The Singapore to Switzerland transfer pricing agreement serves as a crucial framework for regulating intercompany transactions between two of the world’s most competitive and innovation-driven economies.

As Multinational Enterprises (MNEs) expand operations between Singapore’s strategic Asian hub and Switzerland’s financial and pharmaceutical sectors, maintaining arm’s length pricing becomes vital to ensure compliance, transparency, and tax efficiency.

Through comprehensive benchmarking studies and clear documentation standards, businesses operating between these jurisdictions can confidently demonstrate an intercompany agreement between Singapore and Switzerland, whether involving goods, services, or Intellectual Property (IP), reflect fair market value and adhere to international best practices.

Singapore to Switzerland Transfer Pricing: A Strategic Compliance Priority

Intercompany transactions between Singapore and Switzerland require a precise and well-documented transfer pricing framework to ensure compliance with both tax regimes. However, operating across these two advanced economies brings distinct compliance challenges:

- Dual Audit Exposure: Both Singapore’s Inland Revenue Authority (IRAS) and the Swiss Federal Tax Administration (FTA) can review the same transactions, increasing audit and adjustment risks.

- Foreign Exchange (FX) Fluctuations: Currency volatility between the Singapore Dollar (SGD) and the Swiss Franc (CHF) can affect intercompany pricing and profitability analyses.

- Divergent Documentation Rules: Singapore enforces detailed, contemporaneous documentation, while Switzerland requires sufficient evidence to justify compliance when requested.

- Local vs. OECD Alignment: Though both align with the OECD Transfer Pricing Guidelines, local implementation nuances can lead to interpretive differences.

To mitigate these risks, MNEs are increasingly adopting transfer pricing benchmarking software in their transfer pricing operations. By embracing technology-driven transfer pricing solutions, businesses operating between Singapore and Switzerland can transform compliance from a reactive requirement into a strategic advantage.

Common Singapore-Switzerland Intercompany Structures and TP Methods

Here’s a structured table outlining common Singapore–Switzerland intercompany setups, their typical TP methods, and associated audit/compliance risks:

| Intercompany Structure | Typical TP Method | Common Audit / Compliance Risks | Documentation Challenges |

| Captive R&D or Technology Development Center (Singapore) | Cost Plus Markup Transfer Pricing Model | – Disputes over cost allocation and markup justification. – Questions on ownership of resulting intangibles. | – Difficulty substantiating cost bases and benchmarking R&D markups. – Incomplete intercompany agreements detailing IP ownership. |

| Swiss Principal with Singapore Distribution Subsidiary | Transactional Net Margin Method (TNMM) | – Risk of Swiss authorities challenging profit allocation. – IRAS may question the distributor’s functional profile and the tested party selection. | – Insufficient benchmarking studies. – Lack of local comparables or outdated financial data. |

| Shared Service or Back-Office Support Center (Singapore) | Cost Plus Method | – Potential disallowance of costs deemed non-beneficial to the recipient. – Challenges in identifying and allocating indirect costs. | – Missing evidence of services rendered. – Weak cost allocation documentation. |

| Swiss IP Holding with Royalties Charged to Singapore | Comparable Uncontrolled Price (CUP) Method | – Disputes over the comparability of IP or the uniqueness of intangibles. – Risk of double taxation due to differing royalty benchmarks. | – Lack of reliable third-party royalty comparables. – Inconsistent IP valuation reports. |

| Intercompany Financing (Loans from Switzerland to Singapore) | CUP or TNMM | – FX risks and thin capitalization issues. – Challenges in proving creditworthiness and arm’s length interest rates. | – Inadequate support for interest rate determination. – Missing loan agreements or repayment terms. |

| Contract Manufacturing (Singapore) | Cost Plus or TNMM | – Debate over risk allocation between manufacturer and principal. – Customs and TP valuation mismatches. | – Incomplete functional analysis. – Weak justification for selected markup. |

Benchmarking Requirements Under Singapore Transfer Pricing Law

Singapore’s transfer pricing documentation requirements ask MNEs to demonstrate that their related-party transactions are conducted at arm’s length. This is achieved through comprehensive documentation and adherence to prescribed methodologies.

Key Transfer Pricing Documentation Requirements

- Documentation Rules: Under the Income Tax (Transfer Pricing Documentation) Rules 2018, entities meeting specific criteria must prepare contemporaneous TP documentation. This documentation should be maintained and available by the filing due date of the Income Tax Return for the financial year in which the transactions took place.

- Documentation Components:

- Master File: Provides an overview of the MNE group, including its organizational structure, financial activities, and intangibles.

- Local File: Contains detailed information on the taxpayer’s business and transactions with related parties, including functional analysis and TP analysis.

- Thresholds: Entities with gross revenue exceeding S$10 million are required to prepare TP documentation. However, exemptions may apply to certain related-party transactions.

Preferred Benchmarking Methods and Databases

- Transfer Pricing Methods: Singapore’s regulations allow the use of various TP methods, including CUP, Resale Price, Cost Plus, TNMM, and Profit Split. The choice of method should be the most appropriate based on the specific circumstances of the transaction.

- Benchmarking Databases: While specific databases are not mandated, commonly used databases for benchmarking in Singapore include Orbis, Amadeus, and local databases that provide financial data of comparable companies.

Commenda offers a streamlined approach to TP compliance for Singapore-based entities. The platform automates the preparation of TP documentation, ensuring adherence to Singapore’s regulatory requirements.

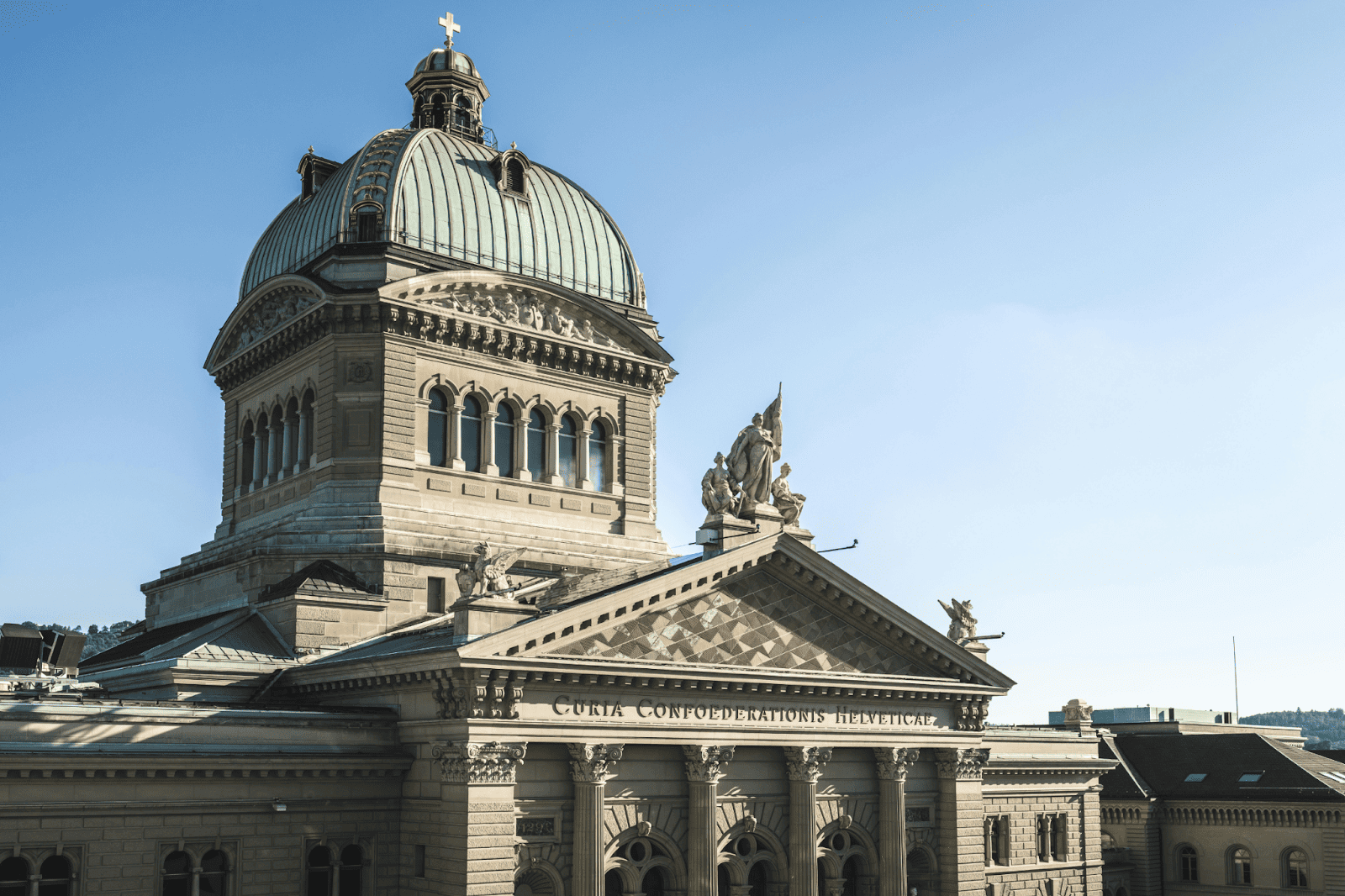

Switzerland Transfer Pricing Rules and Documentation Standards

Switzerland’s transfer pricing framework is grounded in the OECD Transfer Pricing Guidelines, emphasizing the arm’s length principle. While there are no statutory requirements mandating the submission of transfer pricing documentation, taxpayers must be prepared to demonstrate compliance upon request by the Swiss FTA or cantonal tax authorities.

Key Documentation Components

- Master File: Provides an overview of the multinational group’s global operations, including organizational structure, financial activities, and intangibles.

- Local File: Contains detailed information on the taxpayer’s business and transactions with related parties, including functional analysis and transfer pricing analysis.

- Country-by-Country Report (CbCR): Required for multinational groups with consolidated revenue exceeding CHF 900 million. This report provides aggregated data on the global allocation of income, taxes paid, and certain indicators of economic activity among different tax jurisdictions.

Documentation Timeline

While Switzerland does not mandate the submission of transfer pricing documentation, it is advisable to prepare and maintain such documentation contemporaneously with the transactions. In the event of a tax audit, the burden of proof lies with the taxpayer to demonstrate that the transfer prices applied comply with the arm’s length principle. Failure to provide adequate documentation may result in adjustments and potential penalties.

Commenda facilitates the preparation of jurisdiction-specific, audit-ready transfer pricing documentation for Switzerland.

Why Most Singapore–Switzerland TP Agreements Fail Audits

Even well-intentioned transfer pricing agreements between Singapore and Switzerland often face scrutiny during audits due to common pitfalls in documentation and structuring. Understanding the common transfer pricing challenges is critical for maintaining compliance and minimizing tax risk.

- Template Reuse Without Customization: Many companies reuse generic TP agreement templates, failing to reflect the specific economic realities, functions, and risks of the Singapore–Switzerland operations. This can lead to challenges from both the IRAS and the Swiss FTA.

- Missing Critical Clauses: Agreements often omit key provisions on IP ownership, Withholding Tax (WHT) obligations, and jurisdiction-specific legal requirements, leaving gaps that auditors can question.

- Outdated or Inappropriate Markups: Companies sometimes rely on historic margins or unbenchmarked pricing, which may no longer reflect arm’s length conditions, increasing the likelihood of adjustments and penalties.

- Inconsistent Documentation: Discrepancies between the TP agreement, local filings, and benchmarking studies create audit triggers, as authorities seek alignment with the OECD Transfer Pricing Guidelines and local regulations.

Documentation Requirements: Singapore vs Switzerland Compliance Checklist

Here’s a side-by-side compliance checklist comparing Singapore and Switzerland compliance (or local TP regulation) requirements:

| Aspect | Singapore | Switzerland |

| Mandatory Documentation | – Master File: Global overview of MNE operations. – Local File: Detailed local transactions, functional analysis, and benchmarking. | – Master File: Provides global group operations overview. – Local File: Details on Swiss entity transactions, functional profile, and TP analysis. – CbCR: For groups with consolidated revenue > CHF 900 million. |

| Thresholds | – TP documentation required for entities with gross revenue > S$10 million. – Exemptions for certain small-scale or low-value transactions. | – No statutory thresholds; documentation expected upon tax authority request. – CbCR applies if global revenue exceeds CHF 900 million. |

| Preferred Benchmarking Methods | – CUP, Cost Plus, TNMM, Resale Price, Profit Split – Use of financial databases like Orbis, Amadeus, or local sources. | – CUP, TNMM, Profit Split – Benchmarking relies on local or global comparable data; must demonstrate arm’s length pricing. |

| Documentation Timing | Contemporaneous preparation, filed alongside the Income Tax Return for the relevant FY. | Maintain contemporaneously; must be available at the time of audit or upon SFTA/cantonal request. |

| Compliance & Penalties | Failure to maintain or submit TP documentation may lead to adjustments, penalties, or fines. | No specific penalties for lack of documentation, but inadequate files can result in tax adjustments and potential disputes. |

Automating Transfer Pricing Compliance with Commenda

Managing transfer pricing compliance across Singapore and Switzerland can be complex, time-consuming, and audit-sensitive. Commenda simplifies this process with a fully automated transfer pricing documentation and a jurisdiction-specific platform designed to reduce risk and streamline documentation.

Key Features:

- Localized Benchmarking Engine: Access Singapore- and Switzerland-specific financial data to generate accurate, arm’s length comparables for all intercompany transactions.

- Agreement Generator with Legal Clauses: Create fully compliant transfer pricing agreements that include critical IP, withholding tax, and local law provisions for each jurisdiction.

- Prebuilt Documentation Packs: Produce Master and Local Files, as well as Country-by-Country Reports, fully formatted and audit-ready to satisfy both IRAS and SFTA requirements.

With Commenda, businesses can eliminate manual errors, ensure consistency, and maintain audit-ready TP documentation across borders. Book a demo today and take a transfer pricing consultation from our experts to see how Commenda can simplify your Singapore–Switzerland transfer pricing compliance.

FAQs

1. How do I ensure my Singapore–Switzerland intercompany agreement is compliant with both jurisdictions?

Ensure your agreements reflect the functional profile, risk allocation, and economic reality of each entity. Include clauses covering IP ownership, withholding taxes, and local legal requirements, and align pricing with OECD arm’s length principles.

2. Can I benchmark transfer pricing using transfer pricing software?

Yes. TP software can access jurisdiction-specific financial data, automate comparables selection, and calculate arm’s length ranges for methods like CUP, TNMM, or Cost Plus, improving accuracy and consistency.

3. What documentation is required for transfer pricing compliance in both Singapore and Switzerland?

- Singapore: Master File, Local File; contemporaneous documentation for entities with revenue > S$10 million.

- Switzerland: Master and Local Files; Country-by-Country Report (CbCR) if global revenue > CHF 900 million; must be maintained and available for audit.

4. What penalties apply in Singapore and Switzerland if they are not compliant?

- Singapore: IRAS may impose adjustments, fines, or penalties for inadequate or late documentation.

- Switzerland: While no formal TP penalties exist, inadequate documentation can trigger tax adjustments, double taxation, and audit disputes.

5. What markup is considered acceptable in a Cost Plus model between Singapore and Switzerland?

Acceptable markups vary by industry, functional profile, and risk allocation. Companies must use benchmarking to justify arm’s length margins; outdated or generic percentages can be challenged in audits.

6. Do I need separate transfer pricing documentation for Singapore and Switzerland, or can one solution cover both?

Separate documentation is required for each jurisdiction, but it should be aligned and consistent. A single platform like Commenda can generate both Singapore- and Switzerland-compliant files simultaneously.

7. How can Commenda help automate transfer pricing compliance between Singapore and Switzerland?

Commenda provides:

- Localized benchmarking engines for accurate comparables.

- Agreement generators with IP, WHT, and legal clauses for both jurisdictions.

- Prebuilt, audit-ready documentation packs (Master File, Local File, CbCR).

This ensures consistent, error-free compliance while reducing audit risk.