Planning to enter the Indonesian market? Foreign businesses supplying taxable goods, services, or digital products must complete VAT registration in Indonesia. Indonesia imposes strict compliance obligations on non-resident entities, including registration, proper invoicing, and regular reporting, even without a physical presence. In this Indonesia VAT registration guide, let’s have a look at everything you need to get done with this process.

Why Non-Resident Firms Must Register for VAT in Indonesia?

Foreign companies supplying goods or services in Indonesia, including digital services to Indonesian consumers, are required to register for VAT online in Indonesia (locally called PPN). This applies even if you do not have a physical presence in Indonesia. The law ensures that both local and foreign businesses operate under the same tax obligations, creating a fair marketplace.

When Does a Foreign Business Need to Register? Key Triggers

VAT registration for non-resident businesses in Indonesia is required when they engage in taxable activities, even without a physical presence. Key triggers include:

- Supplying Taxable Goods or Services: Any foreign entity selling goods or services within Indonesia.

- Digital Services & Products: Non-resident businesses providing digital content, software, or streaming services to Indonesian customers must register as VAT collectors.

- Cross-Border Transactions: Remote sellers making B2C transactions in Indonesia, especially e-commerce platforms, fall under VAT obligations.

- Threshold Requirement: Foreign digital businesses must register once their annual transaction value exceeds IDR 600 million or reach 12,000 transactions per year.

- Marketplace Operations: Non-resident operators facilitating online sales to Indonesian customers must comply with VAT collection and reporting rules.

Registration Thresholds & Nexus Tests

VAT registration for foreign companies in Indonesia applies specific thresholds for foreign digital service providers and strict nexus rules:

- Threshold Requirement: Foreign digital businesses must register for VAT once:

- Annual transaction value exceeds IDR 600 million, or

- 12,000 transactions per year (or IDR 50 million monthly / 1,000 transactions monthly).

- Nil Threshold for Physical Presence: For businesses with a permanent establishment or physical operations in Indonesia, there is no minimum threshold; registration is mandatory upon the first taxable supply.

- Digital Service Providers (PMSE VAT): Foreign companies supplying electronic services (e.g., streaming, apps, cloud services) to Indonesian consumers must register as PMSE VAT Collectors.

- Cross-Border E-Commerce: Selling goods into Indonesia from abroad requires VAT collection on importation and may trigger additional reporting obligations.

- Marketplace Liability: Digital platforms and online marketplaces may be appointed as tax collectors and are responsible for charging VAT on behalf of sellers.

Indonesia VAT Number Format Explained

Non-resident tax registration in Indonesia, especially for those providing digital goods or services, is managed through the Perdagangan Melalui Sistem Elektronik (PMSE) scheme. Unlike the EU or other jurisdictions, Indonesia does not issue a standard numeric VAT number. Instead, businesses receive a PMSE VAT Collector ID upon registration.

Key Features:

- Format: No fixed numeric pattern. It typically includes the company name and an official PMSE registration code issued by the Directorate General of Taxes (DGT).

- Prefix: Displayed as “PMSE” with the registered entity name in official documentation.

- Purpose: Used on invoices, receipts, and all filings to confirm VAT registration status.

- Requirement: The PMSE ID must appear on tax invoices and reports submitted to the DGT.

Is a Local Tax Agent or Fiscal Representative Required?

Foreign businesses registering for VAT in Indonesia, especially under the PMSE (electronic services) scheme, do not need to appoint a local tax agent or fiscal representative. The DGT enables non-resident businesses to register electronically, collect, and remit VAT without requiring physical presence or local representation.

Special Schemes & Simplifications

Indonesia offers several simplified schemes and sector-specific regimes for VAT compliance:

- PMSE (E-Services) Scheme: Non-resident providers of digital services must register as PMSE VAT Collectors once they meet certain thresholds:

- Annual transactions exceed IDR 600 million or

- Over 12,000 users per year (or 1,000 monthly)

- Import VAT Deferment: Businesses operating in bonded zones (referred to as bonded logistic centers) can import, store, and process goods without immediate VAT or duty payment, provided goods are destined for export or remain within the special zone.

- Small Business Exemption: Small local businesses with an annual turnover up to IDR 4.8 billion may qualify for simplified tax treatment, including a 0.5% final income tax on turnover instead of standard VAT registration. This threshold does not apply to foreign companies.

Step-by-Step: How to Register for VAT in Indonesia

Indonesia has two common paths for foreign businesses:

- Non-resident digital suppliers under the PMSE scheme, and

- Foreign businesses with a local presence/PE registering as PKP (taxable entrepreneur).

Here is the step-by-step guide for both:

PMSE (Non-Resident Digital Services) VAT Registration

- Check Threshold: Confirm you meet the PMSE trigger: IDR 600M/year or 12,000 transactions/year (or monthly equivalents).

- Gather Documents: Certificate of incorporation, website/app URLs, product list, authorized signatory ID, company contact, and billing/bank details.

- Create Portal Account / Complete Form: Register via the DGT PMSE e-services channel; complete the PMSE VAT Collector application with entity and service details.

- Upload Docs & Submit: Upload incorporation docs, signatory ID/POA (if used), URLs, sample invoices/checkout flow; submit for review.

- Pay Fee (If Required): Government fee is typically not charged for PMSE; settle any notarization/translation or agent fees if applicable.

- Receive PMSE VAT Collector ID: On approval, receive your PMSE VAT Collector ID and onboarding pack. Enable VAT collection (currently 11%) and set up monthly reporting/remittance.

Local Presence/PE (PKP) VAT Registration

1. Check Threshold / Status: If you have a PE/local entity making taxable supplies in Indonesia, register from the first taxable transaction (treat as nil threshold).

2. Gather Documents: Articles of incorporation, local NPWP (tax ID), NIB (business ID) if applicable, deed of establishment, office lease/address proof, directors’ IDs, bank letter, POA (if agent).

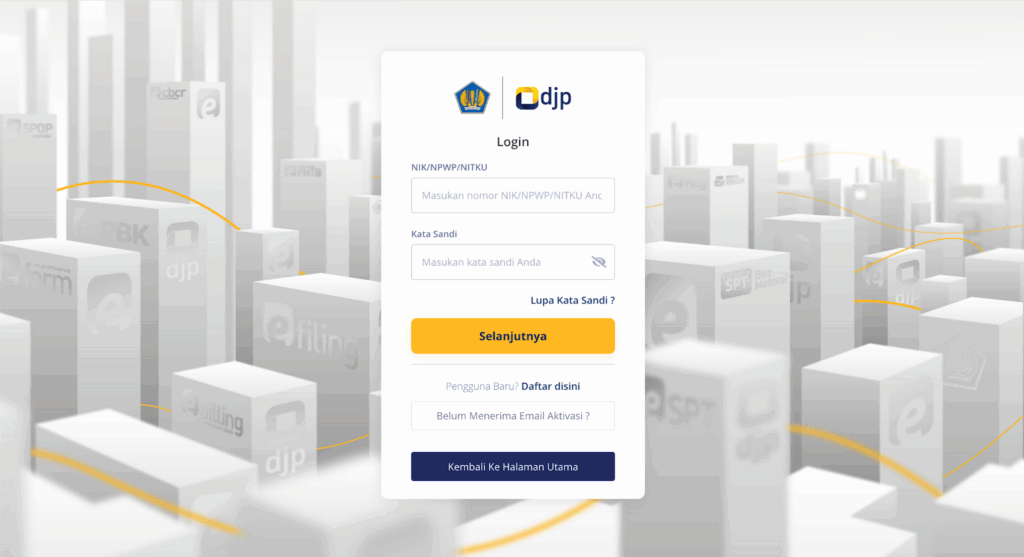

3. Create Tax-Portal Account / Complete Form: Enroll on DJP Online (e-Registration) using NPWP; complete VAT (PPN) PKP registration with business activity codes and contact info.

4. Upload Docs & Submit: Upload corporate/legal docs, address evidence, and POA if using an agent. Some KPPs may request site verification.

5. Pay Fee (If Required): No government VAT registration fee; plan for translation/notarization costs and professional/agent fees if engaged.

6. Receive Tax ID & PKP Approval: You’ll have/receive NPWP and PKP status (confirmation letter). Activate e-Faktur (e-invoicing), e-Bupot (if relevant), and set monthly VAT return processes.

Required Documents Checklist

PMSE (Non-Resident Digital VAT Registration)

If you are a foreign digital business (PMSE) providing goods or services to Indonesian consumers, these documents are essential to complete the VAT registration process:

- Certificate of Incorporation

- Company Name & Registered Address

- Website / App URL (or platform access details)

- List of Goods/Services supplied to Indonesian customers

- Authorized Signatory ID

- Power of Attorney (POA) if a representative is filing on your behalf

- Company Contact Details

- Bank Account Details for remittance confirmation

- Sample Invoice / Checkout Flow Screenshot

- Any existing Tax IDs in other jurisdictions (optional)

PKP (Local Entity VAT Registration)

For businesses establishing a physical presence in Indonesia and registering as a taxable entrepreneur (PKP), the following documents are typically required:

- NPWP (Taxpayer Identification Number) of the entity

- Articles of Incorporation / Deed of Establishment

- NIB (Business Identification Number) – OSS license if applicable

- Office Lease / Address Proof (physical location verification)

- Directors’ ID Cards / Passports

- Power of Attorney (POA) if using a local tax agent

- Bank Reference Letter (or statement showing active account)

- Company Stamp (Cap Perusahaan) for document signing

- Notarized & Translated Documents (if in a foreign language)

- Business Activity Codes (KBLI) for correct VAT classification

Processing Time & Government Fees

VAT registration for foreign businesses in Indonesia is relatively straightforward compared to local PKP registration. Here’s what you need to know:

- Processing Time: Typically, 5–10 business days after submitting all required documents and completing verification. Delays can occur if additional clarification or notarization is needed.

- Government Fees: No official registration fee for PMSE (foreign digital business) VAT registration. For local PKP registration, there’s no security deposit or government charge, but administrative costs for document legalization and notarization may apply.

Post-Registration Obligations

Once registered for VAT in Indonesia, foreign businesses must comply with ongoing reporting and invoicing requirements:

- VAT Returns Filing: Registered PMSE (foreign digital businesses) must file monthly VAT returns electronically via the tax portal. The filing deadline is the end of the following month after the taxable period.

- Payment of VAT: VAT must be remitted in Indonesian Rupiah (IDR) to the designated bank account of the Indonesian Tax Authority.

- E-Invoicing Requirements: VAT invoices must include the assigned PMSE tax ID and transaction details.

- Record-Keeping: Maintain transaction records for 10 years for audit and compliance purposes.

Claiming Input-Tax Credits & Refunds as a Non-Resident

Foreign businesses registered under Indonesia’s PMSE scheme are not eligible to claim input tax credits for VAT incurred on local purchases, as the scheme applies only to tax collection on B2C supplies.

Key Points:

- No Input VAT Recovery: Non-resident entities under the PMSE scheme cannot offset VAT on expenses.

- Refunds Unavailable: VAT refunds are generally not offered to non-residents under this simplified regime.

- Local Registration Exception: Only entities with a permanent establishment (BUT) or local VAT registration (non-PMSE) can claim input tax credits and apply for refunds under standard VAT rules.

Penalties for Late Registration or Non-Compliance

Failure to comply with Indonesia’s VAT obligations can result in significant financial penalties and operational disruptions:

- Late Registration Penalty: IDR 1,000,000 for failure to submit the VAT registration application when required.

- Late Filing: 2% per month (capped at 24 months) on outstanding VAT liabilities.

- Incorrect Invoice or Late Issuance: Fine of 1% of the transaction value for failing to issue VAT invoices or issuing incorrect ones.

Deregistration & VAT Number Changes

Foreign businesses registered for VAT in Indonesia must keep their registration status accurate. This includes deregistering when obligations end or updating details when company information changes.

When to Deregister

Deregistration is required if:

- The business ceases taxable activities in Indonesia.

- Annual turnover falls below the VAT threshold.

- The company closes or liquidates.

- There is a change in business structure, making VAT registration unnecessary.

How to Deregister

- Submit an application via the DGT Online portal or at the tax office.

- Attach supporting documents, including:

- Proof of business closure or change

- Evidence of settled tax liabilities

- Await verification by the DGT.

- Receive confirmation of deregistration and VAT number cancellation.

Changing VAT Number Details

Foreign businesses must update VAT registration details for:

- Business name or address changes

- Mergers, acquisitions, or restructurings

- Updated contact information or representative details

Changes should be reported within one month through the DGT system or tax office with supporting documents (business license, NPWP, etc.).

Conclusion

Understanding VAT obligations in Indonesia is essential for foreign businesses, especially those offering digital services or importing goods. Timely registration, accurate invoicing, and compliance with reporting requirements can prevent costly penalties and operational delays.

Commenda simplifies VAT compliance for non-resident businesses by managing registrations, filings, and ongoing obligations in Indonesia.

Focus on growing your business in Indonesia while we handle the tax complexity. Book a free demo with Commenda today!

FAQs: Foreign Business VAT in Indonesia

1. Do non-resident remote sellers need to register for VAT in Indonesia if they only supply digital services?

Yes. Foreign digital service providers (e.g., SaaS, streaming, apps) must register once they meet the transaction or revenue threshold set by the Directorate General of Taxes (DGT).

2. What is the sales threshold that triggers mandatory foreign business VAT registration in Indonesia?

IDR 600 million annually or 12,000 transactions per year for digital service providers.

3. How long does the VAT number application process take for a company with no local branch?

Typically 5–10 working days, depending on document completeness and DGT verification.

4. Can I reclaim input tax in Indonesia without a resident tax representative?

No. Non-resident businesses registered under the simplified VAT scheme for digital services cannot claim input tax.

5. Which documents are required to open a non-resident VAT account online?

- Certificate of incorporation

- Proof of tax registration in home country

- Contact and banking details

- Digital business description

6. What penalties apply for late or missed VAT filings by overseas entities?

Late reporting can result in administrative fines of 2% per month and potential suspension from providing services in Indonesia.

7. Is there a simplified or low-value import scheme for cross-border e-commerce sellers?

Yes. Indonesia uses simplified e-services VAT collection for digital businesses, but not for physical goods, which follow customs rules.

8. How do currency conversions affect VAT payments from foreign bank accounts?

VAT amounts must be converted to Indonesian Rupiah (IDR) using the exchange rate published by the DGT on the transaction date.

9. Can multiple marketplaces share one Indonesia VAT registration or must each seller register separately?

Each non-resident seller must register individually unless a marketplace is appointed as the VAT collector.

10. What are the annual costs of appointing a fiscal representative in Indonesia and can Commenda handle this role?

Fiscal representation is not mandatory for foreign digital businesses. Commenda can guide businesses through local compliance if required.

11. How do I cancel or deregister my Indonesia VAT number if my turnover drops below the threshold?

Submit a deregistration request through the DGT portal with supporting documents (proof of activity cessation).

12. Does the reverse-charge mechanism remove the need for VAT registration on B2B services?

For B2B digital services, reverse charge applies, so non-resident suppliers do not need to register if only dealing with VAT-registered Indonesian businesses.