Benefits

Use the platform that cross-border sellers trust.

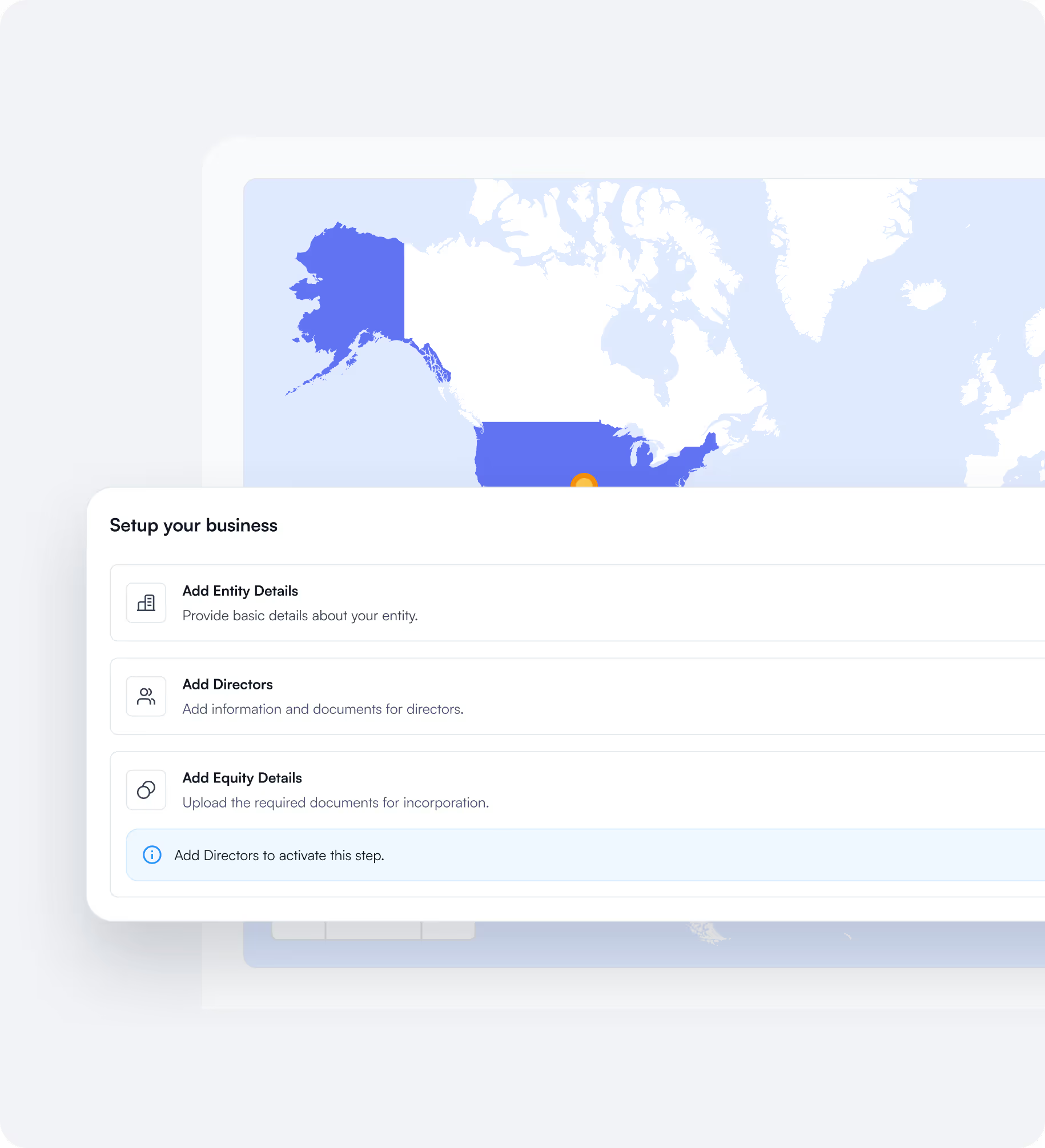

Incorporate a legal entity

Fill out our simple questionnaire and sit back while we register your business in your target market.

Establish a local presence

We get you a local billing address and bank account so you can start collecting payments.

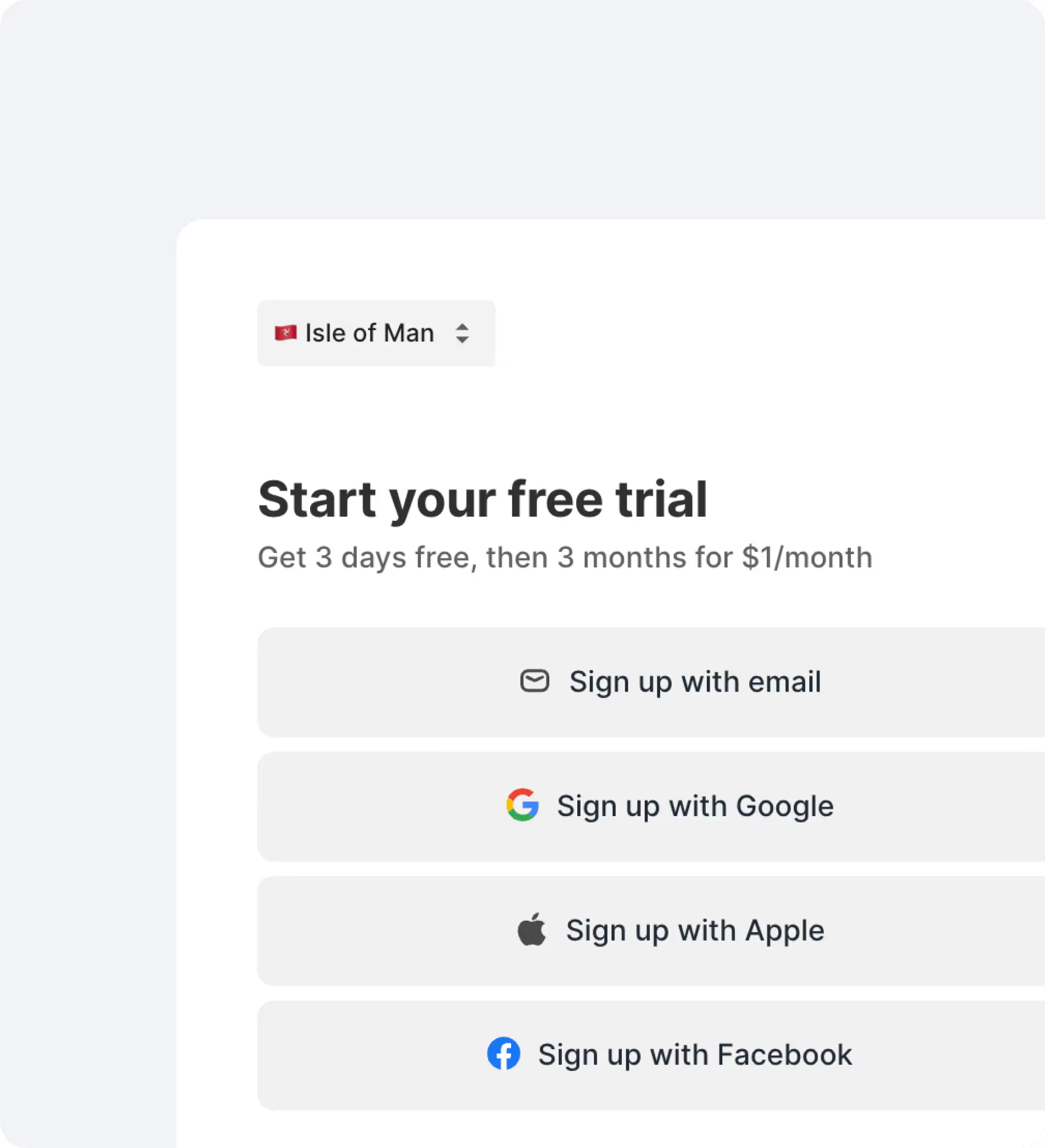

Sign up for the tools you need

With a local bank account and address, the sky’s the limit: you can start selling in a matter of days on most platforms.

Do business like a local

With a fully compliant structure and access to your preferred tools, you reach your target market from the inside.

How it works

Seamlessly set up, manage, and grow your e-commerce business with full tax compliance

Register your entity

Start selling

Monitor your tax liability

services

Got questions?

Schedule a call with one

of our experts

CUSTOMER STORIES

From Startups to

Multi-National Enterprises

Frequently Asked Questions

How does Commenda help with sales tax compliance for international businesses?

We provide an end-to-end solution that tracks your tax liability worldwide, registers entities where required, and ensures timely filings to avoid penalties.

What happens if I fail to comply with sales tax requirements?

Non-compliance can lead to fines, penalties, or even legal action. Our automated system ensures you meet all deadlines and filing requirements, reducing compliance risks.

Can I automate tax compliance without a full-time finance team?

Yes, Commenda’s platform streamlines the entire process, from tracking to filing, so you can stay compliant without hiring a dedicated tax expert.

How does Commenda integrate with my existing e-commerce or accounting platforms?

Our solution seamlessly integrates with major platforms like Shopify, Stripe, QuickBooks, and Xero, making tax tracking and reporting effortless.