive platform simplifies every aspect of IRD number handling – from initial registration and validation to seamless tax filing and compliance support.

Beyond simple verification, our automated system enables bulk IRD number checks through API integration or CSV uploads, ensuring accuracy while saving valuable time. We streamline the entire tax compliance process, including return preparation, submission, and audit readiness – all while maintaining strict adherence to New Zealand tax regulations.

See how Commenda’s advanced IRD verification tools can help simplify your compliance process. Request your free demo now!

FAQs on IRD Verification in New Zealand

Q. What is an IRD number in New Zealand, and how does it differ from a tax registration certificate?

An IRD number is a unique identifier issued by the Inland Revenue Department for tax purposes, while a tax registration certificate is an official document confirming your business’s registration with the tax authorities.

Q. Why should I verify an IRD number online before issuing an invoice or purchase order?

Verifying an IRD number ensures it is valid and active, which helps prevent issues with tax filings, claims, and compliance when dealing with vendors or partners.

Q. What penalties can my business face for quoting an invalid or inactive IRD number on tax returns?

Quoting an invalid or inactive IRD number can result in denied tax claims, financial penalties, and potential audits, all of which can harm your business’s operations and reputation.

Q. How do I check the real-time status of an IRD number on the official New Zealand government portal?

You can check the real-time status of an IRD number by logging into your myIR account or requesting the IRD number holder to provide official documentation confirming its validity.

Q. Can I still claim GST refunds if my supplier’s IRD number is later canceled?

Yes, as long as the IRD number was valid at the time of the transaction, you can still claim GST refunds. Ensure you keep the appropriate records and invoices for verification.

Q. How often should businesses re-check supplier IRD numbers?

It’s recommended to verify IRD numbers at least quarterly or before making any large payments to ensure compliance with New Zealand tax regulations.

Q. Can I bulk verify multiple IRD numbers at once?

Bulk IRD validation is available through approved digital service providers like Commenda. You can upload a list of IRD numbers and verify them in real-time using an API integration.

Q. Does the official IRD verification portal provide historical data on status changes?

No, the official IRD verification portal only provides the current status of the IRD number. Businesses should track historical changes internally or through tracking software.

Q. When is it mandatory to engage a licensed tax agent for IRD registration or verification in New Zealand?

While not mandatory for most businesses, it’s advisable to engage a licensed tax agent for complex filings or if you are unsure about the status of an IRD number, especially for non-resident businesses.