Facilitator laws have gained significance for both operators and sellers ever since the Wayfair Supreme Court ruling. They mandate online marketplaces, such as Amazon, Etsy, and eBay, to automatically collect and remit sales taxes for third-party sellers. In this case, the tax liability shifts from the seller to the individual marketplace. On the other hand, the set of laws regarding tax collection for different states are fraught with complicated nexus rules, filing requirements, and other thresholds. Regulatory scrutiny and financial penalties are additional risks that might arise.

What Does a Marketplace Facilitator Do?

A marketplace facilitator acts as an intermediary for transactions between buyers and sellers, assuming certain tax responsibilities that were previously exclusively the seller’s domain. Under these laws:

- Tax Collection & Remittance: The facilitator applies the applicable marketplace facilitator sales tax during checkout and pays it to the appropriate state authority.

- Registration: Facilitators obtain a sales tax permit in every state that has an active marketplace facilitator law.

- File Consolidation : Over the entire third-party transactions, they generate comprehensive reports, reconcile payments owed with tax collections, and file consolidated returns.

- Economic Nexus Monitoring : Numerous facilitators monitor the volumes of sales and the number of transactions to see when economic nexus thresholds are breached.

The Legal Backdrop: Wayfair Decision and Economic Nexus

Thanks to the 2018 Wayfair v. South Dakota ruling, the lack of a physical presence for the collection of sales taxes is no longer necessary. Economic presence serves as the new fulfillment criterion. This means states can demand tax collection from sellers who meet certain criteria, such as earning more than $100,000 or completing 200 transactions, regardless of having an office or physical store in the area.

This is the reason that countless states adopted marketplace facilitator laws, because tax collection is more efficient at platforms such as Amazon or Etsy compared to individual sellers. These laws assign tax responsibilities to remote sellers and facilitators when the economic nexus is achieved. Facilitators, due to different timelines for implementation, some of which are retroactive, have to monitor deadlines and compliance requirements in various jurisdictions.

State-by-State Breakdown of Marketplace Facilitator Laws

Below is a high‑level overview of each state’s key thresholds, effective dates, and notable quirks. (For full statutory text and updates, always consult the state’s Department of Revenue.).

| State | Effective Date | Threshold | Taxable Goods/Services | Collection Requirements |

| Alabama | Jan 1, 2019 | $250K or 200 transactions | Platforms must register if facilitating retail sales in-state. | Collect & remit for third-party sales. Official guidance: AL DOR. |

| Alaska | No statewide tax | N/A | No state sales tax; local jurisdictions vary. | Facilitators follow local rules where applicable. |

| Arizona | Oct 1, 2019 | $200K gross sales | Applies to sales of tangible personal property. | Collect & remit statewide; some cities require separate filings. |

| Arkansas | Jul 1, 2019 | $100K gross sales | Includes both goods and specified services. | Full remittance to state and local jurisdictions. |

| California | Jan 1, 2019 | $500K gross sales | Broad definition includes digital and marketplace transactions. | Collect & remit statewide, plus local district taxes. |

| Colorado | Aug 1, 2019 | $100K or 200 transactions | Covers all tangible and digital goods. | Single state registration; collects combined state + local rates. |

| Connecticut | Jul 1, 2019 | $100K or 200 transactions | Includes in-state marketplace sales. | Must collect 6.35% state + any municipal taxes. |

| Delaware | No tax | N/A | No sales tax; facilitators exempt. | N/A |

| District of Columbia | Jul 1, 2019 | $100K or 200 transactions | City-administered marketplace law. | Same as Connecticut. |

| Florida | Jul 1, 2021 | $100K or 200 transactions | Encompasses all marketplace sales. | Collect & remit statewide; local surtaxes separate. |

| Georgia | Jul 1, 2019 | $100K or 200 transactions | Broad “retailer” definition includes facilitators. | Collect & remit state + local. |

| Hawaii | Jan 1, 2019 | $100K gross sales | Applies to personal property sales. | Includes O‘ahu surcharge. |

| Idaho | Jul 1, 2019 | $100K gross sales | Exempts real property and services. | Collect & remit state + local. |

| Illinois | Jun 1, 2018 | $100K or 200 transactions | Earliest facilitator law post-Wayfair. | Collect & remit state (6.25%) + local taxes. |

| Indiana | Oct 1, 2020 | $100K gross sales | Excludes casual sales. | State only; local taxes administered by state. |

| Iowa | Jan 1, 2020 | $100K or 200 transactions | Includes tangible personal property. | Collect state (6%) + local. |

| Kansas | Jul 1, 2020 | $100K or 200 transactions | Facilitator means any person providing a marketplace. | Single combined rate filing. |

| Kentucky | Jan 1, 2019 | $100K or 200 transactions | Excludes occasional sellers. | Collect & remit statewide. |

| Louisiana | Jan 1, 2019 | $100K or 200 transactions | Both goods and services included. | State + local; complex parish reporting. |

| Maine | Mar 1, 2019 | $100K or 200 transactions | Tangible personal property only. | Collect & remit statewide rate (5.5%). |

| Maryland | Jul 1, 2019 | $100K or 200 transactions | Includes digital marketplace sales. | Collect state (6%) + local. |

| Massachusetts | Oct 1, 2019 | $500K gross sales | Excludes some specified digital goods. | Collect & remit state (6.25%). |

| Michigan | Aug 1, 2019 | $100K gross sales | Applies to goods and services. | One-stop state + local filing. |

| Minnesota | Oct 1, 2019 | $100K or 200 transactions | Includes marketplace facilitation services. | State (6.875%) + local. |

| Mississippi | Jul 1, 2019 | $250K gross sales | Only tangible goods. | State & local collection. |

| Missouri | Jan 1, 2023 | $100K or 200 transactions | Newest facilitator law. | Collect & remit statewide (4.225%). |

| Montana | No tax | N/A | No general sales tax. | N/A |

| Nebraska | Oct 1, 2019 | $100K or 200 transactions | Tangible property only. | State + local. |

| Nevada | Oct 1, 2019 | $100K or 200 transactions | Includes marketplace revenue. | Combined filing. |

| New Hampshire | No tax | N/A | No general sales tax. | N/A |

| New Jersey | Nov 1, 2018 | $100K or 200 transactions | Early adopter. | State (6.625%) only. |

| New Mexico | Jun 1, 2019 | $100K or 200 transactions | Includes marketplace facilitation. | Collect & remit state + local. |

| New York | Jun 1, 2019 | $300K & 100 transactions | High thresholds. | State + local; reporting per county. |

| North Carolina | Nov 1, 2018 | $100K or 200 transactions | Early adopter. | State (4.75%) + local. |

| North Dakota | Jul 1, 2019 | $100K or 200 transactions | Tangible goods only. | Combined filing. |

| Ohio | Mar 1, 2019 | $100K or 200 transactions | Broad “marketplace provider” definition. | State (5.75%) + local. |

| Oklahoma | Jul 1, 2019 | $100K or 200 transactions | Excludes specified services. | State + local. |

| Oregon | No tax | N/A | No state sales tax. | N/A |

| Pennsylvania | Oct 1, 2019 | $100K or 200 transactions | Excludes digital goods. | State (6%) + local. |

| Rhode Island | Jul 1, 2019 | $100K or 200 transactions | Applies to services too. | State (7%) — highest. |

| South Carolina | Jul 1, 2021 | $100K or 200 transactions | Later implementation. | State (6%) + local. |

| South Dakota | Jan 1, 2019 | Economic nexus only | State law mirrors Wayfair. | State (4.5%) + local. |

| Tennessee | Jan 1, 2020 | $100K or 200 transactions | Tangible property & certain services. | State (7%) + local. |

| Texas | Oct 1, 2019 | $500K gross sales | One of the highest thresholds. | State (6.25%) + local. |

| Utah | Nov 1, 2019 | $100K or 200 transactions | Includes digital products. | Collect & remit statewide. |

| Vermont | Jul 1, 2019 | $100K or 200 transactions | Applies to goods & services | State (6%) — single rate. |

| Virginia | Jul 1, 2019 | $100K or 200 transactions | Exempts casual sales. | State (4.3%) + local. |

| Washington | Jan 1, 2019 | $10K in-state sales | Very low in-state threshold. | State (6.5%) + local. |

| West Virginia | Jul 1, 2019 | $100K or 200 transactions | Includes digital products. | State (6%) + local. |

| Wisconsin | Oct 1, 2019 | $100K or 200 transactions | Broad definition of facilitator. | State (5%) + local. |

| Wyoming | Jan 1, 2020 | $100K or 200 transactions | Tangible personal property only. | State (4%) + local. |

This table illustrates the diversity in state approaches. Some states use revenue‑only thresholds; others combine transaction counts with revenue. Filing schedules vary from monthly to annual. Staying on top of these differences is paramount for any facilitator.

Common Challenges for Facilitators & Sellers

Even though seller’s marketplace facilitator laws relieve other sellers from direct collection responsibilities, the following add new burdens:

Multi‑Jurisdiction Complexity

- Facilitators must integrate thousands of rates and update them, especially since local governments implement new rate changes as often as every week.

- Every single county, municipality, and state has its own set of sales tax and regulatory framework.

Varying Thresholds & Retrospective Dates

- Some states apply laws retroactively, which in turn requires facilitators to back-file returns for previous quarters.

- The limits also differ, such as a $100,000 revenue cap in one state versus $500,000 in another.

Data Reporting & Reconciliation Burdens

- Sellers are often required to submit detailed returns broken down by seller level so that third-party sellers can submit their returns or claim exemption.

- Even with consolidated reporting, facilitators are still burdened with the requirement to share transaction details with sellers.

Marketplace Specific Exceptions

- Certain services or digital products (for example, streaming services as opposed to digital books) may be taxed at different rates or be exempt from taxation altogether.

- Facilitators need to set up rules for product taxability by state.

Audit Risk & Penalty Exposure

- Interest, penalties, and audit assessments can be triggered by inaccurate rate applications or missed filings.

- There’s liability for everyone if the marketplace is noncompliant.

Pitfalls to Avoid:

- Assuming one software solution covers all states, verify coverage maps.

- Neglecting to monitor new legislation. Dozens of states update their facilitator statutes each year.

- Overlooking transitional rules when a state gradually implements a law over multiple quarters.

How to Stay Compliant Across States

To manage marketplace facilitator tax‑principal responsibilities and obligations, compliance requires a blend of technology, processes, and expertise:

Sales Tax Software & Engines

- Automated lookup and calculation accelerators: apply correct state, county and local rates at the transaction level.

- Version control: required to honor retroactive filings by archiving historical rates.

- Nexus tracking: sales volume and trigger monitoring per jurisdiction.

Compliance Calendars & Workflow Automation

- State-by-state month calendars: highlight key dates relevant to each state’s registration deadlines, filing due dates, and payment schedules.

- Automated reminder and task assignment for registration renewals, return preparation, and payment submission.

Professional Tax Advisory Services

- Advise multi-state compliance by engaging specialists in sales tax and marketplace facilitator laws.

- Transactional reviews should be scheduled periodically to confirm exempt sales and validate nexus triggers.

Seller Communication & Data Clarity

- Issue detailed Transactional data reports to third-party sellers as needed so they can reconcile and self-file where necessary.

- Provide portals that allow self-management for the collection and issuance of exemption certificates.

Continuous Legislative Analysis

- Track state sessions for law proposals and tax bills actively.

- Actively participate in public commentary and draft policy consultations to shape favorable rules.

If you are analyzing options, browse Commenda’s dedicated, robust solutions for sales tax as well as facilitator compliance services.

Using Commenda for Marketplace Tax Compliance

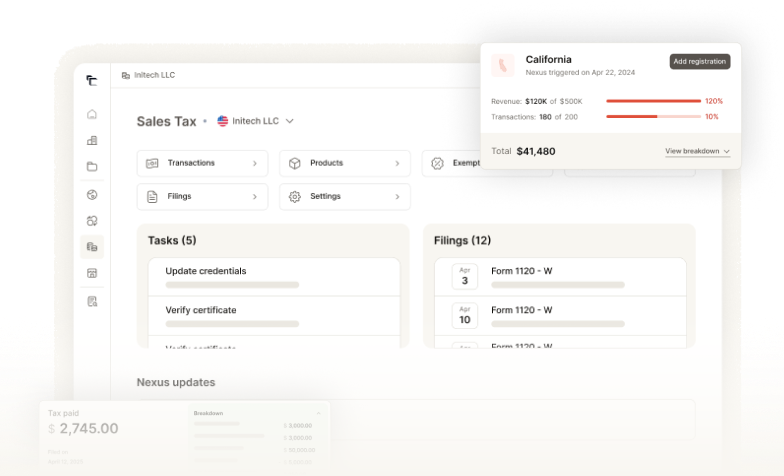

Commenda’s platform fully equips users for compliance with all mandates of marketplace facilitator laws, integrating them into one solution that combines workflow automation with professional consultation:

- Centralized Document Repository

Keep all state registrations, resale certificates, exemption documents, and audit trails in a locked hub with a comprehensive search, and retain perpetual access.

- Automated Compliance Tracking

Get instant notifications in real-time for economic nexus thresholds, law changes, and impending contractual filing deadlines.

- Rate Engine & Taxability Library

Utilise over 14,000 tax jurisdictions with state and industry-specific product taxability guidelines stored in an ever-growing repository. Access to information has never been easier.

- Advanced Reporting & Tax Recon

Access seller grouped and aggregate reporting, cross-reference exported data with prominent accounting or ERP systems, and harmonize taxes collected versus remitted.

- Professional Assistance & Advisory

Count on our U.S. sales tax specialists for any inquiries regarding nexus, sourcing rules, or complicated exemption situations.

Through Commenda, managed marketplaces can flawlessly handle hundreds of thousands, if not millions, of transactions, slash audit exposure, and enable sellers to concentrate on fueling business expansion instead of worrying about tax compliance. Want to see it in action? Schedule a demo today and check our in-depth case studies.

Conclusion: Stay Ahead of Marketplace Tax Changes

Marketplace facilitator laws have emerged in response to the Wayfair decision, changing the roles of online platforms and sellers. Even though these laws provide relief to individual sellers by forcing marketplace facilitators to deal with a complex web of state rules, reporting thresholds, and complex reporting requirements, automation tools, streamlined compliance calendars, and marketplace facilitators remove the burden of labyrinthine state rules on sellers and platform entities like Commenda, ensuring turning automation compliance becomes a competitive advantage fosters growth.

FAQ: Marketplace Facilitator Laws

- Do small sellers qualify as marketplace facilitators?

- Yes, as long as a seller operates a platform where third parties can sell and complies with a state’s economic nexus threshold, which could be $100,000 in sales or 200 transactions, they qualify. However, these definitions differ from state to state.

- What if I sell on multiple platforms?

- Each marketplace (Amazon, Etsy) has its own ecosystem for tax collection, and buyers are responsible for keeping track of their total sales on different platforms to assess their nexus status.

- Can a seller opt out of facilitator tax collection?

- No, generally speaking. Once a marketplace satisfies the necessary criteria to be considered a facilitator in a given state, it must collect sales tax on all taxable sales. Unless there is an exemption provided, sellers can’t choose not to participate.

- How are refunds and returns handled?

- Facilitators are responsible for making changes to tax reports for refunds processed. Most states require tax modifications to be done within a certain time frame, which is usually 180 days.

- How often do state laws change?

- The monitoring of compliance, however, is critical for compliance. States revise and set new limits, taxability of new products or services, and filing rules.