Sweden imposes VAT on most goods and services, and foreign businesses engaging in taxable transactions, such as sales to Swedish customers, are often required to register. Unlike domestic companies, VAT registration in Sweden for non-resident businesses generally has no registration threshold, meaning even a single sale can trigger the obligation. In this Sweden VAT registration guide, let’s understand the process, documentation requirements, and compliance rules.

Why Non-Resident Firms Must Register for VAT in Sweden?

Foreign businesses selling goods or services in Sweden are subject to Swedish VAT rules, even without a local presence. Unlike many EU countries, Sweden does not apply a registration threshold for non-residents, meaning any taxable supply can trigger the requirement. Registration also enables compliance with invoicing rules, reporting obligations, and reclaiming input VAT on Swedish expenses.

When Does a Foreign Business Need to Register? Key Triggers

VAT registration for non-resident businesses in Sweden must be done if the company is engaging in taxable activities, regardless of turnover. Key triggers include:

- First Sale in Sweden: There is no VAT threshold for non-resident businesses, registration is required upon making any taxable supply in Sweden.

- Distance Selling from the EU: EU-based sellers exceeding the €10,000 pan-European threshold can either register directly in Sweden or use the One-Stop Shop (OSS) mechanism.

- Importing Goods for Sale or Storage: Foreign businesses storing inventory in Sweden or importing goods must register for VAT immediately. There is no exemption below a certain volume or turnover.

Registration Thresholds & Nexus Tests

Sweden applies a strict no-threshold rule for non-resident businesses, meaning VAT registration is mandatory from the first taxable transaction in the country.

- No Local Threshold for Foreign Businesses: Unlike Swedish-established companies, foreign businesses must register as soon as they supply taxable goods or services in Sweden.

- Distance Selling & E-Services Nexus: For EU-based businesses, VAT registration or OSS applies once EU-wide B2C sales exceed €10,000 annually.

- B2B Supplies & Reverse Charge: If the reverse-charge mechanism applies (e.g., for services to VAT-registered Swedish businesses), registration may not be required. However, B2C sales, imports, or local warehousing will create a nexus.

Sweden VAT Number Format Explained

Upon completing the VAT registration for foreign companies in Sweden, the company receives a VAT identification number issued by the Swedish Tax Agency (Skatteverket).

Format Details:

- Structure: SE + 12 digits (company’s national registration number) + 01

- Example: SE12345678901201

- Country Code: SE indicates Sweden

- Digits: 12 digits represent the business registration or personal identity number, followed by 01 as a standard suffix

This VAT number must appear on invoices, tax returns, and all official communication with Swedish authorities.

Is a Local Tax Agent or Fiscal Representative Required?

For non-EU businesses registering for VAT in Sweden, appointing a fiscal representative is mandatory. This representative acts as the local contact point for tax compliance and ensures timely filing of VAT returns and payments.

For EU-based companies, a local tax agent is not required, as EU VAT rules provide simplified processes for intra-EU businesses. However, businesses often choose to appoint an agent for convenience and compliance support.

Special Schemes & Simplifications

Sweden offers several simplified regimes to those completing non-resident tax registration in Sweden:

- Import VAT Deferment Scheme: Businesses can defer payment of import VAT to their periodic VAT return instead of paying upfront at customs.

- OSS Scheme: For EU-based companies selling goods or services to Swedish consumers, the OSS scheme allows VAT reporting through their home country.

- Non-Union OSS for Non-EU Suppliers: Non-EU companies providing digital services to Swedish customers can use the Non-Union OSS scheme for simplified VAT reporting.

- Warehouse & Consignment Simplifications: Special rules apply for businesses storing goods in Swedish warehouses for resale, reducing the need for multiple VAT obligations.

Step-by-Step: How to Register for VAT in Sweden

Follow these steps to register for VAT online in Sweden:

1. Check if you meet the registration threshold: Foreign businesses must register before making taxable supplies in Sweden. There is no minimum threshold for non-residents, so registration is required from the first sale.

2. Gather required documents: Prepare documents such as your business registration certificate, articles of incorporation, and proof of activity in Sweden.

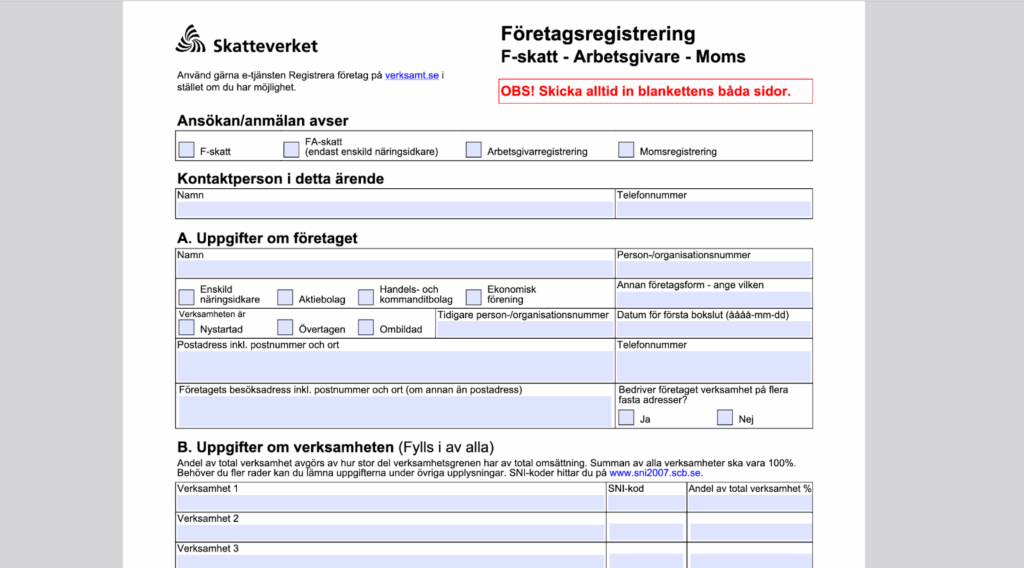

3. Create an account on the Swedish Tax Agency’s portal or complete the VAT registration form: You can register online or submit the SKV 4632 form to the Swedish Tax Agency.

4. Upload documents & submit application: Attach the required documents and submit the application through the portal or by post.

5. Pay any applicable fees (if required): In Sweden, VAT registration is generally free for foreign companies.

6. Receive your Swedish VAT number (Momsregistreringsnummer): Once approved, you will receive your VAT number, typically in the format SE + 12 digits + 01.

Required Documents Checklist

When registering for VAT in Sweden as a foreign business, you must prepare the following documents to ensure a smooth application process:

- Certificate of Incorporation

- Articles of Association

- Proof of Business Activities in Sweden

- Identification Documents for Directors or Authorized Representatives

- Power of Attorney

- Bank Account Details

Having these documents ready before you begin the process will speed up the registration and prevent delays.

Processing Time & Government Fees

The typical processing time for VAT registration in Sweden is 2–6 weeks, depending on the completeness of your application and the workload of Skatteverket.

Government Fees:

- VAT registration is free of charge in Sweden.

- No security deposit or guarantee is generally required for non-resident businesses.

Ensuring that all documents are accurate and properly translated (if necessary) can help avoid delays.

Post-Registration Obligations

Once registered for VAT in Sweden, foreign businesses must comply with the following ongoing obligations:

- VAT Invoicing: All invoices must include your Swedish VAT number and meet the invoicing requirements under EU VAT Directive and Swedish law.

- VAT Returns: Depending on turnover, returns are usually filed monthly, quarterly, or annually. Most non-resident businesses file monthly.

- EC Sales List (if applicable): Required for goods/services supplied to EU customers.

- Record-Keeping: Businesses must maintain records for at least seven years, which can be requested by the Skatteverket.

- Payments: VAT due must be paid by the filing deadline to avoid penalties.

Claiming Input-Tax Credits & Refunds as a Non-Resident

Foreign businesses registered for VAT in Sweden can claim input VAT on eligible business expenses related to taxable supplies. Key points include:

- Eligibility: Only VAT incurred on business-related costs in Sweden or imports handled under your VAT number can be reclaimed.

- Refund for Non-EU Businesses: Non-EU companies may claim VAT through the 13th Directive refund procedure, provided there is reciprocity between Sweden and the applicant’s country.

- EU Businesses: EU-established companies can reclaim via the EU VAT Refund Portal.

- Documentation: Original invoices and import documents must be retained and submitted when requested by Skatteverket.

- Deadline: Claims must typically be submitted by September 30 of the following year.

- Timeframe: Refund processing usually takes 4 to 6 months if all documentation is correct.

Penalties for Late Registration or Non-Compliance

Failing to register or comply with VAT obligations in Sweden can result in significant penalties:

- Late Registration: If you start making taxable supplies before registering, you may be liable for backdated VAT plus interest.

- Late Filing: A fixed late filing penalty of SEK 625 per return applies, increasing if multiple returns are delayed.

- Incorrect VAT Returns: Additional penalties can reach up to 20% of the underpaid tax for incorrect or incomplete declarations.

Deregistration & VAT Number Changes

If your business stops making taxable supplies in Sweden or no longer meets the conditions for VAT registration, you must apply for deregistration with Skatteverket.

When to Deregister:

- Ceasing taxable activities in Sweden.

- Switching to activities that are VAT-exempt.

- Business closure or restructuring.

How to Deregister:

- Submit an application via Skatteverket’s online portal or paper form.

- Include your current VAT number and the reason for deregistration.

- Ensure all pending VAT returns and payments are cleared before approval.

VAT Number Changes:

- If your business details change (e.g., company name, address, or legal structure), you must update Skatteverket promptly to maintain compliance.

Processing Time:

- Typically 2–6 weeks for approval, depending on case complexity.

Conclusion

Registering for VAT in Sweden is a legal requirement for non-resident businesses engaging in taxable transactions within the country. Timely registration helps avoid backdated VAT, financial penalties, and potential legal issues. With strict rules on filing, record-keeping, and reporting, compliance ensures smooth business operations and safeguards your reputation.

If you’re unsure about Swedish VAT obligations, working with a trusted partner like Commenda can simplify the process, from registration and filings to fiscal representation.

Don’t risk penalties or delays; let Commenda handle your Swedish VAT registration from start to finish. Our experts assist with threshold checks, documentation, filings, and fiscal representation so you stay fully compliant.

FAQs: Foreign Business VAT in Sweden

1. Do non-resident businesses need to register for VAT in Sweden if they supply only digital services?

Yes. Non-EU companies supplying digital services to Swedish consumers must register for VAT, usually through the VOEC (OSS) system or Swedish Tax Agency.

2. What is the sales threshold that triggers mandatory VAT registration for foreign businesses in Sweden?

There is no threshold for non-EU businesses. Even a single taxable transaction requires registration.

3. How long does the VAT registration process take for a company with no local branch in Sweden?

Typically 2–6 weeks, depending on documentation accuracy and Skatteverket’s workload.

4. Can a non-resident business reclaim input VAT in Sweden without appointing a local fiscal representative?

Yes, if the company is based in an EU country. Non-EU businesses usually require a fiscal representative.

5. Which documents are required to open a non-resident VAT account online in Sweden?

- Certificate of incorporation

- Articles of association

- Proof of business activity

- Identification documents of directors

- Power of attorney (if using an agent)

6. What penalties apply for late or missed VAT filings by overseas entities?

Late submission can result in administrative fines of SEK 625 per return, and interest charges apply on late payments.

7. Is there a simplified scheme for digital services provided to Swedish consumers?

Yes, the OSS scheme for EU businesses and non-Union OSS for non-EU suppliers of electronic services.

8. How do currency conversions affect VAT payments from foreign bank accounts?

VAT must be paid in SEK (Swedish Krona). Skatteverket uses the European Central Bank exchange rate on the due date.

9. Can multiple online sellers share one Swedish VAT registration under a marketplace arrangement?

No, each seller must register separately, unless the marketplace is considered the deemed supplier under Swedish VAT law.

10. What are the annual costs of appointing a fiscal representative in Sweden, and can Commenda handle this role?

Costs vary, typically €1,500–€3,000 per year. Yes, Commenda can assist with fiscal representation.

11. How do I cancel or deregister my Swedish VAT number if my turnover drops below the threshold?

Submit a deregistration request to Skatteverket. There is no minimum threshold, so deregistration is only possible if you stop taxable activities.

12. Does the reverse-charge mechanism remove the need for VAT registration on B2B services?

Yes, for cross-border B2B services, reverse charge often applies, so you may not need Swedish VAT registration.