Benefits

Get a local tax team for your global business

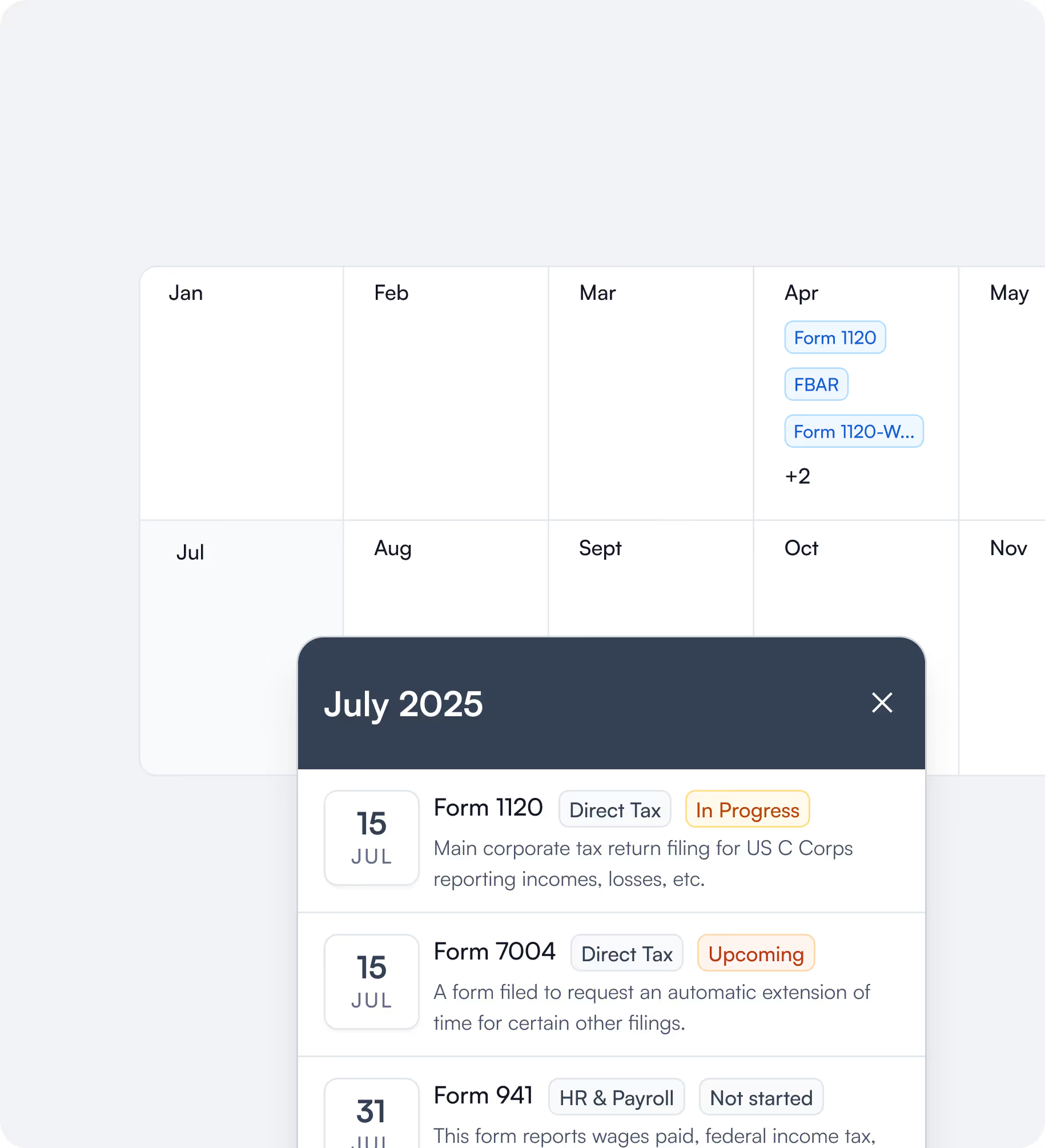

Comprehensive entity onboarding

Add your global entities and answer a few basic questions to build out your integrated compliance calendar.

Cross-entity information management

Securely store your core entity information, documents, and financial history in a unified dashboard.

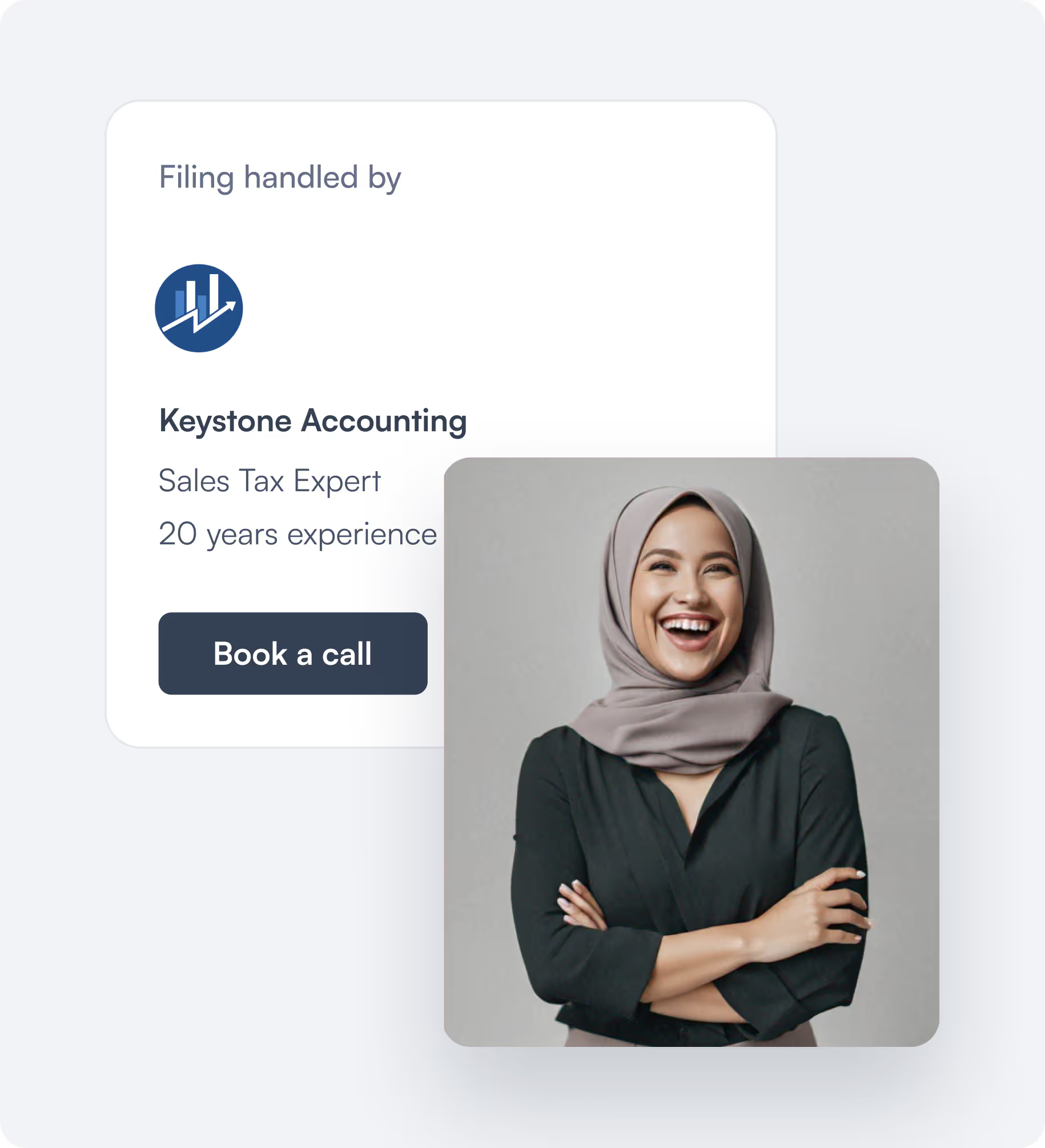

Real people, real support

Meet your accountants face-to-face — Commenda’s back office solution is powered by real people.

Peace of mind

Be as involved as you want to — we keep you in the loop, but we’ve got you covered for all tax filings, everywhere.

How it works

Get comprehensive accounting support with a streamlined process

Onboard your entities

Meet your accounting team

Stay compliant everywhere

services

Got questions?

Schedule a call with one

of our experts

CUSTOMER STORIES

From Startups to

Multi-National Enterprises

Frequently Asked Questions

How does Commenda compare to Big Four firms in entity onboarding and management?

We offer the same high-level expertise and compliance solutions as Big Four firms but at a fraction of the cost, with a more personalised approach.

How does Commenda simplify multi-entity document management?

Our platform centralizes all entity records, legal documents, and compliance filings, making it easy to manage everything in one place.

What are the biggest challenges of cross-border entity management?

Tracking regulatory changes, maintaining compliance, and managing multi-country tax obligations are complex. Commenda automates and streamlines these processes.

How does your pricing compare to traditional legal and tax firms?

Unlike expensive hourly rates, we offer transparent, cost-effective pricing tailored to your entity onboarding and compliance needs.

Can Commenda support businesses with existing international entities?

Yes, we assist with restructuring, compliance audits, and ongoing regulatory management, regardless of how many entities you already operate.

What industries benefit the most from your entity onboarding and management solutions?

E-commerce, SaaS, fintech, and global service providers benefit the most, as they often deal with multi-jurisdictional compliance challenges.