VAT ID Verification in South Africa: Step-by-Step Process to Check a VAT ID Number Online

Dealing with fraud and potential penalties resulting from incorrect or unverified VAT ID numbers can pose a major challenge for businesses. An invalid or incorrect VAT ID can lead to compliance problems, financial penalties, and avoidable delays.

To mitigate these risks, it is crucial to perform a VAT ID check and ensure your VAT ID is properly verified to guarantee your business is registered and compliant with local tax regulations.

This blog offers a comprehensive, easy-to-follow guide that walks you through the process of VAT ID verification and how to check your South Africa VAT ID number online.

Note: To ensure your VAT ID is accurate, it is important to check your South African VAT number regularly and perform a VAT ID verification to maintain compliance.

What is a VAT ID in South Africa?

A VAT ID is a unique identifier essential to the tax system for businesses registered for Value Added Tax (VAT) in South Africa. In South Africa, possessing a valid VAT ID is essential for businesses and individuals engaged in taxable activities. To ensure compliance with local tax authorities and maintain accurate records, businesses must regularly perform a VAT ID status lookup.

A VAT ID in South Africa is issued by the South African Revenue Service (SARS). The VAT ID is important for filing VAT returns, issuing invoices, and for any official communications with SARS.

Importance of the South Africa VAT Registration Number for Businesses & Individuals

To ensure your business is compliant and properly registered for VAT in South Africa, it’s recommended to verify your VAT ID online regularly using the SARS portal or third-party verification tools.

A valid South African VAT number is essential for businesses registered for VAT to comply with tax obligations. Non-compliance or failure to update VAT details can result in penalties.

A penalty of 10% is levied on the outstanding VAT amount. Also, interest is charged on the outstanding VAT due at a rate fixed periodically by the Minister of Finance.

Note: By March 2025, SARS collected R2.303 trillion, a 6.9% growth, refunded R447.7 billion, and prevented R146.7 billion in impermissible refunds.

Why Verify a VAT ID in South Africa?

VAT ID verification helps you stay compliant with VAT regulations, protect your business from fraudulent activities, and ensure that you can claim tax refunds and other tax credits without issues.

Using an incorrect or unverified VAT ID can have serious consequences, which are:

- Fines: Penalties from the tax authorities for incorrect VAT IDs on official documents or returns.

- Denied Deductions: Loss of VAT refunds or other tax credits.

- Reputational Damage: Harm to your reputation with vendors and partners, as many require validated VAT IDs to confirm compliance.

Regular verification helps avoid these risks and ensures smooth operations.

Note: Many vendors and business partners implement strict due diligence policies to ensure they’re working with legally compliant businesses. These policies often require the validation of the VAT ID number to confirm that your business is registered with SARS.

VAT ID Number Format Explained

The format of the VAT ID varies depending on the entity type, but it typically includes a combination of letters and digits. Below is a breakdown of the VAT ID structure in South Africa:

| Aspect | Details |

| VAT ID Format | 10 digits: 4XXXXXXXXX |

| Example | 4123456789 |

| Prefix | The VAT number always starts with the digit 4. |

| Issuing Authority | The VAT number is issued by SARS. |

Common Typos in VAT ID Numbers

Common typos in VAT IDs in South Africa include missing digits, such as entering only 9 digits instead of the required 10, or incorrect formatting where the “4” prefix might be omitted. Another common mistake is using the wrong VAT number format, like entering a corporate VAT number as an individual’s number or vice versa.

These typos can easily be avoided with regular VAT ID verification. Additionally, businesses and individuals should perform a VAT ID lookup South Africa to confirm the validity of their VAT ID.

Step-by-Step Process to Verify a VAT ID on the Official South Africa Portal

In South Africa, the process of verifying a VAT ID can be done online through the SARS official portal. This tool provides real-time validation of VAT numbers across South Africa, ensuring that businesses are compliant with South African VAT regulations.

Note: If you’re specifically looking to validate a VAT ID number, you can check the South Africa VAT number using the same portal.

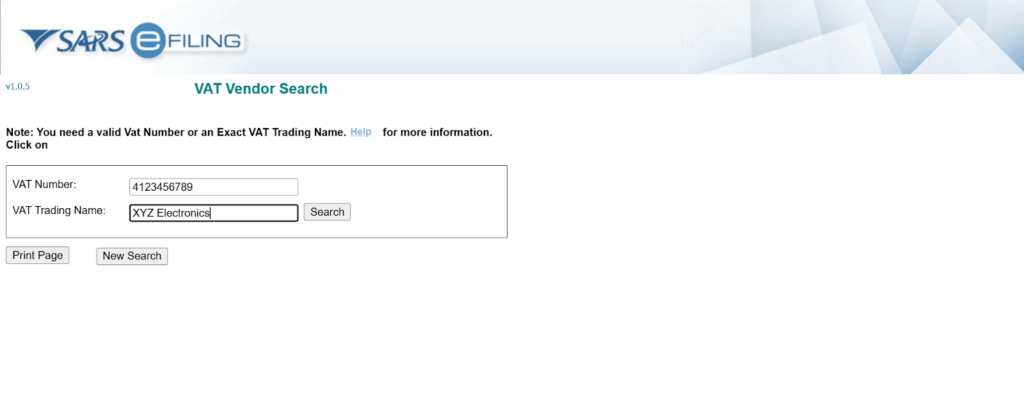

To verify a VAT ID in South Africa, follow these simple steps:

- Go to the official SARS VAT Vendor Search page tool.

- Accept the terms and conditions and click Continue on Vendor Search.

- Click on Verify a VAT Registration number.

- Type the VAT ID number you want to verify and the VAT trading name.

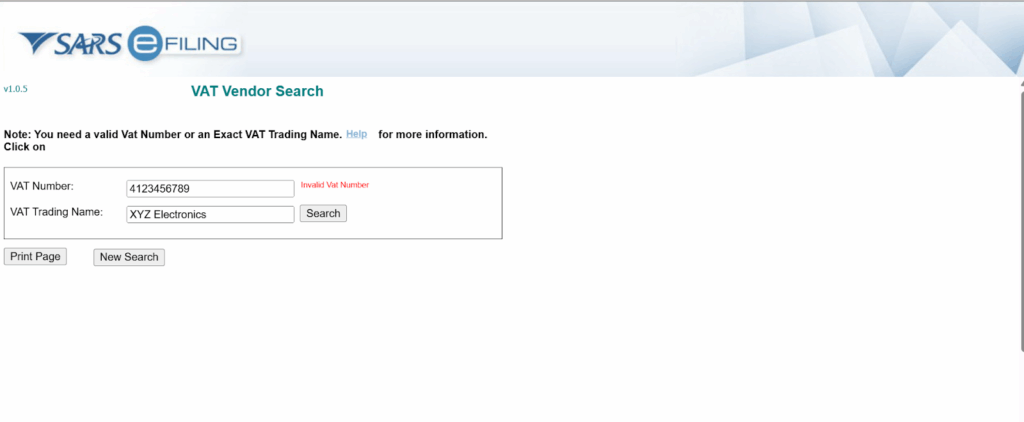

- Click on the Search button. The system will display the VAT ID status, indicating whether it is valid or not.

Troubleshooting Invalid or Inactive Results

During your VAT ID verification, you may encounter error messages indicating that the number is invalid or inactive. Below is a troubleshooting guide to help you resolve common errors:

| Error Message | Likely Cause | Quick Fix |

| Invalid or Not Recognized | VAT ID is not registered in the relevant national VAT database or is incorrect. | Double-check the VAT ID for errors or re-enter it. |

| Inactive ID | VAT ID may have been newly issued or deactivated. | Allow time for processing or confirm activation with SARS. |

| No Record Found | The VAT ID is not linked to any active business or account in the relevant country’s database. | Verify with the SARS or ensure the business is correctly registered for VAT. |

| Mismatch with Records | The VAT ID does not match the business details in the national VAT database (e.g., name or address mismatch). | Confirm that the details (name, address, etc.) are correct and match what was registered with the SARS. |

The Role of Licensed Tax Agents in VAT ID Registration & Verification

Licensed tax agents play a crucial role in assisting businesses with the VAT ID verification and registration process. Businesses often rely on tax agents for VAT ID registration, status verification, resolving discrepancies, or managing complex filings and disputes.

Tax agents provide services such as filing returns, handling appeals, ensuring regulatory compliance, and offering expert tax advice. When selecting a tax agent, it’s important to evaluate their credentials, experience, and reputation and establish clear agreements on fees from the start.

VAT ID Verification in South Africa: Why It Matters for Local Businesses?

VAT ID verification is an essential process for South African businesses to stay compliant with tax laws, avoid penalties, and maintain smooth operations. Ensuring the validity of your VAT ID is especially important for businesses involved in transactions and cross-border sales.

A VAT ID check ensures that businesses align with South Africa VAT regulations, preventing issues related to business registration, corporate tax filings, and the use of fraudulent or incorrect VAT ID numbers.

Bulk & Automated VAT ID Validation

Manually verifying VAT IDs can be slow and error-prone, especially for businesses handling large volumes. Commenda simplifies the process through automated VAT ID verification using CSV uploads and a powerful Bulk VAT ID validation API.

Manual VAT ID check involves entering numbers one by one, which is time-consuming and prone to mistakes. In contrast, Commenda’s API enables real-time VAT ID verification of hundreds or thousands of records within seconds.

Additionally, Commenda supports the South Africa tax registration number check, allowing South African businesses to verify VAT numbers along with other tax registration details seamlessly.

Commenda offers a simple API for seamless VAT ID check integration into your system. It delivers 99.9% uptime for uninterrupted VAT ID verification.

Explore all features with a 14-day free trial and see how Commenda’s Bulk VAT ID validation API and CSV upload options can simplify your VAT ID check.

Additionally, local businesses dealing with suppliers, such as those in free zones or across different South African regions, must ensure VAT ID verification to avoid regulatory issues.

Conclusion: South Africa VAT-ID Verification Made Simple

For businesses operating in South Africa, VAT compliance is a necessity. Commenda provides comprehensive VAT services covering registration with SARS, real-time validation, return filings, and ongoing compliance support through our automated platform.

Our platform simplifies VAT management with bulk validation capabilities via CSV upload or API integration, enabling efficient processing of thousands of VAT numbers while maintaining full compliance with South African Revenue Service requirements.

Beyond verification, we streamline the complete VAT lifecycle – from initial registration to accurate return preparation and timely submissions – all designed to keep your business compliant.

Ready to optimize your tax verification process? Get a free demo and see how Commenda simplifies VAT ID checks with speed, accuracy, and compliance.

FAQs on VAT ID Verification in South Africa

Q. What is a VAT ID in South Africa, and how is it different from a tax registration certificate?

A VAT ID is a unique number for VAT-registered businesses, used for VAT transactions. A tax registration certificate confirms registration with SARS, but is not specific to VAT.

Q. Why should I verify a VAT ID online before issuing an invoice or purchase order?

Verifying a VAT ID ensures it’s valid and active, preventing compliance issues and input tax credit denials. It also protects your business from dealing with non-compliant vendors.

Q. What penalties can my business face for quoting an invalid or inactive VAT ID on tax returns in South Africa?

You may face denied VAT claims, financial penalties, or interest charges from SARS. Repeated violations could lead to audits and increased penalties.

Q. How do I check the real-time status of a VAT ID on the official South Africa government portal?

Use the SARS eFiling Portal or the VAT Vendor Search Tool on the SARS website to verify the VAT ID. This tool provides instant validation of VAT numbers across South Africa.

Q. Can I still claim input tax credit / VAT refund if my supplier’s VAT ID is later canceled?

Yes, if the supplier was valid and registered at the time the transaction took place. Ensure you retain proper documentation, such as valid tax invoices and proof of supply.

Q. How long does it take for a newly issued VAT ID to appear as “active” in the online lookup tool?

VAT numbers typically become searchable within 24–72 hours after registration. If delayed, the supplier should contact VIES to resolve activation issues.

Q. What common errors cause a “No records found” result when I try to validate a VAT ID?

Common issues include typos, incorrect formatting, or entering a number not yet activated. Additionally, entering an incorrect country prefix or using outdated information can also lead to this result.

Q. Is there a free API or bulk CSV upload option to bulk-verify VAT IDs for hundreds of vendors at once?

SARS does not currently offer bulk tools, but services like Commenda provide both. These enable automated, real-time VAT ID verification at scale via API or CSV upload.

Q. How often should finance teams re-check supplier VAT ID numbers to stay compliant with South Africa regulations?

It is best practice to re-verify VAT IDs quarterly or before issuing large payments. This ensures supplier statuses haven’t changed (e.g., deregistration or suspension).

Q. Does the official South African VAT ID verification portal provide historical data on status changes (e.g., “active” to “suspended”)?

No, SARS checker only shows the current VAT status, not historical records. For audit trails, businesses must maintain internal logs or use tracking-enabled software.

Q. What data privacy safeguards apply when I submit a VAT ID lookup through third-party services like Commenda?

While not mandatory for most businesses, it’s recommended for non-residents or complex VAT situations. A licensed agent ensures proper filing and resolves issues with the SARS.

Q. When is it mandatory to engage a licensed tax agent for VAT ID registration or verification in South Africa?

In South Africa, it’s not mandatory for most businesses, but it’s often required for non-residents or complex VAT setups. A licensed agent helps ensure correct filing and faster resolution of tax authority queries.